Top 10 Online Accounting software

February 03, 2024 | Editor: Michael Stromann

16

Online Accounting software allows to manage finances, expense tracking, invoicing, reconciliation, accounts payable, bookkeeping and more.

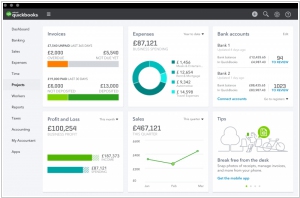

1

QuickBooks Online puts you in control of your finances, your time, your business—and where you work. From setup to support, QuickBooks Online makes your accounting easy. With simple tools to get you started, free support, and a money-back guarantee, QuickBooks Online is the effortless choice.

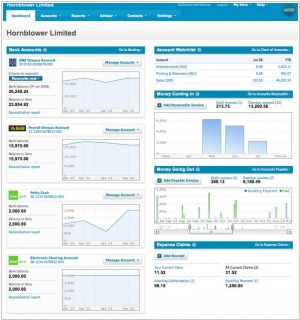

2

Xero is accounting software for small business. Like alternatives, Xero allows to manage invoicing, reconciliation, accounts payable, bookkeeping and more. Share access to your latest business numbers with your team & your accountant – so everyone is up to speed. Xero accounting software lets you work anywhere.

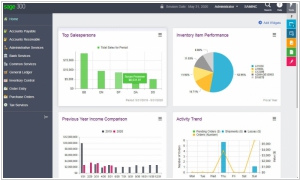

3

Sage Business Cloud is the right, proven solution for mid-market customers with international ambitions and multi-national requirements. Sage Business Cloud technology is available on all leader platforms in the market with End-to-end process integrity and data consistency in your Webtop across the enterprise.

4

Zoho Books is an online accounting software with time tracking that allows you to easily manage the money flowing in and out of your business. Manage your customers and invoices, while keeping expenses in check. Record, monitor and reconcile your bank accounts and transactions, and collaborate with your accountant in real-time. Most importantly, Zoho Books helps you make better, more informed decisions and stay on top of your business.

5

FreshBooks is an online invoicing software as a service for freelancers, small businesses, agencies, and professionals. The product includes a myriad of other related features, such as time tracking, expense tracking, recurring billing, online payment collection, the ability to mail invoices through the U.S. Post, and support tickets.

6

Half a million customers use Wave's online small business software to do their invoicing, accounting and payroll. Smart cloud apps for smart business owners. Wave makes it easy to be your own boss. Just do what you're good at, and lean on Wave's smart online software for help with invoicing, accounting and payroll.

7

FreeAgent is accounting software for small businesses and freelancers, recommended by 99.5% of our users. From expenses and time tracking, to estimates and invoices, FreeAgent helps you take care of business day-to-day. Keep track of your cash flow and project profitability, and see who owes you money on your FreeAgent overview screen. No need to sweat. Set up and configure multiple sales tax rates for your country and the countries you do business with.

8

Tally's Accounting Software is the trusted name worldwide to simplify and manage your financial accounting, inventory management, banking and other business needs.

9

Online Accounting Software made simple. VAT is automatically updated & can be submitted directly to HMRC. Get paid faster and improve cashflow wherever you are. Share directly with your accountant for easy management

10

Kashoo mobile and online accounting software for small business. Cloud based system for invoicing, expense tracking & bookkeeping. Kashoo is a complete double-entry accounting software solution that you and your accountant will love! Running your business gets a whole lot easier when you can access your books anywhere and anytime.

11

Small business accounting software from Less Everything, because your job title isn't accountant. Track all of your business expenses with LessAccounting, quickly and easily. You can put your expenses into categories, add notes to them, mark them as paid or due, and even upload a picture of your receipt with each expense. Send online invoices to any of your contacts, and track payments when you receive them. You can also set up invoices to reoccur whenever you need, and you can even accept payments for invoices via Paypal. You can customize your invoices with our powerful template engine as well.

12

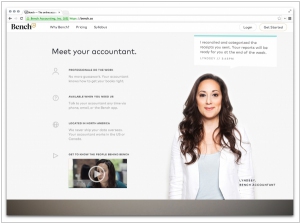

Bench is the online bookkeeping service that provides you tax-ready financial statements from professional bookkeepers.

Latest news about Online Accounting software

2023. Intuit launches generative AI–powered digital assistant for small businesses and consumers

Intuit, the prominent U.S. financial and accounting software company, has introduced its inaugural customer-centric generative AI-driven solution known as Intuit Assist. Functioning as a digital assistant, it is seamlessly integrated into Intuit's suite of platforms and products, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. With a consistent user interface, Intuit Assist leverages contextual datasets to deliver personalized recommendations to the company's vast customer base of over 100 million small businesses and consumers worldwide. This innovative offering also facilitates human assistance through Intuit's live platform when necessary. The digital assistant was created using GenOS, Intuit's proprietary operating system based on generative AI, which was launched in June to empower developers in incorporating AI across the company's product portfolio.

2023. Accounting AI automation startup Trullion lands $15M

Trullion, a startup providing accounting software, has raised $15 million. It connects corporate controllers, CFOs, and external auditors on a single platform, providing a unified source of truth for financial leaders. Trullion offers various tools such as lease accounting, revenue recognition, and audit automation tools that can algorithmically extract data from lease contracts and generate audit-ready reports for financial stakeholders. The platform also manages customer relationship management software, billing, and contract data and presents a dashboard with all data sources in one place.

2023. Accounting and financial compliance startup Wafeq raises $3M

Wafeq, a startup offering an accounting and e-invoicing SaaS solution targeted towards clients in the UAE and Saudi Arabia, has recently secured $3 million in funding. Wafeq is an authorized provider in Saudi Arabia and the UAE, where e-invoicing is not currently mandatory. The company is also actively seeking approval from the Egyptian Tax Authority, recognizing the significant potential in the North African market. Egypt, with its millions of small and medium-sized businesses, presents substantial opportunities for Wafeq's expansion.

2022. Accounting platform Osome raises $25M

Osome, a financial administration platform based in Singapore, has successfully raised $25 million in a Series B funding round. Osome specializes in assisting business owners with various administrative tasks, including payroll management, accounting, and tax reporting. In recent times, the company has expanded its services to include an accounting platform that provides comprehensive financial reports, expense and invoice management, as well as a unique hybrid accounting service called the Accounting Factory. The Accounting Factory combines the power of machine learning with human accountants, aiming to replace conventional accounting software such as Xero and QuickBooks. Osome's services have garnered significant popularity, serving over 11,000 businesses across Singapore (where its headquarters are located), Hong Kong, and the United Kingdom. Additionally, Osome offers business incorporation services in Singapore, Hong Kong, and the United Kingdom and seamlessly integrates with prominent e-commerce platforms like Amazon, eBay, Shopify, Lazada, Etsy, and Shopee. With its robust and comprehensive financial administration solutions, Osome continues to empower businesses and streamline their operational processes.

2021. “Autonomous accounting” platform Vic.ai raises $50M

Startup Vic.ai has secured $50 million in Series B funding for its AI-based platform designed to streamline enterprise accounting processes. Vic.ai claims that its platform can "automate" accounting operations by leveraging artificial intelligence and machine learning algorithms. By analyzing historical data and existing workflows, Vic.ai aims to deliver enhanced automation capabilities, resulting in time savings and a reduction in errors and duplicates within accounting processes. The platform's autonomous Artificial Intelligence gradually assumes control over cost-side accounting tasks, leveraging insights gleaned from both your data and your accounting team.

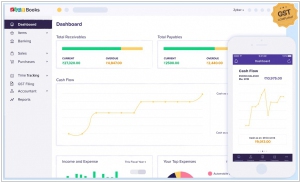

2021. Zoho Books gets a Free Plan

Zoho has introduced the free plan for Zoho Books, a solution specifically designed to address the accounting requirements of small businesses, startups, and freelancers. The aim of Zoho Books' free plan is to revolutionize the financial workspace for small businesses by offering a modern cloud-based accounting platform that replaces traditional or spreadsheet-based accounting methods. This transition helps eliminate the risk of data loss, reduces manual effort and errors, and provides a more efficient accounting process. By utilizing the free plan, you can embrace a paperless approach, automate various accounting tasks, and access your accounting system from anywhere. The free plan enables you to create, customize, and send up to 1,000 invoices annually. You can conveniently collect payments both online and offline while automating payment reminders. Additionally, the plan allows you to upload expense receipts and effectively monitor expenses by category, helping you stay within your budget. By enabling the client portal feature, your customers gain access to view their outstanding invoices, provide transaction comments, make online payments, and leave reviews.

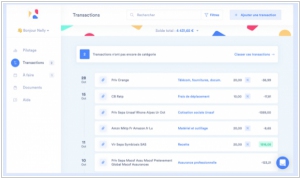

2021. Pennylane raises $18.3M for its accounting service

French accounting startup Pennylane has secured a fresh round of funding amounting to $18.3 million. The company has been dedicated to developing an advanced accounting platform that enhances the accounting processes for both clients and their accountants. With a specific focus on small and medium-sized businesses, Pennylane has successfully attracted a substantial client base, with 1,000 executives currently utilizing their services. Pennylane offers seamless integration with various third-party services, such as Stripe, Payfit, Qonto, Zoho, Sellsy, and more. This integration allows the platform to access valuable information already stored in these services. Regular data synchronization ensures that users can easily monitor outstanding invoices, facilitate payments to suppliers, and gain clear visibility into inbound and outbound payments. Pennylane empowers businesses to effectively manage their financial standing through its comprehensive accounting solution.

2021. Docyt raises $1.5M for its ML-based accounting automation platform

Docyt, a startup, has secured $1.5M in funding. The company aims to simplify the lives of small and medium business owners and their accounting firms through the use of machine learning. Docyt automates various routine tasks related to gathering financial data, digitizing receipts, categorization, and reconciliation. While it may initially appear that Docyt competes with popular small business accounting software like QuickBooks, it actually functions as a partner to such platforms. When small and medium businesses outgrow systems like QuickBooks, Docyt extends their usability by automating many of the tasks performed by QuickBooks.

2021. Ageras nabs $73M for its accountancy marketplace and bookkeeping software

Denmark-based startup Ageras has successfully raised $73 million. Ageras offers a dual-purpose platform that serves as both accountancy software and a marketplace for small and medium businesses (SMBs) to connect with accountants. The platform follows a typical labor marketplace model, where SMBs can submit their requirements in accounting, bookkeeping, or auditing, and receive three leads to contact. In addition to this service, Ageras has expanded its business model by venturing into the development of accounting software. This diversification allows Ageras to provide comprehensive solutions for SMBs in managing their accounting needs.

2021. Accounting automation startup Indy raises $42.4M

French startup Georges, which focuses on developing an accounting automation application for freelancers and small companies, is currently raising a new funding round amounting to $42.4 million. Alongside this financial boost, the service is also undergoing a rebranding and will now be known as Indy. Originally, Indy introduced a tailored product specifically designed for various professionals such as freelancers, self-employed individuals, doctors, architects, lawyers, and more. The platform aims to streamline accounting processes to the point where it can potentially replace the need for an accountant. By linking your bank account to Indy, the service automatically imports and attempts to tag and categorize all your transactions, providing a comprehensive financial management solution.

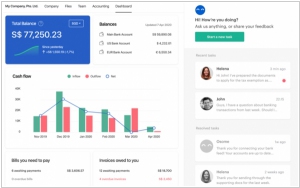

2021. Pennylane raises $18.4 million for its accounting service

French startup Pennylane has successfully raised $18.4 million (€15 million) for its unique accounting service that combines automated processes with human accountants. Pennylane operates as both a software-as-a-service company, facilitating efficient management of financial data, and an accounting firm. By directly engaging with accountants through the platform, clients have the convenience of communicating with their accountants within a single centralized source of information for all their financial data. The primary objective of the startup is to enhance the experience for both clients and accountants alike.

2020. Accounting outsourcing startup Osome raises $3M

The business assistant app, Osome, which is based in Singapore and specializes in digitizing accounting and compliance tasks, has successfully raised $3 million. With approximately 4,500 SME clients in Singapore, Hong Kong, and the United Kingdom, Osome's platform employs machine learning technology to automate various administrative, accounting, payroll, and tax-related processes. Additionally, depending on the subscription tier, businesses can also benefit from access to chartered accountant services through the Osome platform.

2019. Zoho Books introduced free plan

The Government of India, through GSTN, has chosen Zoho Books, our cloud-based accounting software, to provide it free of charge to businesses with an annual turnover of less than ₹1.5 crore. Zoho Books is a comprehensive accounting solution that automates your business finances and ensures tax compliance. With this government initiative, you now have an excellent opportunity to digitalize your accounting processes using Zoho Books. Say goodbye to manual data entry, as you can automate repetitive tasks and instantly track the financial performance of your business. Rest assured, your financial data is securely stored in the cloud, eliminating concerns about data loss. Moreover, Zoho Books facilitates online collaboration with your accountants and financial investors, allowing you to receive timely financial advice.

2019. Georges raises $11.2 million for its accounting automation tool

Georges, a French startup, aims to assist freelancers, doctors, and lawyers with their accounting needs. With Georges, you have the option to eliminate the need for an accountant and transition to a software-as-a-service solution. The product is incredibly user-friendly. To begin, you establish a connection between Georges and your professional bank account. The company utilizes Bankin' to establish connections with the majority of French banks. Subsequently, Georges automatically assigns tags to your income and expenses, enabling the calculation of your annual revenue, VAT, and other relevant factors. While some transactions may still require manual categorization, this process is significantly faster than individually entering each transaction into an accounting application. Once all items are accurately tagged, Georges generates the necessary paperwork and submits it to the tax authorities. Georges competes with more traditional software solutions like BNC Express. By incorporating machine learning, Georges has the potential to surpass these legacy tools in terms of efficiency.

2017. Xero integrated with spending tracker Curve

Accounting software provider Xero has joined forces with Curve, a fintech startup that enables users to consolidate multiple bank cards into a single card and easily monitor their spending. The objective of this collaboration is to simplify the process of expense filing by reducing unnecessary complexities. Through the integration, users now have the option to connect the Curve app to Xero, allowing expenditures made using the Curve card to be automatically synced with the accounting software, eliminating the need for manual entry of each expense.

2017. Zoho Books gets document hub and receipt auto-scanning

The Zoho Books online accounting app has incorporated valuable features to enhance document management. The Auto-scan functionality within Zoho Books enables you to effortlessly scan your documents and automatically extract relevant details, which can then be converted into expenses, bills, or purchase orders. In case you have already scanned your documents, you can directly upload them, and our software will intelligently extract the essential data for you. With the Documents feature, a unique email address is provided, allowing you to conveniently import files into Zoho Books simply by sending an email. Upon receiving a file, you can organize it into folders or create a transaction, subsequently clearing the inbox. All uploaded documents are instantly stored in a secure centralized hub, providing a unified location for convenient viewing and management.

2015. Cloud accounting service for freelancers FreeAgent raises $5M

The UK-based cloud accounting software for freelancers and micro-businesses, FreeAgent, has secured $5 million in funding. FreeAgent was founded in 2007 out of the frustration faced by small businesses and freelancers in managing their company finances, which was often deemed challenging. This funding news arrives at a time when the UK's cloud-based accounting software market presents opportunities for further consolidation. In 2013, Iris acquired KashFlow for an estimated £20 million, leaving several accounting SaaS startups available. These include Clearbooks and Crunch, with Crunch also targeting freelancers and micro-businesses while offering an accountant-inclusive model.

2015. Cloud accounting service Xero raises $111M

New Zealand-based online accounting software firm Xero has successfully secured a $110.8 million funding round with the aim of expanding its presence in the North American market. Including this latest investment, Xero has raised a total of over $240 million from various investors. Xero specializes in offering online accounting software tailored for small and medium-sized businesses, as well as accountants. Recognizing that many small businesses still relied on basic accounting systems or even Excel spreadsheets, Xero anticipated the future shift towards cloud-based solutions. By providing a platform that enables small businesses, accountants, and bookkeepers to perform accounting tasks online and through mobile devices, Xero has revolutionized the way they operate.

2015. Online accounting service Bench raises $7 Million

Bench, the platform that connects businesses with bookkeepers, has successfully concluded a $7 million Series A funding round. Originally known as 10sheet, Bench operated as a hybrid platform combining algorithms and human expertise. Small and medium-sized businesses (SMBs) could enroll in the 10sheet system, which facilitated the direct submission of transaction paperwork for review by a human bookkeeper. However, the company later rebranded as Bench and introduced a new approach. Under this system, every customer is matched directly with a dedicated Bench bookkeeper, offering a personalized one-on-one service. While the technology continues to import transactions from corporate cards and checking accounts, it now also provides the added benefit of direct communication with the assigned accountant.

2015. Xero launched cloud payroll service in US

Cloud accounting startup Xero has unveiled a new product that expands its reach into the back-office realm by offering cloud-based payroll and tax software. Known as Xero Payroll, this solution specifically caters to the needs of over 5 million small businesses in the United States with less than 20 employees. Payroll management can often pose a significant financial burden for these employers, costing between $200 and $500 per month when outsourced to third-party providers. Apart from the outsourcing expenses, there is also the risk of human errors and potential penalties due to incomplete or inaccurate information. Xero Payroll aims to address these challenges by providing small and medium-sized businesses (SMBs) with a cloud-based platform similar to its accounting software. This platform enables seamless employee payment processing and facilitates the electronic filing of state and federal payroll taxes.

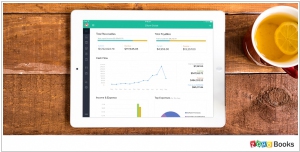

2014. Zoho Books became available on iPad

Zoho has recently unveiled the new Zoho Books iPad app, designed specifically for iPad, iPad Air, and iPad Mini. This native application has been optimized to provide a seamless experience on your tablet, enabling you to manage your business operations from anywhere. The iPad app offers all the key functionalities available in the web version, empowering you to efficiently run your business on the go. Upon launching the app, you will be greeted with an interactive dashboard that delivers crucial insights into your business. Instantly access information regarding your receivables, payables, and cash flow, enabling you to evaluate the performance of your business and identify areas that require attention. Moreover, Zoho Books for iPad offers various features, including business expense management, time tracking, timesheets, estimates, and a range of informative reports.

2014. Intuit acquired cloud integration service ItDuzzit

Intuit is further expanding its cloud platform for small and medium-sized businesses (SMB) through the acquisition of itDuzzit, a startup offering integration tools for connecting various web and mobile apps within enterprises. This can be likened to the functionality of IFTTT but tailored for business needs. Intuit's intention is to incorporate itDuzzit into its QuickBooks platform, which not only provides accounting services but also offers a growing range of additional services for businesses. itDuzzit competes with similar platforms like Zapier and Cloudwork. The platform currently supports integration with numerous apps, including Asana, Box, Coinbase, Freshbooks, PayPal, and Shopify, with the promise of adding more apps in the future. In essence, this acquisition allows Intuit to provide its customers with a seamless way to utilize these integrated apps on its platform, alongside Intuit software, even if Intuit doesn't have a direct hand in each of those services.

2014. Zoho Books app for Windows 8.1 released

Zoho has introduced a Windows 8 version of its accounting app designed for growing businesses, known as Zoho Books. This app enables users to send invoices to clients instantly, record payments, track expenses, and categorize them by type. It also helps identify and reduce unnecessary expenditures, providing instant insights into business performance through interactive graphs and charts. With Zoho Books, users can efficiently organize contacts, capturing crucial information like currency, email, phone numbers, and billing addresses in a centralized location. Additionally, the app facilitates the maintenance of a product and price list for streamlined management.

2013. Xero Launches New Features and Plans for a Payroll Solution

Xero, the cloud-based accounting solution designed for small businesses, has introduced a range of new features. One of the notable additions is Xero Touch, an updated version of its mobile app for Apple's iOS7. With Xero Touch, users can conveniently perform various tasks directly from their smartphones, such as checking bank transactions, creating invoices, and communicating with their accountant. Additionally, Xero has introduced Xero Files, a user-friendly drag and drop application. This feature enables users to easily upload and attach files such as invoices, expense receipts, contracts, and more, making them readily accessible and organized within the system. Furthermore, Xero Purchase Orders now allows businesses to create purchase orders in a similar manner to how they can generate invoices in Xero. The pricing for Xero's services starts at $19 per month for small businesses, which may vary depending on the volume of invoices and payments processed.

2010. LessAccounting makes small business bookkeeping easier

There is a wide range of web accounting services available, but LessAccounting emerges as a strong contender for a user-friendly and uncomplicated accounting system. This is attributed to its intuitive user interface and its ability to seamlessly integrate with your bank's data. According to the developers, this integration can significantly reduce the time spent on bookkeeping by up to 80%. Unlike other similar systems that operate on tiered subscriptions where you pay more to access additional features, LessAccounting offers an unlimited transaction capacity and allows for an unlimited number of members with its flat monthly subscription fee of $30. The application runs directly in your web browser, eliminating the need for any extra software installation, and is compatible with all operating systems. The comprehensive set of features offered by LessAccounting can be easily accessed from the menu on the left-hand side of the interface, categorized for effortless navigation. This menu remains accessible from anywhere within the application, ensuring a seamless experience without the need for constant page switching.

2009. FreshBooks - online billing for small business

There are numerous online billing services available on the Web, each offering their own unique blend of usability and relevance to businesses. However, if you're seeking a straightforward solution that simplifies monitoring your billing cycles, FreshBooks is an excellent starting point. FreshBooks streamlines the management of clients, projects, and, most importantly, invoices. This tool facilitates the generation of recurring invoices and automates the billing process for customers. Furthermore, it is relatively cost-effective, with the option to use basic invoicing for free or pay up to $149 per month to grant additional employees access to the account. In addition to the ability to import from and export to QuickBooks and CSV files, FreshBooks seamlessly integrates with popular payment processing solutions like PayPal. Its intuitive design enables swift completion of invoicing tasks. However, the most valuable feature lies in its tracking capabilities. If you currently employ a rudimentary billing system, you may encounter difficulties in remembering when payments were made or received. FreshBooks eliminates this issue by providing a menu pane that displays outstanding and historical payments, allowing you to stay informed about incoming revenue. Moreover, if you have concerns about the appearance of your invoices, you have the freedom to customize them according to your preferences, including the option to incorporate your company logo.

2008. Intuit launches QuickBooks Online Edition

Intuit dominates the accounting software industry, with its flagship product QuickBooks enjoying immense popularity among small and medium-sized businesses, boasting over three million users. In response to the increasing demand for web-based and online accessible solutions, Intuit introduced QuickBooks Online Edition (QBOE). Although QBOE has been available for several years, its adoption has been gradual yet steady. QBOE fulfills essential business requirements, offering comprehensive double-entry accounting capabilities that enable accurate balance sheets, profit and loss statements, and trial balances. The home screen serves as the starting point for users, distinguishing QBOE from other online accounting applications that aim to present a "dashboard view" of the business. Instead, QBOE presents a process diagram-style interface, allowing users to navigate through different functional areas of the accounting system. The Basic edition of QBOE provides fundamental features such as accounts receivable, expense tracking, and check printing, albeit with somewhat limited functionality considering its $10 monthly cost. On the other hand, the Plus version enriches the offering with additional features like estimates and invoice customization, time tracking, recurrent billing, budgeting, and online billing.

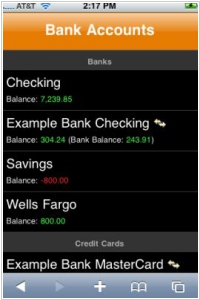

2008. Accounting on the go: Quickbooks for iPhone and Blackberry

Quickbooks, a leading accounting software for small businesses, has recently launched web interfaces for Blackberry and iPhone devices. The iPhone version, displayed on the left, features a sleek user interface that provides convenient access to all your financial information stored in Quickbooks Online. At first glance, the web app presents a simple overview of various aspects, including outstanding payments, payables, vendors, employees, and bank accounts. However, as you delve deeper, you discover a wealth of detailed information. While this web app appears to be an excellent tool for referencing financial data, there are a few areas where it falls short. It would have been nice to have a standalone app available through the App Store for the iPhone, although it's not entirely necessary. The most significant drawback is the inability to edit or add data, which, in my opinion, would be a primary use case for this app. It's worth noting that this is the initial version of the app, and additional functionality may be added in future updates. If you are already a Quickbooks Online user, these new web interfaces for Blackberry and iPhone provide additional benefits. Although they may not be the sole deciding factor in switching to Quickbooks Online, they can certainly contribute to the decision-making process.