Top 10 Online Payment Processing platforms

March 07, 2024 | Editor: Sandeep Sharma

16

Online Payment Processing (Checkout) platforms allow to accept different payment options in your online store or cloud service

1

Accept credit cards on your iPhone, Android or iPad. Send invoices free with Square Invoices. Signing up for Square is fast and free, and there are no commitments or long-term contracts like with alternative services.

2

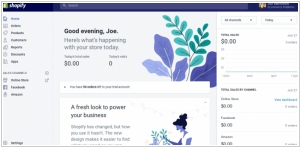

Simple, Beautiful, and Flexible End-to-End E-Commerce Solution. Simply choose a stylish ecommerce website design, easily customize your online store, add products, and you're pretty much ready to accept payments. Whether you already have products, are looking to sell digital goods or are interested in drop shipping — Shopify has a complete solution for you.

3

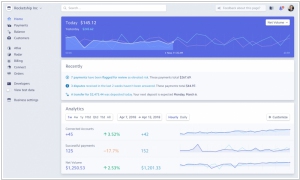

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

4

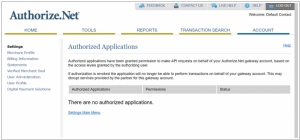

Authorize.Net provides payment solutions that save time and money for small- to medium-sized businesses and organizations. Accept credit cards and electronic checks securely and easily from your website. Solutions range from simple Buy Now buttons to more sophisticated subscription and tokenized payment products.

5

Some of the fastest growing companies in the world rely on us to process mobile and web payments. Elegant code. Drop-in checkout. Secure, client-side integration. Zero-hassle PayPal integration will be available soon. Mobile payment processing designed to keep the checkout flow streamlined.

7

Accept Credit Cards, PayPal, and Debit Cards. With our international payment processing features, you have the opportunity to sell globally and reach a truly international audience. We give your customers the option to select from any of 15 languages and 26 currencies through the checkout process giving them a familiar and comfortable experience.

8

Millions of Amazon customers can login and pay on your website with their stored account information on Amazon.com. Login and Pay with Amazon can help you add new customers, increase sales and turn casual browsers into buyers. It’s fast, easy and trusted — leverage the Amazon brand to grow your business.

9

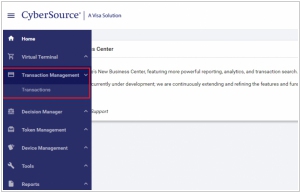

With Visa CyberSource you can sell online almost anywhere in the world, instantly boosting your customer reach. Accept the payment types preferred in local markets, transact payments in over 190 countries and fund in 21 currencies, all through a single connection.

10

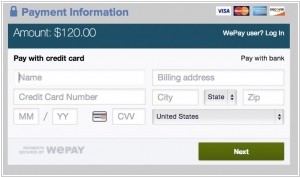

WePay is an online payment service provider in the United States. WePay's payment API focuses exclusively on platform businesses such as crowdfunding sites, marketplaces and small business software. Powered by JP Morgan Chase

11

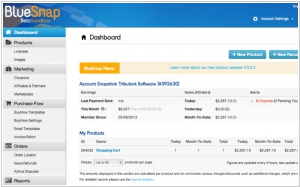

BlueSnap helps online companies maximize customer acquisition and retention. Each day, thousands of merchants realize the power and potential of eCommerce through our smarter global payment gateway and easy to use checkout pages. Together, we'll help your business achieve the success it deserves.

12

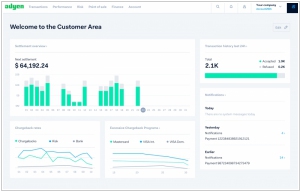

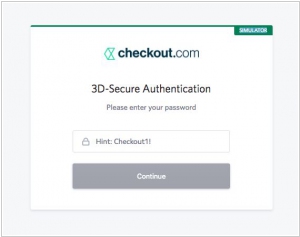

Accept more payments. Get access to a global acquiring network, benefit from real-time insights, centralized reconciliation tools and complete feature parity across multiple geographies. All through one unified API.

13

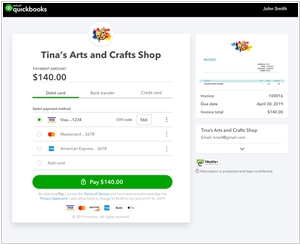

Manage all kinds of payments, all in one place. Take payments via cards, ACH, Apple Pay, PayPal, and Venmo. No matter how you get paid, manage it all in QuickBooks so you never miss a thing.

14

Online payments made easy. Have customers pay directly on your website. Accept payments in 100 currencies. Simple and transparent pricing. Be safe comprehensive risk and anti-fraud measures

15

Collecting payments online just got simpler. Zoho Checkout is designed with you in mind. Build a custom, branded payment page in a matter of minutes and start accepting payments right away.

Latest news about Online Payment Processing platforms

2024. PayPal launches Tap to Pay on iPhone for business

PayPal has announced the rollout of "Tap to Pay" for merchants utilizing iPhones through the Venmo and Zettle applications in the U.S. This feature, facilitated by PayPal, enables businesses to accept contactless card and digital wallet payments directly on their iPhones without incurring extra expenses or requiring additional hardware. Following its introduction for Android phone merchants eight months prior, Tap to Pay allows merchants not only to accept payments from cards or digital wallets such as Apple Pay or Google Pay but also to incorporate taxes, receive tips, issue receipts, and process refunds seamlessly. PayPal assures that funds from transactions are promptly deposited into the merchant's Venmo or PayPal Zettle account. For each sale via the tap-to-pay method across Zettle and Venmo, PayPal applies a charge of 2.29% + 9¢.

2023. Rally bags $12M to build the future of e-commerce checkout

Rally, a composable checkout platform for e-commerce merchants, has raised $12M. Rally has divided its operations into two parts. The first aims to assist traders by integrating with commercial tools such as Salesforce Commerce Cloud, Magento, and BigCommerce. The second part provides merchants with a "headless" ecosystem that allows them to change either the front or back end of their website without affecting the other. While Rally's CEO did not disclose any specifics, he stated that the company is nearing a partnership announcement with front-end and back-end experts to provide headless-as-a-service.

2023. Paytrix raises $18.3M to build out its one-stop payments shop

UK startup Paytrix has raised $18.3 million to build a solution to fix this: a single platform — and single contract — that lets its customers manage all of the different payments options from payment acceptance to payouts, in one place. Paytrix describes itself as a “payments curation” platform, and behind an API that it provides to its customers to integrate into their own services, it negotiates its own banking relationships in different countries, which lets it bypass the traditional payment rails used for card payments and other payment services like Stripe, as well as some of the newer channels that have been emerging in more recent years, such as open banking standards.

2021. Silverflow nabs $17M for its updated, cloud-based take on payments processing technology

In the realm of online payments, the frontend of the system has witnessed significant disruption in recent years. Companies like Stripe, Adyen, PayPal, Square, and others have developed APIs that simplify the integration of seamless payment services into the checkout processes of online merchants. Silverflow, a company that takes a fresh approach to a specific aspect of online payments by offering a data-driven payment processing API, has announced securing $17 million in funding. The essence of Silverflow's innovation lies in providing a highly advanced alternative to traditional processing systems. By leveraging data-based networks in the cloud, Silverflow offers a broader range of supplementary services, enhancing the overall payment experience for businesses.

2021. South African payments gateway Ozow raises $48M

When it comes to enabling people to utilize their basic bank accounts for making payments, digital payments gateways play a crucial role. One such player in this field is Ozow. Having experienced significant growth over the past year, Ozow has successfully raised $48 million in Series B funding. The primary objective of this funding is to expand the range of alternative payment solutions available to their extensive base of merchants and consumers. Ozow simplifies the payment process by automating it. Merchants only need a bank account and a "smart-enabled device" to receive payments. Notable enterprise clients of Ozow include MTN, Vodacom, Shoprite Group, Takealot, and Uber. Individual users can enjoy the services of Ozow free of charge, while merchants can utilize the payments gateway for free during the initial 12 months or for up to $65,000 in monthly processing value.

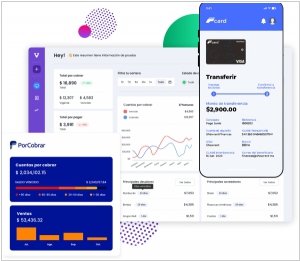

2021. Yaydoo secures $20M, aims to simplify B2B collections, payments

Mexico-based B2B software and payments company Yaydoo has successfully concluded a $20.4 million Series A funding round. The company, represented by Yaydoo, offers three products, namely VendorPlace, P-Card, and PorCobrar, which aid in cash flow management, optimizing smart liquidity access, and connecting businesses of varying sizes to a range of digital tools. This recent investment will facilitate the recruitment of new talent within Mexico and support Yaydoo's expansion into other Latin American countries. Additionally, Yaydoo aims to explore future opportunities in its working capital business, including analyzing customer invoice volumes, monitoring payment transactions, and gaining insights into working capital funding gaps. The company also plans to allocate resources towards product development.

2021. Square acquires buy-now, pay-later company Afterpay for $29 billion

Square has reached an agreement to acquire Afterpay, an Australian buy-now, pay-later service, in an all-stock transaction valued at approximately $29 billion. This acquisition stands as one of the largest in Australian history. Square has announced its intention to incorporate Afterpay into both Cash App and Seller. Cash App facilitates payments and money transfers for customers, while Seller caters to retailers. Following the integration, Cash App users will have the ability to manage their Afterpay payments directly within the app, and Seller merchants will be able to offer Afterpay as a payment option to their customers.

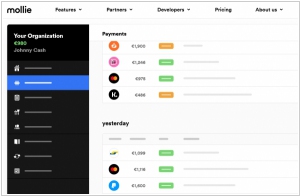

2021. Dutch payments startup Mollie raises another $800M

Mollie, a startup based in Amsterdam, offers businesses an API-driven solution to seamlessly integrate payments into websites, documents, and various services. Today, Mollie announces a successful funding round, raising $800 million. While Mollie operates in a competitive landscape with numerous payment companies experiencing significant growth, it's worth noting that even prominent players like Stripe do not rank among the top 10. Companies such as JP Morgan, WorldPay, Fiserv (First Data), and PayPal currently dominate the top spots. This dynamic not only highlights the vast potential for Mollie to expand and solidify its position but also underscores the immense size of the overall market.

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Stripe, the privately-held payments company, has recently completed the acquisition of TaxJar, a well-known provider of cloud-based tax services. TaxJar's suite of services enables businesses to automatically calculate, report, and file sales taxes. An important aspect of TaxJar is its ability to navigate various geographies and the complex sales tax regulations associated with each, making it a valuable resource for online businesses. Stripe plans to integrate TaxJar's technology into its revenue platform, alongside its existing tools such as Stripe Billing for subscriptions and Radar for fraud prevention. Additionally, Stripe envisions leveraging AI and other technologies to automate further functions and potentially introduce new services. While TaxJar will be integrated with Stripe's offerings, businesses will still have the option to use TaxJar directly for their tax-related needs.

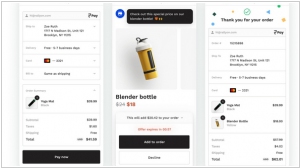

2021. Shopify expands its payment option, Shop Pay, to its merchants on Facebook and Instagram

Shopify and Facebook have joined forces to extend the availability of their payment option, Shop Pay, to all Shopify merchants selling on both Facebook and Instagram. This marks the first time that Shop Pay will be accessible beyond Shopify's own platform, signifying a significant expansion of the e-commerce platform's payment technology. Initially, Shop Pay will be introduced to Shopify merchants using Instagram's checkout feature in the United States, followed by its rollout on Facebook in the subsequent weeks. Prior to this launch, Facebook's platform has been widely favored among Shopify merchants as a prominent sales and marketing channel.

2021. Online checkout service Fast raises $102M

Fast, a startup specializing in online checkout and identity products, has announced the successful completion of a $102 million Series B funding round. Last year, Stripe, a prominent online payments company, also led Fast's Series A funding round, which amounted to $20 million. In total, Fast has raised $124 million in funding thus far. Fast aims to serve as your universal profile for accessing services and making online purchases across various platforms. While Stripe has established a system for numerous digital stores and businesses to accept payments, Fast endeavors to create an equivalent consumer-focused solution for the other side of these transactions. Notably, Fast seeks to be a platform that enables other companies to incorporate its services into different industry niches.

2021. Checkout.com raises $450 million and reaches $15 billion valuation

Payments company Checkout.com has successfully concluded a Series C funding round, raising $450 million. The company aims to establish an all-in-one solution for payment-related services, encompassing transaction acceptance, processing, and fraud detection. Its primary focus is on serving large merchants, offering a highly customizable product that can be seamlessly integrated as an infrastructure partner within their own offerings.

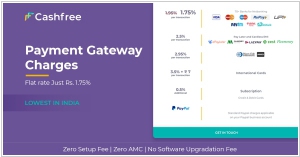

2020. Cashfree raises $35.3 million for its payments platform

Cashfree, an Indian startup that specializes in a wide range of payment services for businesses, has secured $35.3 million in funding. Currently, Cashfree provides over a dozen products and services, catering to more than 55,000 businesses. Its offerings include salary disbursal to employees, online payment acceptance, recurring payment setup, and marketplace commission settlements. Notable customers of Cashfree include Cred, BigBasket, Zomato, HDFC Ergo, Acko, and Ixigo. The startup collaborates with various banks and offers integrations with platforms like Shopify, PayPal, and Amazon Pay.

2020. Cloud-native card payments processor Silverflow raises €2.6M

Dutch startup Silverflow has secured seed funding of €2.6 million. The company is developing a cloud-native online card processor that establishes direct connections with card networks. Its objective is to offer a modern alternative to the outdated payments card processing technology that has been predominantly used for the past 20 to 40 years. Silverflow provides user-friendly APIs and streamlined data flows, seamlessly integrated into the card networks. Instead of managing a complex network of acquirers and maintaining multiple connections with banks and card networks in various markets, Silverflow offers card-acquiring processing as a service. This service directly connects to card networks through a simple API.

2020. Payment processing startup PayMongo lands $12M

PayMongo, a provider of an online payments API tailored for businesses in the Philippines, has successfully raised $12 million in funding from Stripe and other investors. PayMongo collaborates with financial institutions and offers various products, including a payments API that can be seamlessly integrated into websites and applications. This enables businesses to accept payments from bank cards and popular digital wallets such as GrabPay and GCash. For individuals engaged in social commerce and predominantly selling through messaging apps, PayMongo offers PayMongo Links, allowing buyers to conveniently click and send payments. Additionally, PayMongo's platform incorporates advanced features like a fraud and risk detection system to ensure secure transactions.

2020. WhatsApp finally launches payments

WhatsApp has made an announcement that users in Brazil will have the privilege of being the first to send and receive money through its messaging app. This will be made possible by utilizing Facebook Pay, the payments service launched by WhatsApp's parent company, Facebook, last year. The payments service is currently free for consumers, meaning there are no commission fees involved. However, businesses will be required to pay a 3.99% processing fee to receive payments. To complete transactions, users will need to enter a six-digit PIN or use their fingerprint. To use the service, you need to connect your WhatsApp account with your Visa or Mastercard credit or debit card. Initial local partners for this service include Banco do Brasil, Nubank, and Sicredi. Additionally, Cielo, a payments processor, is collaborating with WhatsApp to facilitate transactions. The company stated, "We have created an open model to allow for the inclusion of more partners in the future."

2020. Fast raises $20M to build a universal checkout service for e-commerce

Fast, a startup focused on developing platform-agnostic login and checkout services, has announced a $20 million investment led by Stripe. As its name suggests, Fast aims to revolutionize the login process by making it faster and streamline online checkout experiences. When encountering the Fast checkout button for the first time during a purchase, users can simply click on it. They will then be presented with a "short, optimized checkout form" that only requires five pieces of information: email, name, phone number, address, and credit card details. Once the user completes these fields, Fast securely wraps up the transaction and saves the customer's information for future use.

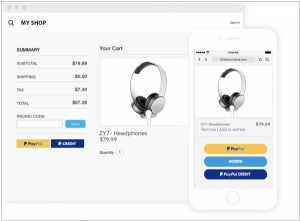

2018. PayPal Checkout improves personalization

PayPal has unveiled an innovative checkout technology designed for e-commerce websites, enabling the dynamic presentation of the most suitable payment method for individual customers. Instead of cluttering the checkout page with multiple payment options, PayPal Checkout now features "smart payment buttons" that adapt and display the appropriate set of choices based on each customer's location and preferences. This empowers retailers to seamlessly incorporate alternative payment methods, including local wallets and country-specific options, alongside the traditional PayPal button, offering a more tailored and convenient payment experience.

2018. Stripe launched online billing tool

Stripe is introducing a billing solution tailored for online businesses. This new product enables these businesses to efficiently manage recurring subscription revenue and invoicing within the Stripe platform, streamlining their operations. The aim is to replace previously manual methods of invoicing or assembling various subscription tools, offering a seamless experience similar to charging for products on Stripe. This launch is partially motivated by customer requests for a unified solution that consolidates invoices and subscription expenses. As an enterprise company, Stripe prioritizes understanding customer needs while simultaneously innovating to provide elegant solutions for problems that small businesses may not have anticipated.

2018. Braintree launches Stripe competitor - Extend

PayPal's payment services division, Braintree, is taking steps to enhance its competitive position in the market, particularly against rivals like Stripe. To achieve this, Braintree is introducing a new solution called Extend, which offers a range of tools for seamless integration of Braintree payments with other services commonly utilized by online businesses beyond basic transactions. Extend encompasses features such as loyalty and reward program integration, advanced fraud prevention measures, and support for "contextual commerce," enabling merchants to sell and accept payments on platforms other than their own. Some of these services, including contextual commerce, were already available, powering features like Pinterest's buyable pins. With Extend, Braintree aims to streamline and expand its payment offerings, catering to the evolving needs of online companies.

2017. Zoho launched online checkout service for small business

Zoho has recently unveiled a new service called Zoho Checkout, designed to equip businesses across various industries with essential functionalities for facilitating online payments from their customers. With Zoho Checkout, you have the ability to create and personalize pages for one-time and recurring payments. You can also incorporate your company's branding and style into the page design, and easily share it via social media or email, enabling your clients to make immediate payments, even without a dedicated website. To ensure security, Zoho Checkout employs SSL encryption and safeguards your customers' credit card information. Online payments are processed through Stripe. Pricing for Zoho Checkout begins at $9 per month, which includes three payment pages.

2016. Braintree launches Auth to bring its payments platform to more merchants

PayPal-owned payments platform, Braintree, has introduced Braintree Auth, a system designed to simplify the process of enabling payments on e-commerce platforms. This launch enables e-commerce platform owners, shopping cart providers, and recurring billing services to facilitate credit card, debit card, and PayPal payments on their merchants' online storefronts. Through a unified interface for shoppers, Braintree Auth grants access to customer and transaction data on behalf of the merchants. This strategic move by Braintree demonstrates its efforts to expand its presence in the SMB market, particularly in the face of increasing competition from startups like Stripe.

2015. Indian largest shopping site Snapdeal aquired online payment service FreeCharge

Snapdeal, India's largest e-commerce site, has successfully completed what it describes as "one of the biggest acquisitions in the history of the internet industry in India" by acquiring the online transaction service FreeCharge. FreeCharge offers users coupons as rewards when they recharge their phone credit or pay utility bills. What sets FreeCharge apart is its significant mobile device usage, accounting for 85 percent of its business, and the fact that over half of its customers have payment cards linked to their accounts, making them ideal candidates for conversion into regular Snapdeal customers. Snapdeal has assured that FreeCharge will continue to operate as an independent platform, maintaining its current shopping experience, while also planning to enhance integration between the two services.

2015. Stripe gets Balanced customers

Balanced, a payments platform catering to peer-to-peer marketplace businesses, has made the decision to shut down due to insufficient growth. The company has reached an agreement with one of its long-standing competitors, Stripe, to assist with the smooth transition of its existing customers. This closure will impact approximately 320 customers, including prominent platforms such as Tilt (a crowdfunding platform), RedditGifts, Tradesy, Relay Rides, and Artsy. These customers collectively process hundreds of millions of dollars annually. In comparison, Stripe, led by CEO Patrick Collison, handles billions of dollars per year for thousands of businesses across 18 countries worldwide. Balanced faced competition from other industry players like WePay, Dwolla, Amazon Payments, and PayPal.

2015. PayPal acquires Paydiant to add NFC into its Here readers

PayPal acquired Paydiant, a startup known for its mobile wallet technology, in order to enhance its mobile business for physical merchants. This move aims to strengthen PayPal's position and competitiveness against rivals such as Apple, Google, and Samsung in the field of tech payment solutions. Paydiant's technology is responsible for powering payment applications utilized by major businesses such as Subway, Harris Teeter supermarkets, Capital One bank, and notably, MCX—an enterprise-owned network currently working on a payment app called CurrentC. While Google focuses on carriers and Apple offers a visually appealing but device-specific experience, PayPal seeks to establish itself as the primary point of contact for merchants, an area where its competitors are also making progress.

2014. European payments processor Klarna comes to US

The leading payments processor in Europe, Klarna, has announced its expansion into the U.S., with a planned investment of at least $100 million. Klarna Checkout, a direct competitor to platforms like PayPal and Stripe, offers an alternative payment solution for online merchants. By employing an algorithmic risk assessment of the customer's behavior and credit scores, the service minimizes the amount of information required for payment, thus reducing friction in the buy-now-pay-later process. This approach proves particularly advantageous in the realm of mobile payments, where minimizing typing is desirable.

2014. Stripe - the new king of online payment processing

Stripe, the highly popular payments processing service, has secured $70 million in funding, reaching a valuation of $3.5 billion. Notably, this valuation has doubled in less than a year. Founded in 2010, Stripe initially aimed to simplify online payment processing for businesses. It has since become a key player in powering commerce services for prominent tech giants such as Twitter and Apple, and it will also be responsible for facilitating Facebook's Buy button. Stripe's founder, Patrick Collison, highlighted that when they began, the majority of online transactions relied on outdated banking and merchant infrastructure. He emphasized Stripe's unique approach to addressing this challenge and emphasized their vision of building the foundation for internet commerce.

2014. Braintree enables super easy sign-up for merchants (including Europe)

PayPal's payment processing service Braintree is introducing a new service that simplifies the merchant sign-up process. Now, merchants can join the platform by providing just their email address, URL, and a brief company description. Additionally, Braintree is extending its offering to Europe, allowing merchants to conduct the first $50,000 worth of transactions (in the local currency equivalent) without incurring any commission fees. This streamlined approach contrasts with the traditional method of setting up payment systems, particularly in Europe, where banks often require physical documentation for account approval. Instead, Braintree employs a combination of algorithms and human intelligence to assess the legitimacy of a company based on the provided information. This innovative approach enables Braintree to efficiently evaluate and onboard legitimate merchants onto its platform.

2014. Global payment processing provider BlueSnap raises $50 million

Global payment services provider BlueSnap has secured $50 million in funding to accelerate the adoption of innovative processing technologies. Originally established as Plimus in Israel, BlueSnap revolutionized global online sales of digital goods by eliminating the complexities associated with cross-border transactions. In 2011, the company was acquired by Boston-based private equity firm Great Hill Partners and rebranded as BlueSnap. Presently, BlueSnap operates in 180 countries, catering to 29 languages, and facilitates payments across 110 diverse platforms in 60 currencies. Notable competitors in the payment processing sector include Adyen, Braintree, and the emerging Credorax, which recently raised $40 million in financing.

2014. First Data takes on Square with its portable payments terminal

Payment processing leader First Data has unveiled a new mobile product called Clover Mobile, designed to transform the traditional point-of-sale (POS) system into a handheld device. Clover Mobile features a magnetic stripe reader for standard card transactions, along with a slot for next-generation credit cards that support Chip-and-PIN transactions. These advanced cards, already prevalent overseas, are expected to become standard in the U.S. next year. To facilitate transactions with Apple Pay, Google Wallet, and Softcard, the tablet includes an embedded near-field communications (NFC) radio. Running on an Android-based operating system, the tablet utilizes the familiar Clover Station software and grants access to the Clover app store, where retailers can download various POS, inventory, and marketing software applications. While Clover Mobile directly competes with Square in the small business market segment, it primarily serves as a strategic move for First Data to safeguard its existing market share rather than venture into new territories. As Square and other emerging payment processors expand into larger retail locations and restaurants, traditional banks and payment processors are striving to innovate with software and design.