Square vs Stripe

July 02, 2023 | Author: Sandeep Sharma

27

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Square and Stripe are both prominent payment platforms, but they differ in their target audience, functionality, and approach. Square is a comprehensive financial technology company that provides a suite of services for businesses, including point-of-sale hardware and software, online payment processing, and business management tools. It caters to small businesses and offers solutions for accepting payments in various settings, including in-person and online. Square is known for its user-friendly interface, integrated ecosystem, and accessibility for businesses of all sizes. On the other hand, Stripe is a developer-centric payment infrastructure that offers tools and APIs for businesses to integrate payment processing directly into their websites or applications. It provides extensive customization options, advanced developer tools, and support for subscription billing. Stripe is popular among businesses that require flexible payment solutions and want to have greater control over the payment process.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

Square vs Stripe in our news:

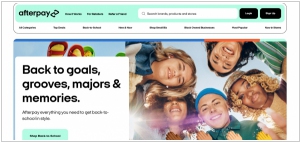

2021. Square acquires buy-now, pay-later company Afterpay for $29 billion

Square has reached an agreement to acquire Afterpay, an Australian buy-now, pay-later service, in an all-stock transaction valued at approximately $29 billion. This acquisition stands as one of the largest in Australian history. Square has announced its intention to incorporate Afterpay into both Cash App and Seller. Cash App facilitates payments and money transfers for customers, while Seller caters to retailers. Following the integration, Cash App users will have the ability to manage their Afterpay payments directly within the app, and Seller merchants will be able to offer Afterpay as a payment option to their customers.

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Stripe, the privately-held payments company, has recently completed the acquisition of TaxJar, a well-known provider of cloud-based tax services. TaxJar's suite of services enables businesses to automatically calculate, report, and file sales taxes. An important aspect of TaxJar is its ability to navigate various geographies and the complex sales tax regulations associated with each, making it a valuable resource for online businesses. Stripe plans to integrate TaxJar's technology into its revenue platform, alongside its existing tools such as Stripe Billing for subscriptions and Radar for fraud prevention. Additionally, Stripe envisions leveraging AI and other technologies to automate further functions and potentially introduce new services. While TaxJar will be integrated with Stripe's offerings, businesses will still have the option to use TaxJar directly for their tax-related needs.

2020. Square acquires inventory management company Stitch Labs

The financial services, merchant services aggregator, and mobile payment company Square has acquired Stitch Labs, a company that specializes in inventory management software. Square, which is widely used by over 33.5 million small businesses for various purposes like accepting credit card payments, tracking sales and inventory, and obtaining financing, aims to enhance its Seller ecosystem by incorporating Stitch Labs' expertise. Currently, Square's functionality falls short of providing a complete inventory and order management system or fully meeting the needs of advanced Stitch Labs users. However, there is potential for Square to expand its software capabilities in the future with the assistance of the Stitch Labs team. In the meantime, we have compiled a list of the best alternatives to Stitch Labs that are currently available on the market.

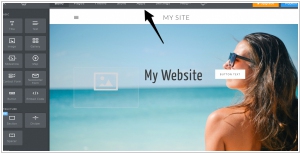

2018. Square acquired website builder Weebly

Square, renowned for its payment software, has announced its acquisition of Weebly for a sum of $365 million. Weebly specializes in providing user-friendly website-building tools primarily tailored for small businesses and e-commerce companies. The company has successfully secured $35.7 million in funding. Square's objective in acquiring Weebly is to establish a unified solution that caters to entrepreneurs seeking to establish a robust online and offline business presence. This strategic move will also facilitate Square's global expansion, given that 40 percent of Weebly's 625,000 paid subscribers are based outside of the United States.

2018. Stripe launched online billing tool

Stripe is introducing a billing solution tailored for online businesses. This new product enables these businesses to efficiently manage recurring subscription revenue and invoicing within the Stripe platform, streamlining their operations. The aim is to replace previously manual methods of invoicing or assembling various subscription tools, offering a seamless experience similar to charging for products on Stripe. This launch is partially motivated by customer requests for a unified solution that consolidates invoices and subscription expenses. As an enterprise company, Stripe prioritizes understanding customer needs while simultaneously innovating to provide elegant solutions for problems that small businesses may not have anticipated.

2017. Mobile POS system Square launched Retail app

Square is introducing an all-new Square Retail app that complements an extensive backend package of tools. This package includes comprehensive inventory management, customer relationship management, and employee tools. The aim of this new offering is to deliver a top-notch retail solution for merchants and shop owners who require more than just the Square Reader and basic Square mobile app. The scalability of this solution allows it to cater to clients ranging from single-location shops to merchants with multiple storefronts and extensive inventory tracking needs. Initially, Square is primarily targeting retailers in the "finished goods" industry, which includes those selling packaged products, apparel with barcodes, as well as items like wine or games.

2016. Square now allows to charge loyal customers without card swiping

Mobile payment processing service Square has introduced a new feature called Card on File, which enables businesses to charge recurring customers without physically swiping their cards or requesting them. This feature benefits customers as well, as they can visit your shop or restaurant without carrying their cards or cash. They can simply choose what they want and leave, while you effortlessly charge the appropriate amount directly from their cards. To avail this service, customers must initially opt in and provide their card information to your company's Square account. Additionally, Card on File allows businesses to charge remote customers even without an internet payment connection. However, it is important to note that this feature comes at a slightly higher cost for businesses, with a fee of 3.5% plus 15 cents, as compared to the standard 2.75% commission for card swiping.

2015. Payment processing company Stripe partners with Visa

Payment processing company Stripe has recently completed a financing round, resulting in a valuation of $5 billion. In addition to securing nearly $100 million in funding, the company has formed a partnership with Visa, aimed at collaborating on various initiatives, including digital transactions and security. Stripe has been actively pursuing its global expansion strategy, and this partnership with Visa will play a crucial role in that endeavor. By leveraging Visa's extensive international presence and expertise, Stripe intends to broaden its existing coverage of 20 countries. CEO and co-founder, Patrick Collison, emphasized the significance of this collaboration in expanding Stripe's reach and capabilities, as highlighted in The New York Times.

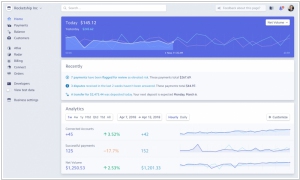

2015. Square launched a dashboard app for iOS

Mobile payment processing service Square has introduced its second non-consumer application, an iOS dashboard app designed for business owners. This app enables business owners to monitor real-time sales data and gain valuable insights into the performance of their business through analytics. While this app is not intended for the barista on duty, it serves as a valuable tool for owners who need to oversee operations remotely. With this app, business owners can conveniently track stock levels across multiple locations, enabling them to make informed decisions on the go, without the need for a desktop computer.

2015. Square launched payroll service for small businesses

Mobile payment startup Square has introduced Square Payroll, a software solution designed to assist businesses in managing payroll, tracking taxes, and handling other expenses related to both hourly and salaried employees. The pricing for this product is set at $20 per month, with an additional charge of $5 per employee. Square aims to position itself as a relatively straightforward and uncomplicated option within the payroll software market, at least for the time being. The software includes features such as timecard management, tax management, and the capability to handle payments for both hourly and salaried workers, all bundled together at a single price. Square Payroll enters a competitive landscape, facing established players like Intuit's QuickBooks, ADP, Paychex, and others. While some competitors like Wave Accounting offer similar features, they may not provide the complete range of services offered by Square Payroll. For instance, Wave Accounting does not handle tax payments or tax filings, only estimated tax liabilities. Additionally, Wave Accounting offers lower pricing, with two base tiers starting at $10 and $15 plus an additional $4 per employee.