Braintree vs Stripe

June 26, 2023 | Author: Sandeep Sharma

27

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Braintree and Stripe are both widely used payment platforms, but they differ in their features, target audience, and integration capabilities. Braintree, owned by PayPal, offers a comprehensive payment solution that enables businesses to accept online and mobile payments, including credit cards, PayPal, Venmo, and digital wallets. It focuses on providing a seamless user experience, advanced fraud protection, and support for subscription billing. Stripe, on the other hand, is a developer-centric payment infrastructure that offers tools and APIs for businesses to integrate payment processing directly into their websites or applications. It provides a wide range of features, including customizable checkout options, subscription management, and extensive developer documentation. Stripe is known for its developer-friendly approach, robust functionality, and ease of integration.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

Braintree vs Stripe in our news:

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Stripe, the privately-held payments company, has recently completed the acquisition of TaxJar, a well-known provider of cloud-based tax services. TaxJar's suite of services enables businesses to automatically calculate, report, and file sales taxes. An important aspect of TaxJar is its ability to navigate various geographies and the complex sales tax regulations associated with each, making it a valuable resource for online businesses. Stripe plans to integrate TaxJar's technology into its revenue platform, alongside its existing tools such as Stripe Billing for subscriptions and Radar for fraud prevention. Additionally, Stripe envisions leveraging AI and other technologies to automate further functions and potentially introduce new services. While TaxJar will be integrated with Stripe's offerings, businesses will still have the option to use TaxJar directly for their tax-related needs.

2018. Stripe launched online billing tool

Stripe is introducing a billing solution tailored for online businesses. This new product enables these businesses to efficiently manage recurring subscription revenue and invoicing within the Stripe platform, streamlining their operations. The aim is to replace previously manual methods of invoicing or assembling various subscription tools, offering a seamless experience similar to charging for products on Stripe. This launch is partially motivated by customer requests for a unified solution that consolidates invoices and subscription expenses. As an enterprise company, Stripe prioritizes understanding customer needs while simultaneously innovating to provide elegant solutions for problems that small businesses may not have anticipated.

2018. Braintree launches Stripe competitor - Extend

PayPal's payment services division, Braintree, is taking steps to enhance its competitive position in the market, particularly against rivals like Stripe. To achieve this, Braintree is introducing a new solution called Extend, which offers a range of tools for seamless integration of Braintree payments with other services commonly utilized by online businesses beyond basic transactions. Extend encompasses features such as loyalty and reward program integration, advanced fraud prevention measures, and support for "contextual commerce," enabling merchants to sell and accept payments on platforms other than their own. Some of these services, including contextual commerce, were already available, powering features like Pinterest's buyable pins. With Extend, Braintree aims to streamline and expand its payment offerings, catering to the evolving needs of online companies.

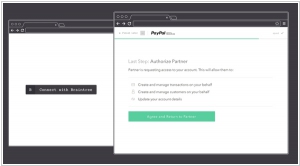

2016. Braintree launches Auth to bring its payments platform to more merchants

PayPal-owned payments platform, Braintree, has introduced Braintree Auth, a system designed to simplify the process of enabling payments on e-commerce platforms. This launch enables e-commerce platform owners, shopping cart providers, and recurring billing services to facilitate credit card, debit card, and PayPal payments on their merchants' online storefronts. Through a unified interface for shoppers, Braintree Auth grants access to customer and transaction data on behalf of the merchants. This strategic move by Braintree demonstrates its efforts to expand its presence in the SMB market, particularly in the face of increasing competition from startups like Stripe.

2015. Payment processing company Stripe partners with Visa

Payment processing company Stripe has recently completed a financing round, resulting in a valuation of $5 billion. In addition to securing nearly $100 million in funding, the company has formed a partnership with Visa, aimed at collaborating on various initiatives, including digital transactions and security. Stripe has been actively pursuing its global expansion strategy, and this partnership with Visa will play a crucial role in that endeavor. By leveraging Visa's extensive international presence and expertise, Stripe intends to broaden its existing coverage of 20 countries. CEO and co-founder, Patrick Collison, emphasized the significance of this collaboration in expanding Stripe's reach and capabilities, as highlighted in The New York Times.

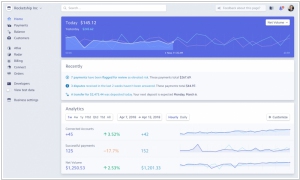

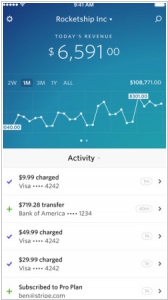

2015. Stripe released iPhone app for monitoring payment activity

Stripe, a payment acceptance service for businesses, has introduced an iPhone app that enables businesses to conveniently track purchases and user activity. This app offers the same functionality as Stripe's existing online dashboard but presents it in a mobile-friendly interface. Users can configure notifications to receive alerts whenever a payment or purchase occurs, as well as set up a daily summary for an overview of the day's activities. Additionally, Stripe's iPhone app includes a search function for easy access to specific information. This mobile application proves to be a valuable tool for busy business owners who may find themselves on the go, whether stuck in traffic, traveling in a taxi, using ride-sharing services like Uber or Lyft (remember not to use your phone while driving), or commuting on public transportation. It provides a quick and convenient way to stay updated on the latest developments in their business.

2015. Stripe gets Balanced customers

Balanced, a payments platform catering to peer-to-peer marketplace businesses, has made the decision to shut down due to insufficient growth. The company has reached an agreement with one of its long-standing competitors, Stripe, to assist with the smooth transition of its existing customers. This closure will impact approximately 320 customers, including prominent platforms such as Tilt (a crowdfunding platform), RedditGifts, Tradesy, Relay Rides, and Artsy. These customers collectively process hundreds of millions of dollars annually. In comparison, Stripe, led by CEO Patrick Collison, handles billions of dollars per year for thousands of businesses across 18 countries worldwide. Balanced faced competition from other industry players like WePay, Dwolla, Amazon Payments, and PayPal.

2014. Stripe - the new king of online payment processing

Stripe, the highly popular payments processing service, has secured $70 million in funding, reaching a valuation of $3.5 billion. Notably, this valuation has doubled in less than a year. Founded in 2010, Stripe initially aimed to simplify online payment processing for businesses. It has since become a key player in powering commerce services for prominent tech giants such as Twitter and Apple, and it will also be responsible for facilitating Facebook's Buy button. Stripe's founder, Patrick Collison, highlighted that when they began, the majority of online transactions relied on outdated banking and merchant infrastructure. He emphasized Stripe's unique approach to addressing this challenge and emphasized their vision of building the foundation for internet commerce.

2014. Braintree enables super easy sign-up for merchants (including Europe)

PayPal's payment processing service Braintree is introducing a new service that simplifies the merchant sign-up process. Now, merchants can join the platform by providing just their email address, URL, and a brief company description. Additionally, Braintree is extending its offering to Europe, allowing merchants to conduct the first $50,000 worth of transactions (in the local currency equivalent) without incurring any commission fees. This streamlined approach contrasts with the traditional method of setting up payment systems, particularly in Europe, where banks often require physical documentation for account approval. Instead, Braintree employs a combination of algorithms and human intelligence to assess the legitimacy of a company based on the provided information. This innovative approach enables Braintree to efficiently evaluate and onboard legitimate merchants onto its platform.

2014. Stripe will power Facebook’s Buy button

Stripe, an e-payments provider, has been chosen to power the "Buy" button for Facebook users who utilize the social network for online shopping. This new button enables users to make purchases directly from ads or posts showcasing products. Confirming the ongoing tests of the new button, a Facebook spokesperson revealed that Stripe is the exclusive payments partner for Facebook in this venture. Stripe has already established payment partnerships with prominent companies such as Apple, Twitter, and the Chinese digital payments service Alipay. Additionally, the company is collaborating with Apple for its recently launched Apple Pay mobile payments service. Facebook has also joined forces with various payments companies for different features, including PayPal's mobile payments unit, Braintree.