Oracle Marketing Cloud vs Pardot

November 12, 2023 | Author: Sandeep Sharma

4

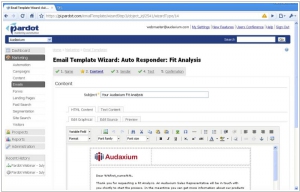

Pardot offers a software-as-a-service marketing automation application that allows marketing and sales departments to create, deploy, and manage online marketing campaigns that increase revenue and maximize efficiency. Pardot features certified CRM integrations with salesforce.com, NetSuite, Microsoft Dynamics CRM, and SugarCRM, empowering marketers with lead nurturing, lead scoring, and ROI reporting to generate and qualify sales leads, shorten sales cycles, and demonstrate marketing accountability.

Oracle Marketing Cloud and Pardot are both powerful marketing automation platforms, but they differ in their approach and target markets.

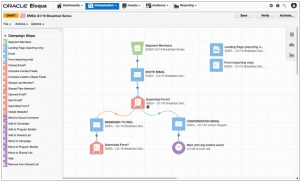

Oracle Marketing Cloud is an enterprise-level marketing automation solution that offers a comprehensive suite of tools for managing and optimizing marketing campaigns. It provides features for email marketing, lead management, customer data management, content marketing, social media marketing, and marketing analytics. Oracle Marketing Cloud caters to large enterprises that require a scalable and highly customizable marketing automation platform. It offers advanced segmentation, personalization, and integration capabilities, allowing organizations to create personalized and targeted marketing campaigns.

Pardot, on the other hand, is a marketing automation platform specifically designed for B2B (business-to-business) marketing. It focuses on lead generation, lead nurturing, and sales alignment. Pardot provides features for email marketing, lead scoring, lead tracking, form creation, landing page optimization, and marketing analytics. It integrates seamlessly with Salesforce CRM, allowing for a unified view of marketing and sales activities. Pardot is ideal for organizations that have a strong emphasis on B2B marketing and require a platform that aligns marketing and sales efforts.

See also: Top 10 Marketing software

Oracle Marketing Cloud is an enterprise-level marketing automation solution that offers a comprehensive suite of tools for managing and optimizing marketing campaigns. It provides features for email marketing, lead management, customer data management, content marketing, social media marketing, and marketing analytics. Oracle Marketing Cloud caters to large enterprises that require a scalable and highly customizable marketing automation platform. It offers advanced segmentation, personalization, and integration capabilities, allowing organizations to create personalized and targeted marketing campaigns.

Pardot, on the other hand, is a marketing automation platform specifically designed for B2B (business-to-business) marketing. It focuses on lead generation, lead nurturing, and sales alignment. Pardot provides features for email marketing, lead scoring, lead tracking, form creation, landing page optimization, and marketing analytics. It integrates seamlessly with Salesforce CRM, allowing for a unified view of marketing and sales activities. Pardot is ideal for organizations that have a strong emphasis on B2B marketing and require a platform that aligns marketing and sales efforts.

See also: Top 10 Marketing software

Oracle Marketing Cloud vs Pardot in our news:

2015. Marketing software Pardot improves collaboration and productivity

B2B marketing automation software Pardot (owned by Salesforce) has recently introduced a range of beneficial enhancements for productivity and collaboration. These include a Chrome extension that enables email tracking, faster data synchronization, improved data visualization, and enhanced customization options for reporting. The Chrome extension for Gmail is an invaluable marketing automation plug-in that empowers sales representatives to send trackable emails directly from their Gmail accounts. It not only simplifies their tasks, allowing them to sell more effectively, but also serves as a covert B2B tool disguised as a harmless email plug-in. The additional improvements offer similar advantages. Notably, the data synchronization with Salesforce now boasts the fastest speed among all marketing automation tools, as it checks for changes every two minutes. This convenience benefits sales representatives by promptly revealing prospect insights, enabling them to respond swiftly and gain a competitive edge.

2014. Oracle acquired marketing data provider Datalogix

Oracle has recently declared its plan to acquire Datalogix, a specialist in data marketing that obtains consumer sentiment data through partnerships with Facebook, Twitter, and other sources. In industries such as consumer product goods and automotive, businesses are striving to maximize their benefits from social networks. Consequently, the data collected by companies like Datalogix, Acxiom, and Epsilon is highly regarded for its immense value. This acquisition takes place just ten months after Oracle's acquisition of Bluekai, another prominent player in the field of data aggregation.

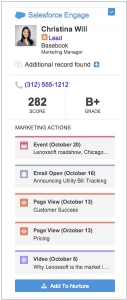

2014. Salesforce announced Sales Reach to promote Pardot

The primary source of revenue for Salesforce comes from subscriptions to the Sales Cloud. However, the company is also focused on expanding its earnings in the marketing solutions sector. To this end, Salesforce made a significant investment of up to $2.5 billion last summer to acquire ExactTarget/Pardot, a marketing-automation and campaign-management software. Yesterday, Salesforce announced a new feature for its Sales Cloud called Sales Reach. This optional feature brings the fundamental capabilities of Salesforce.com's marketing-oriented Pardot offering to salespeople. Sales Reach empowers salespeople to create micro campaigns, track responses to those campaigns, and receive real-time notifications when prospects engage with campaign content, such as downloading materials, attending events, or viewing videos. Additionally, salespeople can invite prospects to join communities, and they can perform all of these actions through their Salesforce1 mobile apps. Sales Reach is set to be available in the first half of 2015.

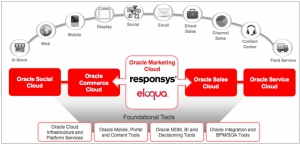

2013. Oracle Buys Responsys for $1.5 Billion, Merges with Eloqua

Exactly one year after Oracle's acquisition of marketing automation company Eloqua for $871 million, Larry Ellison and his team have revealed plans to purchase marketing cloud player Responsys for $1.5 billion. Oracle's foray into the marketing realm in 2012 has been marked by a series of acquisitions, leading to a direct competition with its primary rival, Salesforce. In response to Oracle's purchase of Eloqua, Salesforce acquired ExactTarget in the middle of 2012. This move occurred shortly after ExactTarget had acquired B2B marketing automation vendor Pardot. As a result, both Oracle and Salesforce now possess marketing systems explicitly tailored for either B2B or B2C customers.