Top 10: Financial Analytics software

Updated: July 30, 2023

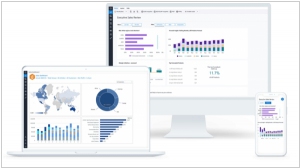

Financial Analytics software is a sophisticated tool that enables businesses to gain valuable insights into their financial performance and make data-driven decisions to improve profitability and operational efficiency. This specialized software aggregates and analyzes financial data from various sources, such as accounting systems, ERP software, and transaction records, to provide comprehensive and real-time financial reporting. Financial Analytics software offers features for budgeting, forecasting, and financial modeling, helping organizations to plan and strategize effectively. It also facilitates advanced financial analysis, such as variance analysis, trend analysis, and profitability analysis, allowing businesses to identify areas for improvement and optimize resource allocation. By leveraging Financial Analytics software, organizations can gain a deeper understanding of their financial health, mitigate risks, and seize growth opportunities, ultimately enhancing their financial performance and gaining a competitive edge in the market.

Some of the most popular financial analytics software options are listed below.

See also: Top 10 Business Intelligence software

See also: Top 10 Business Intelligence software

2021. Abacum, a SaaS for finance teams, raises $25M

Abacum, a SaaS company that specializes in enhancing the financial planning and analysis tools of mid-sized companies, has successfully raised $25 million in a Series A funding round. The software's primary objective is to introduce a collaborative element to financial planning and analysis, simplifying the process of sharing data within financial teams and across the entire organization. This is achieved through the automation of laborious and repetitive manual tasks, such as copying and pasting data between spreadsheets, as well as other data transformations that are prone to human error.

2021. DataRails books $25M to build better financial reporting tools for SMBs

An Israeli startup named DataRails has secured $25 million in funding to further develop its platform, enabling small and medium-sized businesses (SMBs) to utilize Excel for financial planning and analytics, similar to larger enterprises. DataRails has created a platform that can extract and analyze the data from existing Excel spreadsheets, providing a comprehensive overview of the company's financial status. For SMEs, Excel is a fundamental software tool, but its limitations and lack of extensibility have long been a source of frustration. Addressing this pain point was the primary motivation behind the inception of DataRails.

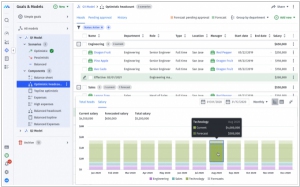

2021. Cube raises $10M more to help companies plan their financial future

Cube, a startup specializing in developing financial planning and analysis software tailored for the mid-market, has announced the successful completion of a $10 million Series A funding round. Cube aims to create FP&A software that not only enhances the user experience but also allows companies to continue utilizing spreadsheets. The software seamlessly integrates data from a company's general ledger (accounting software), CRM (such as Zoho CRM), and payroll service into a centralized platform. This empowers CFOs and their teams to review historical data and strategize for the future using various visualization methods, including the trusted spreadsheet format.

2021. Mosaic raises $18.5M to rebuild the CFO software stack

Startup Mosaic has recently secured $18.5 million in Series A funding for its "strategic finance platform" software. This platform is specifically designed to gather data from various enterprise IT systems such as ERPs, HRISs, and CRMs. It then equips CFOs and their teams with strategic planning tools, enhancing their ability to predict and forecast with improved accuracy and speed. Mosaic's goal is to reconstruct the CFO software stack by creating a platform that serves as a gateway, facilitating collaborative discussions on finance across the entire organization. While Mosaic primarily focuses on reporting and planning, which are essential aspects of the finance office, it aims to expand access to these dashboards and forecasts, enabling more individuals to gain insight into financial matters and provide feedback to the CFO.

2021. Jedox raises $100M to expand its financial modeling and analytics software to more verticals

Jedox, a German startup specializing in financial planning and analysis tools, has secured a funding round of over $100 million. Jedox's software was initially designed to assist financial planners by utilizing data from common documents like Excel spreadsheets, and it was compatible with both on-premises and cloud environments. In recent years, the company has expanded its offerings to include HR planning and procurement, catering to a broader range of users. With the new funding, Jedox aims to further broaden its application by targeting additional use cases and industry verticals.

2020. Cube closes $5M Seed round to scale its financial planning software

Cube, the software startup specializing in financial planning and analysis (FP&A) work, has successfully concluded a Seed round of funding, raising a little over $5 million. Within the realm of FP&A, traditional spreadsheet usage remains prevalent, and Cube aims to revolutionize this practice. The core functionality of Cube involves consolidating data from a company's various sources such as the general ledger (e.g., Quickbooks), customer relationship management (CRM) system (e.g., Salesforce), and human resources information system (HRIS) like ADP, into a centralized repository. This consolidated data can then be effectively managed and organized by FP&A professionals using Cube's proprietary visualization tool, spreadsheets, or web interface. The pricing for Cube's services starts at $850 per month, with options for higher-tier plans and discounted startup packages also available.

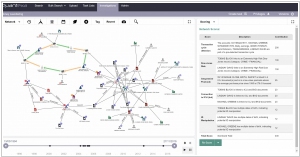

2020. Quantexa raises $64.7M to bring big data intelligence to risk analysis and investigations

Quantexa, the company behind the development of a machine learning platform called "Contextual Decision Intelligence" (CDI), has secured $64.7 million in a Series C funding round. CDI utilizes advanced analytics to analyze diverse data points, enabling improved identification of suspicious activities and the creation of comprehensive customer profiles for businesses. Quantexa initially gained traction by providing solutions to major banks and financial institutions. Moving forward, the company plans to further enhance its tools for the financial services sector while also expanding into two emerging markets: insurance and government/public sector organizations.

2019. Cash Flow Tracking software Tesorio raised $10M

Tesorio, a startup specializing in assisting businesses with consolidating and analyzing their cash flow data, has successfully raised $10 million in a Series A funding round. The company is addressing a fascinating yet surprisingly underserved market, considering that every company desires to closely monitor its cash flow. Despite this, many companies still rely on Excel spreadsheets for this purpose. Tesorio offers a solution that aggregates all cash flow data, comparable to Mint's function for individuals, and applies AI models to predict a company's overall financial well-being. Notable customers already benefiting from Tesorio's services include Veeva Systems, Box, and WP Engine.

2019. AppZen raised $50M to build AI for financial analysis

AppZen, the startup specializing in building AI-powered tools to automate functions within the finance department, has secured an additional $50 million in funding. So far, AppZen's primary offering has been a service that conducts automated expense audits. It compares an employee's charges with their travel history, among other data points, to determine if the expenses align. The service also ensures compliance with company policies and raises alerts for any non-compliant expenses. AppZen's exceptional product has garnered a substantial client base, including Amazon, Nvidia, Salesforce, and three of the leading banks in the United States.

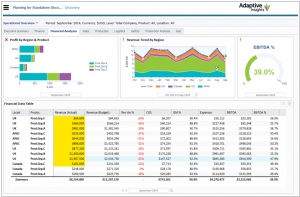

2018. Workday acquired financial modelling startup Adaptive Insights

Cloud-based HRM service Workday is set to acquire Adaptive Insights, a leading provider of cloud-based business planning and financial modeling tools, for a substantial sum of $1.55 billion. This strategic move by Workday aims to position itself as the primary destination for comprehensive back-office services catering to its business clientele. Workday plans to seamlessly integrate Adaptive Insights' robust suite of tools into its existing platform, offering an all-encompassing solution to its customers. With a vast customer base, Adaptive Insights has witnessed remarkable growth, mirroring the rapid expansion of cloud services and the emergence of business intelligence as a dedicated software category. This evolution has resulted in not only CFOs but also a multitude of in-house analysts relying on sophisticated data analytics to facilitate informed decision-making at various levels within organizations.

2015. FinancialForce cloud ERP raises $110M to take on SAP and Oracle

FinancialForce, the cloud-based ERP solution built on the Salesforce1 platform, has announced a successful funding round, securing an additional $110 million in investment. As the cloud computing industry continues to mature, we are witnessing a growing trend of back-office functions, such as ERP, transitioning to the cloud and gaining significant traction. Traditionally, this market has been dominated by established players like SAP, Oracle, and Microsoft. However, cloud-based providers like FinancialForce and NetSuite are starting to make their presence felt. FinancialForce, in particular, stands out as an intriguing player in the field. While it positions itself as the logical ERP choice for Salesforce customers, it has also established itself as a strong offering in its own right. Leveraging the capabilities of Force.com, FinancialForce not only integrates seamlessly with Salesforce but also provides a credible and independent ERP solution.