Gusto vs QuickBooks

July 02, 2023 | Author: Adam Levine

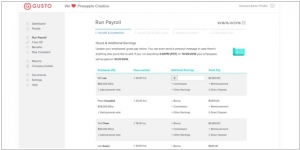

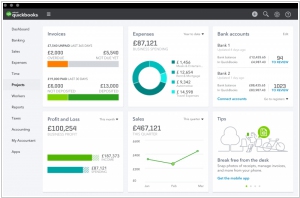

Gusto and QuickBooks are both widely used cloud-based platforms for small business management, but they focus on different aspects of business operations. Gusto is primarily known for its payroll and HR services. It offers features such as automated payroll processing, employee benefits administration, time tracking, and employee onboarding. Gusto's user-friendly interface and intuitive design make it popular among small businesses seeking a streamlined payroll solution. On the other hand, QuickBooks is a comprehensive accounting software that provides a range of financial management tools. It includes features such as invoicing, expense tracking, bank reconciliation, and financial reporting. QuickBooks is well-suited for businesses that require robust accounting capabilities and want to manage their finances efficiently.

See also: Top 10 Talent Management Systems

See also: Top 10 Talent Management Systems

Gusto vs QuickBooks in our news:

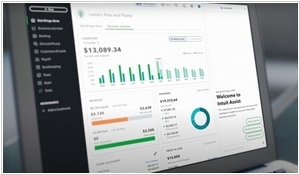

2023. Intuit launches generative AI–powered digital assistant for small businesses and consumers

Intuit, the prominent U.S. financial and accounting software company, has introduced its inaugural customer-centric generative AI-driven solution known as Intuit Assist. Functioning as a digital assistant, it is seamlessly integrated into Intuit's suite of platforms and products, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. With a consistent user interface, Intuit Assist leverages contextual datasets to deliver personalized recommendations to the company's vast customer base of over 100 million small businesses and consumers worldwide. This innovative offering also facilitates human assistance through Intuit's live platform when necessary. The digital assistant was created using GenOS, Intuit's proprietary operating system based on generative AI, which was launched in June to empower developers in incorporating AI across the company's product portfolio.

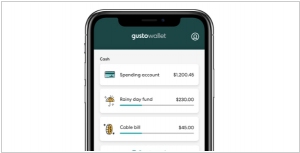

2020. Gusto is expanding from payroll into a full suite financial wellness platform

Gusto initially emerged as a payroll startup catering to small businesses. However, in recent years, the company has expanded its range of features beyond payroll, redefining the boundaries between payroll and financial wellness. This has led to a convergence that blurs the traditional lines of the fintech market. Presently, Gusto has unveiled a range of new offerings intended to provide employees with enhanced financial and health options through their employers. Notably, one noteworthy addition is Gusto Wallet, an app and suite of products designed for employees who receive their wages through Gusto. Gusto Wallet functions as a mini bank and financial health monitoring tool. It includes an interest-bearing cash account known as Cash Accounts, which can automatically allocate a portion of each paycheck into the user's savings, similar to offerings from Acorns and Digit.

2020. Intuit acquires inventory management software TradeGecko

Intuit, a US-based business and financial software company, has made a deal to purchase TradeGecko, a Singaporean software-as-a-service company specializing in online inventory and order management software for small businesses. The acquisition, valued at $80 million, aims to combine TradeGecko's inventory and order management capabilities with Intuit's QuickBooks accounting platform. This integration will enable QuickBooks Online customers to effectively launch and oversee products across online and offline sales channels. Additionally, they will be able to handle orders and inventory fulfillment from different channels and multiple inventory locations, as stated in the announcement.

2017. Intuit acquired time-tracker TSheets

Intuit, the company renowned for products like QuickBooks, has recently made a significant acquisition. They have acquired TSheets, a time-tracking service and employee scheduling app with a customer base exceeding 35,000, for a total of $340 million. Given the substantial overlap in their target markets, primarily catering to small and medium-sized businesses, it's evident that QuickBooks and TSheets complement each other. In fact, Intuit reveals that the two companies already share 12,000 customers, indicating an existing synergy. This acquisition is not primarily aimed at acquiring new customers but rather at enhancing the QuickBooks ecosystem. It's worth noting that TSheets already integrates with QuickBooks. Throughout my discussions with Intuit in recent months, it has become apparent that their current product plans revolve around minimizing friction, particularly in relation to QuickBooks, aligning with their commitment to creating seamless experiences for their users.

2015. ZenPayroll rebrands as Gusto and takes on Zenefits

Payroll startup ZenPayroll, which now goes by the name Gusto, has broadened its range of services from solely payroll to include additional benefits like health insurance and workers' compensation. This development has sparked a rivalry with Zenefits, a cloud HR benefits company that previously collaborated with Gusto to offer payroll services to its clients. The partnership between Zenefits and Gusto proved crucial earlier this year when ADP, a major player in the payroll industry, terminated its access for Zenefits' small business customers. Zenefits turned to Gusto (previously ZenPayroll) to handle their payroll processing needs. Interestingly, Zenefits is also planning to introduce its own payroll service, mirroring Gusto's offerings. This turn of events has transformed the partnership between these cloud-based startups into a competition, as both aim to provide comprehensive payroll and benefits services on a unified platform.

2015. Cloud-based payroll service ZenPayroll scores $60 Million

Cloud-based payroll processing startup, ZenPayroll, has successfully concluded a Series B funding round, raising $60 million with Google Capital as the lead investor. ZenPayroll primarily targets the small business market, providing an alternative to manual payment and direct deposit processing. Its user-friendly, cloud-based interface offers convenience and efficiency, enabling ZenPayroll to compete with established industry leaders such as Paychex and ADP. While Paychex and ADP have transitioned to the cloud in recent years, allowing their existing customer bases to manage payroll online and via mobile platforms, ZenPayroll's recent funding round empowers it to target larger businesses currently serviced by Paychex and ADP.

2014. Intuit acquired cloud integration service ItDuzzit

Intuit is further expanding its cloud platform for small and medium-sized businesses (SMB) through the acquisition of itDuzzit, a startup offering integration tools for connecting various web and mobile apps within enterprises. This can be likened to the functionality of IFTTT but tailored for business needs. Intuit's intention is to incorporate itDuzzit into its QuickBooks platform, which not only provides accounting services but also offers a growing range of additional services for businesses. itDuzzit competes with similar platforms like Zapier and Cloudwork. The platform currently supports integration with numerous apps, including Asana, Box, Coinbase, Freshbooks, PayPal, and Shopify, with the promise of adding more apps in the future. In essence, this acquisition allows Intuit to provide its customers with a seamless way to utilize these integrated apps on its platform, alongside Intuit software, even if Intuit doesn't have a direct hand in each of those services.

2014. Intuit buys Lettuce for $30M to add inventory and order management to Quickbooks

Intuit has expanded its portfolio by acquiring Lettuce, a platform designed for online order and inventory management, aiming to solidify its position as the leading provider of cloud-based office solutions for small and medium businesses. Unlike typical acquisitions where the purchased product is either shut down or its technology repurposed for a new service, Intuit plans to keep Lettuce functioning as an independent application. Additionally, Intuit intends to enhance the integration of Lettuce into its flagship small and medium business accounting product, Quickbooks, building upon the existing integration to provide a more comprehensive solution.

2008. Intuit launches QuickBooks Online Edition

Intuit dominates the accounting software industry, with its flagship product QuickBooks enjoying immense popularity among small and medium-sized businesses, boasting over three million users. In response to the increasing demand for web-based and online accessible solutions, Intuit introduced QuickBooks Online Edition (QBOE). Although QBOE has been available for several years, its adoption has been gradual yet steady. QBOE fulfills essential business requirements, offering comprehensive double-entry accounting capabilities that enable accurate balance sheets, profit and loss statements, and trial balances. The home screen serves as the starting point for users, distinguishing QBOE from other online accounting applications that aim to present a "dashboard view" of the business. Instead, QBOE presents a process diagram-style interface, allowing users to navigate through different functional areas of the accounting system. The Basic edition of QBOE provides fundamental features such as accounts receivable, expense tracking, and check printing, albeit with somewhat limited functionality considering its $10 monthly cost. On the other hand, the Plus version enriches the offering with additional features like estimates and invoice customization, time tracking, recurrent billing, budgeting, and online billing.

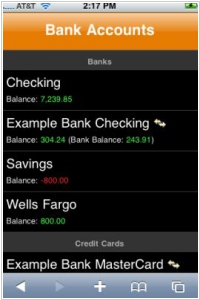

2008. Accounting on the go: Quickbooks for iPhone and Blackberry

Quickbooks, a leading accounting software for small businesses, has recently launched web interfaces for Blackberry and iPhone devices. The iPhone version, displayed on the left, features a sleek user interface that provides convenient access to all your financial information stored in Quickbooks Online. At first glance, the web app presents a simple overview of various aspects, including outstanding payments, payables, vendors, employees, and bank accounts. However, as you delve deeper, you discover a wealth of detailed information. While this web app appears to be an excellent tool for referencing financial data, there are a few areas where it falls short. It would have been nice to have a standalone app available through the App Store for the iPhone, although it's not entirely necessary. The most significant drawback is the inability to edit or add data, which, in my opinion, would be a primary use case for this app. It's worth noting that this is the initial version of the app, and additional functionality may be added in future updates. If you are already a Quickbooks Online user, these new web interfaces for Blackberry and iPhone provide additional benefits. Although they may not be the sole deciding factor in switching to Quickbooks Online, they can certainly contribute to the decision-making process.