Marketo vs Oracle Marketing Cloud

June 12, 2023 | Author: Sandeep Sharma

Marketo and Oracle Marketing Cloud are both popular marketing automation platforms, but they differ in their features, target markets, and integration capabilities.

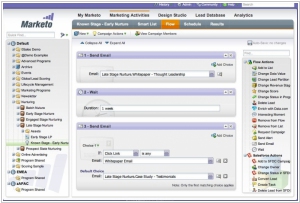

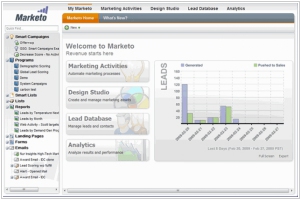

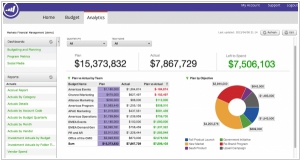

Marketo is a widely used marketing automation software that offers a comprehensive suite of tools for managing and optimizing marketing campaigns. It provides features for lead management, email marketing, campaign management, social media marketing, analytics, and more. Marketo is known for its user-friendly interface, ease of use, and robust lead nurturing capabilities. It is commonly used by small to medium-sized businesses that prioritize lead generation and marketing automation.

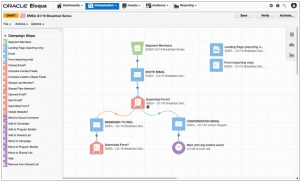

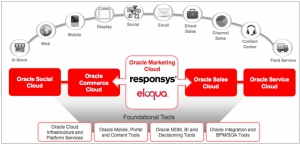

Oracle Marketing Cloud, on the other hand, is an enterprise-level marketing automation platform developed by Oracle Corporation. It offers a comprehensive set of tools for managing marketing campaigns, customer data, and customer experiences. Oracle Marketing Cloud provides advanced features for segmentation, personalization, campaign automation, content marketing, social media marketing, and analytics. It is designed to cater to the needs of large enterprises that require scalability, customization options, and seamless integration with other Oracle products.

See also: Top 10 Marketing software

Marketo is a widely used marketing automation software that offers a comprehensive suite of tools for managing and optimizing marketing campaigns. It provides features for lead management, email marketing, campaign management, social media marketing, analytics, and more. Marketo is known for its user-friendly interface, ease of use, and robust lead nurturing capabilities. It is commonly used by small to medium-sized businesses that prioritize lead generation and marketing automation.

Oracle Marketing Cloud, on the other hand, is an enterprise-level marketing automation platform developed by Oracle Corporation. It offers a comprehensive set of tools for managing marketing campaigns, customer data, and customer experiences. Oracle Marketing Cloud provides advanced features for segmentation, personalization, campaign automation, content marketing, social media marketing, and analytics. It is designed to cater to the needs of large enterprises that require scalability, customization options, and seamless integration with other Oracle products.

See also: Top 10 Marketing software

Marketo vs Oracle Marketing Cloud in our news:

2018. Adobe acquires Marketo for $4.75 billion

Adobe has announced its acquisition of the marketing automation company Marketo for a significant $4.75 billion. This strategic move positions Adobe strongly in the enterprise marketing arena, pitting it against major competitors like Salesforce, Microsoft, Oracle, and SAP. The acquisition not only bolsters Adobe's Marketing Cloud portfolio but also grants access to Marketo's expansive customer base of 5000 organizations. This presents a valuable opportunity for Adobe to drive revenue growth in this particular segment of its offerings, while intensifying its competitive edge within the enterprise market. With the integration of Marketo, Adobe is poised to further solidify its position and expand its reach in the realm of marketing automation.

2017. Marketo picks Google Cloud to migrate from on-prem data centers

Marketo, the marketing automation platform, has made the strategic decision to migrate its entire on-premises operation to the Google Cloud Platform. This collaboration goes beyond mere hosting, as Google will offer enhanced integration with GSuite. As a result, Marketo customers will enjoy the ability to create content and engage with their customers directly from the Marketo platform, leveraging popular Google tools such as Gmail, Sheets, and Hangouts Chat. Additionally, Marketo has outlined plans to leverage Google BigQuery for advanced analytics and utilize Google's machine learning APIs to unlock improved marketing insights for its clientele. By embracing this partnership, Marketo aims to empower its customers with an enriched experience and enable more effective marketing strategies.

2016. Vista Equity Partners acquired marketing platform Marketo

San Francisco-based Vista Equity Partners has entered into an agreement to acquire the online marketing platform Marketo for a sum of $1.79 billion. This strategic acquisition will enable Marketo to maintain its unwavering commitment to customer success and retain its position as a leading independent player in the market. Marketo will continue to spearhead product innovation and thought leadership within the digital marketing industry, setting the agenda for the future. Furthermore, this partnership will empower Marketo to fulfill its ambitious vision of providing an ultra-scalable enterprise platform for customer engagement, catering to the needs of tomorrow's marketers and the C-suite.

2015. Marketing platform Marketo adds LinkedIn integration

The engagement marketing platform Marketo has introduced integration with the lead-generation and nurturing solution provided by the professional networking site LinkedIn. This integration aims to assist marketers in bridging the gap between digital, social, and offline channels, ultimately facilitating meaningful conversations with customers. According to a blog post by LinkedIn officials, the solution effectively addresses the issue of prospect abandonment. When a prospect visits a webpage but closes their browser without taking further action, they are not forgotten. Instead, they are nurtured through a series of messages across various channels, including LinkedIn social ads, display ads, and more. When the prospect later completes a form, their email and other relevant information are captured in Marketo's system. Subsequently, the prospect receives targeted emails, display ads, and social ads tailored to their demographics, website behavior, and engagement with the company's content.

2014. Oracle acquired marketing data provider Datalogix

Oracle has recently declared its plan to acquire Datalogix, a specialist in data marketing that obtains consumer sentiment data through partnerships with Facebook, Twitter, and other sources. In industries such as consumer product goods and automotive, businesses are striving to maximize their benefits from social networks. Consequently, the data collected by companies like Datalogix, Acxiom, and Epsilon is highly regarded for its immense value. This acquisition takes place just ten months after Oracle's acquisition of Bluekai, another prominent player in the field of data aggregation.

2013. Oracle Buys Responsys for $1.5 Billion, Merges with Eloqua

Exactly one year after Oracle's acquisition of marketing automation company Eloqua for $871 million, Larry Ellison and his team have revealed plans to purchase marketing cloud player Responsys for $1.5 billion. Oracle's foray into the marketing realm in 2012 has been marked by a series of acquisitions, leading to a direct competition with its primary rival, Salesforce. In response to Oracle's purchase of Eloqua, Salesforce acquired ExactTarget in the middle of 2012. This move occurred shortly after ExactTarget had acquired B2B marketing automation vendor Pardot. As a result, both Oracle and Salesforce now possess marketing systems explicitly tailored for either B2B or B2C customers.