SaaS Management platforms

Updated: November 11, 2023

SaaS Management platforms are specialized tools that help businesses efficiently manage their Software as a Service (SaaS) applications and subscriptions. These platforms offer features for tracking and monitoring SaaS usage across the organization, providing insights into license utilization and costs. SaaS Management platforms enable businesses to discover and assess all the SaaS applications in use, ensuring compliance with IT policies and security standards. With integration capabilities, these platforms streamline the onboarding and offboarding of employees, enabling IT administrators to manage user access and permissions to SaaS applications effectively. Additionally, SaaS Management platforms can help optimize software spend by identifying underutilized licenses or redundant applications. By leveraging SaaS Management platforms, organizations can improve visibility and control over their SaaS landscape, enhance security and compliance, and maximize the value of their SaaS investments.

See also: Top 10 IT Service Desk software

See also: Top 10 IT Service Desk software

2022. Cledara raises $20M to help companies control their SaaS sprawl

Cledara, a platform dedicated to software management, has successfully raised $20 million in a Series A funding round. Its primary goal is to empower companies with enhanced control and insights into their SaaS (Software as a Service) subscriptions. With the rise of SaaS sprawl, where organizations subscribe to numerous online services, often exceeding 200, through web browsers, managing these subscriptions becomes increasingly complex. While the SaaS model offers many advantages and aligns with the broader cloud movement, it poses challenges for IT departments tasked with overseeing and tracking all the associated costs. Cledara addresses this challenge by acting as a comprehensive "system of record," providing valuable insights into application usage, renewal reminders, cost analysis, spend analytics, and forecasting. By leveraging Cledara's platform, companies of all sizes can streamline their SaaS management and gain better control over their software expenses.

2022. Josys secures $32M for its SaaS management platform

Japanese B2B SaaS platform Josys announced today that it has successfully raised $32 million in funding. As a spin-off from its parent company Raksul, Josys launched its automated management IT devices and SaaS application in September 2021, aiming to streamline and automate corporate IT operations while reducing costs and enhancing security systems. What sets Josys apart from other SaaS management platforms like BetterCloud and Okta, according to the company, is its comprehensive approach that empowers users through various professional services. These services include device procurement, business process outsourcing (kitting services), storage, and SaaS management.

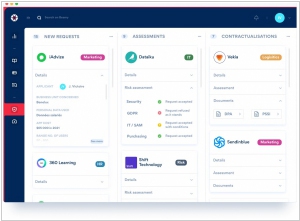

2022. Beamy lands $9M to help enterprises detect and manage their SaaS apps

Beamy, a startup, has secured $9 million in a funding round as it aims to address the challenges of SaaS management. The company's platform promises to simplify the installation, updating, and maintenance of SaaS applications. Beamy differentiates itself by offering a "decentralized" approach to detecting and controlling SaaS apps. Through advanced algorithms, the platform tracks the lifecycle of each app and identifies potential security and compliance risks. While Beamy is not alone in this market, with competitors such as Meta SaaS, AppOmni, and Productiv offering similar SaaS security and governance controls for enterprises, there are also specialized solutions like Atmosec and Grip Security that focus specifically on the cybersecurity aspects of SaaS management.

2021. Cacheflow raises $6M to simplify SaaS buying experience

Cacheflow, a startup that is developing a SaaS buying service and financing solution, has successfully secured a seed round of funding totaling $6 million. In today's modern era, SaaS sales can be unexpectedly inflexible, with many companies preferring yearly contracts and upfront payments for the sake of cash flow. To address this challenge, Cacheflow aims to provide buyers with multiple payment options, while also offering upfront cash to software companies. Cacheflow allows customers to select monthly, quarterly, or deferred payment plans for their software contracts. This approach enables customers to purchase software even if they have exhausted their current budget cycle. As a result, software companies can achieve more consistent sales without having to wait for late-year budget resets.

2021. Sastrify snags $7M to help SMEs manage SaaS buying

Sastrify, a startup, has successfully concluded a seed funding round of $7 million. The company offers a highly automated platform that covers a wide range of SaaS solutions, exceeding 20,000, to assist businesses in procuring and managing third-party services. Sastrify specifically targets SMEs and emphasizes the significant benefits its customers have experienced, including an average return on investment of 6.5x and substantial time savings from streamlining SaaS procurement processes. While acknowledging competition from companies like Vendr and Tropic, Sastrify's regional focus extends beyond Europe, demonstrating its commitment to a global market presence.

2021. Vendr raises huge $60M for its SaaS-purchasing service

SaaS procurement startup Vendr has successfully raised $60 million in Series A funding. The company's unique approach of facilitating transactions between SaaS buyers and sellers has proven to be a great fit for the growing reliance on software and the increased focus on cost control in 2020. Vendr acts as an intermediary, streamlining the purchasing process and reducing costs for its customers. By managing their software spend, Vendr charges a percentage ranging from 1% to 5%. For instance, a typical company with 500 employees might allocate $2 million to $3.5 million annually for software expenses. Based on this calculation, Vendr could generate revenue between $20,000 and $35,000 at a 1% spend rate. But why would Vendr customers choose to outsource their software spend management? The answer lies in savings. By leveraging Vendr's services, both buyers and sellers benefit from cost efficiencies. The buyers achieve significant savings, while the sellers may miss out on the opportunity to charge higher prices to less experienced buyers.

2021. Torii raises $10M to automate SaaS management

Torii, an Israeli startup aiming to simplify SaaS tool management, has recently secured a $10 million Series A funding. At the core of Torii's concept lies an automation engine designed to discover and oversee all SaaS tools utilized within an organization. By gaining insights into their software stack, users can leverage a no-code workflow engine to create customized workflows for essential activities like employee onboarding and offboarding. This approach has proven successful, especially as the pandemic struck in 2020, leading to an increased need for effective control and understanding of SaaS tools. Torii experienced remarkable growth, with a 400% year-over-year revenue increase. Notable customers of Torii include Delivery Hero, Chewy, Monday.com, and Palo Alto Networks.

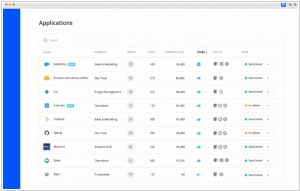

2020. Cledara, the SaaS purchase and management platform, raises $3.4M

Cledara, the SaaS purchase and management platform dedicated to enhancing visibility and control over company software subscriptions, has secured an additional $3.4 million in funding. With its innovative software, Cledara enables companies to effectively track and manage their SaaS usage and expenditures. It offers analytics capabilities to assess the value of these investments. Notably, Cledara provides unlimited virtual debit cards, empowering employees and external teams to make independent SaaS purchases. The platform allows management to review and approve each transaction in advance while providing real-time updates on all purchases made. Cledara generates revenue through interchange fees from card spend and operates under a SaaS subscription model.

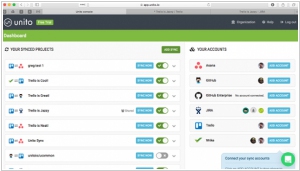

2020. Unito raises $10.5M to integrate workplace collaboration tools

Montreal-based startup Unito has successfully concluded a Series A funding round, raising $10.5 million. Unito specializes in developing software that facilitates seamless communication between various collaboration platforms. By leveraging the APIs of leading workplace productivity software suites, Unito's tool enables actions performed in one software to be automatically translated and synchronized with others. This includes updates, comments, and due dates, ensuring that information remains consistent across all integrated apps. Consequently, employees can focus on utilizing the software that best suits their specific job requirements. Currently, Unito offers integrations with a range of popular tools such as Jira, Asana, Trello, GitHub, Basecamp, Wrike, ZenDesk, Bitbucket, GitLab, and HubSpot.

2019. SaaS buying platform Vendr raises $2M

Vendr, a company specializing in enterprise SaaS management, has successfully raised $2 million in funding. Their offering is a subscription-based software that caters to the needs of rapidly expanding businesses, allowing them to purchase and oversee enterprise SaaS solutions. The pricing of the software depends on the size of the company's workforce. In essence, the product streamlines the sales process by removing the need for direct human intervention, enabling companies to procure or upgrade software through automated means. The objective is not to eliminate the sales profession, but rather to eliminate the reliance on persuasive sales tactics and simplify enterprise software purchases, making them as effortless as buying consumer products. Vendr currently has a team of six employees and serves 19 customers, including prominent names like Canva, Grammarly, GitLab, Brex, HubSpot, and InVision. Notably, the company has garnered support from influential figures such as Jon Runyan, Okta's general counsel, Dan Wright, AppDynamics' COO, and Aaron Epstein, a partner at YC.