Spend Management software for business

Updated: November 11, 2023

Spend management software is a specialized tool that helps organizations efficiently track, analyze, and optimize their spending across various categories. This software enables businesses to manage their expenses, invoices, and procurement processes in a centralized platform. It allows for real-time visibility into spending data, vendor performance, and contract compliance, helping organizations make informed decisions and negotiate better deals with suppliers. Spend management software often includes features such as budgeting, expense tracking, vendor management, and analytics, providing valuable insights into spending patterns and identifying cost-saving opportunities. By adopting spend management software, businesses can streamline their financial processes, enforce spending policies, and improve overall financial efficiency, leading to better financial control and improved profitability.

See also: Top 10 Online Accounting software

See also: Top 10 Online Accounting software

2023. Spend management firm Clara secures $60M

Clara, a Mexico-based spend management company, has raised $60M. The company provides reporting software for better financial decision-making, locally issued corporate cards, bill pay and financing solutions. Its end-to-end solution includes our locally-issued corporate cards, Bill Pay, financing solutions, and our highly-rated software platform used by thousands of the most successful companies across the region. Clara also continues to prove rapid growth. In addition, the company partners with financial institutions to provide additional lending capabilities. Clara is working with 10,000 companies across Latin America, notably in Brazil, Mexico and Colombia.

2022. Mesh Payments closes on $60M as demand for its corporate spend offering surges

Financial management startup Mesh Payments has secured $60 million in fresh funding. Originally established in Israel and currently headquartered in New York, Mesh Payments is part of the growing cohort of startups dedicated to streamlining companies' expenditure through automated solutions. This sector is currently thriving with fierce competition, including notable players such as Ramp, Brex, Airbase, TripActions, Rho, and others. Mesh Payments' objective is to enable its clients to automate their spending processes while providing real-time insights. Similar to its aforementioned competitors, the company also offers a corporate card service.

2022. Sava, a spend management platform for African businesses, gets $2M

Sava, the South African fintech startup empowering small businesses with comprehensive spending management solutions, has successfully secured $2 million in pre-seed funding. Sava's innovative platform integrates bank accounts, mobile wallets, payment systems, and accounting tools into a unified interface. By addressing two critical pain points in business operations—spend management and reconciliations—Sava aims to provide small businesses with the necessary tools to control their expenditures effectively. Additionally, Sava acknowledges that business owners and their teams currently spend significant amounts of time on manual record-keeping and reconciliations, lacking sufficient data for prudent decision-making.

2021. Rho raises $75M for its one-stop corporate spend and cash management solution

Corporate spend and cash management company Rho has recently secured $75 million in Series B funding. With a particular emphasis on serving companies with 30 to 500 employees, Rho caters to small and medium-sized businesses (SMBs) seeking streamlined workflows across banking, cards, and accounts payable processes. The company's primary focus is on automating back-office operations and developing a platform that enables "self-driving" finance within enterprises. In line with this vision, Rho offers solutions like Rho AP for automated accounts payable and the Rho Card, as part of its comprehensive strategy to position itself as the ultimate finance platform for businesses.

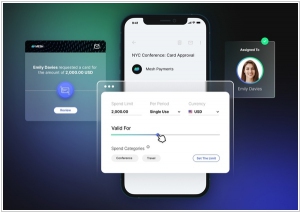

2021. PayEm raises $27M for its answer to the expense report

Israeli company PayEm has successfully raised $27 million. PayEm specializes in developing a spend and procurement platform tailored for high-growth and multinational organizations. The company's advanced technology automates various financial processes, including reimbursement, procurement, accounts payable, and credit card workflows. This comprehensive solution efficiently manages requests, invoices, bill creation, and payment distribution across more than 200 territories, supporting 130 different currencies. By providing real-time visibility, PayEm enables finance teams to monitor employees' expenditure requests and actual spending. For instance, teams can submit customized purchase requests with associated transaction descriptions, going through an approval flow. Simultaneously, the platform continuously reconciles all transactions, eliminating the need for time-consuming paperwork reconciliation at the end of each month.

2021. Trace announces $8M seed to help companies coordinate budgets

Trace, a startup specializing in collaborative purchasing and hiring, has successfully raised $8 million in seed funding. Trace streamlines and manages essential interactions between finance departments and other stakeholders within a business, with a particular focus on budget owners. By providing visibility into financial targets, Trace empowers budget owners by ensuring clarity on their objectives. The underlying idea is to establish a more synchronized workflow among all stakeholders involved in the process, including finance, department heads, legal teams, security operations, and more. Rather than relying on multiple fragmented tools, Trace aims to consolidate and simplify this entire process within a single service.

2021. Spend management startup Divvy raises $165M

Divvy, a startup specializing in corporate spend management, has successfully concluded a funding round, raising $165 million and achieving a valuation of $1.6 billion. Divvy operates within the corporate spend management space, which encompasses corporate cards and software aimed at assisting companies in managing and controlling expenses. This market segment is currently experiencing significant activity as businesses seek to modernize their financial infrastructure. Divvy's successful capital raise comes amidst similar funding announcements from several other competitors. Notable rivals in this space include Ramp, Teampay, and Airbase. Divvy and Ramp offer their corporate spend products and software free of charge, generating revenue through interchange revenues. On the other hand, Teampay and Airbase not only earn income from interchange but also charge for their software services.

2020. Coupa Software snags Llamasoft for $1.5B to bring together spending and supply chain data

Coupa Software, a publicly traded company specializing in assisting large corporations in spending management, has announced its acquisition of Llamasoft, an 18-year-old Michigan-based company focused on aiding large enterprises in supply chain management. The purchase was valued at $1.5 billion. Llamasoft recently introduced its latest AI-driven platform designed for intelligent supply chain management. This specific feature caught the attention of Coupa, as it sought a supply chain application to complement its existing spend management capabilities.

2020. Spend software startup Airbase raises $23.5M

Airbase, a startup specializing in spend and budgeting software for companies, has announced a $23.5 million extension to its Series A funding round. Airbase provides a range of financial solutions, including virtual cards, corporate cards, and a streamlined bill payment method. To facilitate financial tracking, the platform offers spend reporting and controls that help organizations manage their cash outflows effectively. By simplifying and centralizing the purchasing process, Airbase aims to provide businesses with greater control and management capabilities. While the software offers a free tier, larger companies with higher spending volumes are charged a SaaS fee for accessing the full suite of features. This new funding will further support Airbase's mission to enhance financial management for businesses.

2019. Soldo scored $61M for its spend management platform for business

Soldo, the platform providing a multi-user spending account solution for businesses, has successfully raised $61 million in Series B funding. Soldo caters to businesses of all sizes, ranging from SMEs to larger enterprises, that require efficient expense management across their entire organization. The platform combines a Soldo account, a central dashboard, iOS and Android apps, and virtual wallets or physical "pre-paid" Mastercards, which can be distributed to employees, departments, consultants, or contractors. Soldo also offers comprehensive spending controls as a core feature of its technology stack. Additionally, users can capture receipt data, and the platform seamlessly integrates with popular business accounting software such as Xero, QuickBooks, Concur, Expensify, NetSuite, Zucchetti, and SAP.