DigitalOcean is #5 in Top 10 Public Cloud Platforms

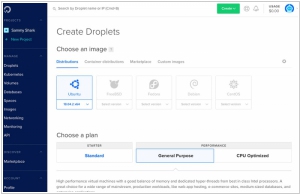

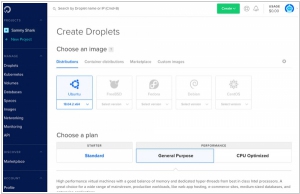

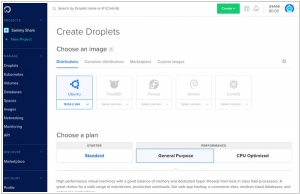

The developer cloud helping millions of developers easily build, test, manage, and scale applications of any size – faster than ever before.

Positions in ratings

#5 in Top 10 Public Cloud Platforms

Alternatives

The best alternatives to DigitalOcean are: Amazon Web Services, Heroku, Google Cloud Platform, Microsoft Azure

Latest news about DigitalOcean

2020. Cloud for developers DigitalOcean raises $50M

DigitalOcean, a leading cloud provider for developing modern applications, has announced the successful closure of a $50 million Series C funding round. The funding was led by Access Industries, with participation from Andreessen Horowitz. DigitalOcean Cloud offers simplified app creation capabilities for a wide range of developers, including individuals, startups, and small to medium-sized businesses. With its infrastructure and platform-as-a-service (IaaS and PaaS) solutions, DigitalOcean provides a seamless experience that eliminates the need for extensive DevOps expertise. This empowers developers to dedicate their efforts towards building innovative software. Following this funding round, the company's valuation has reached $1.15 billion, indicating a significant increase from its pre-money valuation of $1.1 billion.

2020. Cloud infrastructure provider DigitalOcean raises $100M

DigitalOcean, a cloud infrastructure provider with a focus on smaller businesses and younger companies, has announced today that it successfully raised $100 million. Unlike traditional sales-driven models, DigitalOcean operates as a self-serve SaaS business, allowing users to easily get started without requiring assistance. This approach avoids the costly and time-consuming sales cycles. However, while the convenience of self-signup appeals to small companies, this acquisition method often leads to high customer turnover. To address this, DigitalOcean is dedicated to establishing a niche in SMB and developer-oriented cloud infrastructure, maintaining favorable economics through low customer acquisition costs and self-service revenue generation. The profits generated from this approach sustain the company's growth, enabling it to invest in itself through debt rather than equity. Overall, this unexpected news adds an exciting element to the day.