Poly is #13 in Top 10 Videoconferencing software

Collaborate anywhere, anytime, with anyone using Polycom video, voice, and content-sharing solutions. One-touch ease; audio and video with crystal-clear quality; enterprise-grade security, reliability and scalability. Polycom solutions give you the flexibility to meet and collaborate with colleagues, partners, and customers in any environment―immersive theater, conference room, work office, home office, or on-the-go. Wherever you are, wherever you go.

Positions in ratings

#13 in Top 10 Videoconferencing software

Alternatives

The best alternatives to Poly are: Cisco Unified Communications, Avaya, Zoom

Latest news about Poly

2019. Polycom (and Plantronics) rebrand as Poly

Plantronics has made an announcement regarding its transformation into Poly, a technology company that prioritizes the human experience in communications and collaboration. The primary objective of Poly is to enable communication that is as immersive and natural as face-to-face interactions. As part of this rebranding effort, the video-conferencing software previously known as Polycom will also adopt the name Poly. In 2018, Plantronics, renowned for its audio communications equipment catering to both businesses and consumers, acquired Polycom for a sum of $2 billion. Leveraging the extensive audio and video expertise of both Plantronics and Polycom, Poly, which signifies "many," offers a wide range of intelligent endpoints that seamlessly connect with unified communications platforms. By doing so, it aims to minimize distractions, simplify complexity, and bridge gaps in the modern workspace. Poly strives to be the preferred solution for collaboration whenever and wherever cloud-based communication reaches individuals.

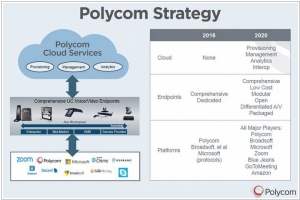

2018. Polycom launched Cloud Services for Enterprise

Polycom is enhancing its enterprise cloud capabilities through the introduction of Polycom Cloud Services. This comprehensive cloud solution primarily focuses on providing enterprises with efficient tools for provisioning and managing various voice and video endpoints found in conference rooms worldwide. One of the key offerings within Polycom Cloud Services is Polycom Device Management Services (PDMS), which empowers enterprises to effectively manage these devices, monitor their performance, and resolve any arising issues. This service enables customers to easily provision, update, and secure a large number of desk and conference room phones. Initially, PDMS will be available for audio systems, but Polycom anticipates expanding its support to include video conferencing devices by the end of the year.

2016. Mitel acquired Polycom for $1.96B

Canadian enterprise communications provider Mitel has announced its intention to acquire Polycom through a cash-and-stock agreement valued at $1.96 billion. Polycom will retain its branding following the acquisition. Both companies are competitors of Cisco and Avaya. Mitel is renowned for its IP telephony solutions, including PBX systems, while Polycom specializes in conferencing services. They also offer SIP technology, catering to a customer base that includes 82% of Fortune 500 companies. This deal represents a significant milestone in recent enterprise collaboration and communication collaboration endeavors.

2011. Polycom buys HP's videoconferencing business

In 2009, Cisco acquired Tandberg, the leading provider of videoconferencing solutions, solidifying its dominant position in the market. Naturally, this prompted competitors to take action. Initially, rumors circulated that HP would purchase Polycom, the second-largest player in the market. However, it became apparent that Polycom possessed a stronger foothold and greater interest in the videoconferencing industry than HP. Just yesterday, Polycom announced its acquisition of HP's video conferencing business for $89 million. HP primarily focuses on high-end telepresence systems marketed under the Halo brand, which will complement Polycom's primarily low-end video conferencing solutions in an organic manner. Market experts, however, believe that the main competition lies not between the two industry giants, Cisco and Polycom, but between two distinct approaches to videoconferencing. The first approach entails expensive hardware systems (exemplified by Cisco and Polycom), while the second revolves around affordable and mobile Internet services such as Microsoft Skype, Google Talk, and GoToMeeting.