Top 10 Retail management and POS software

March 07, 2024 | Editor: Sandeep Sharma

26

Retail software is used by all small, medium and large enterprises. The main purposes of using a software is to regulate pricing, calculate taxes, inventory management and manage POS, billing and payroll. The features include Retail Inventory Management which helps to manage different aspects of retailer’s supply chain. CRM to support multi channel retailing and retain customers. Retail accounting for inventory control, transaction monitoring and pricing. Order Management to keep the track of orders being made. Transportation management to track deliveries and also Chain store management. Retail billing management to optimize store performance and increase productivity.

1

Accept credit cards on your iPhone, Android or iPad. Send invoices free with Square Invoices. Signing up for Square is fast and free, and there are no commitments or long-term contracts like with alternative services.

2

PayPal is an international e-commerce business allowing payments and money transfers to be made through the Internet. Online money transfers serve as electronic alternatives to paying with traditional paper methods, such as cheques and money orders. PayPal is the faster, safer way to send money, make an online payment, receive money or set up a merchant account.

3

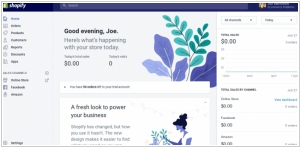

Simple, Beautiful, and Flexible End-to-End E-Commerce Solution. Simply choose a stylish ecommerce website design, easily customize your online store, add products, and you're pretty much ready to accept payments. Whether you already have products, are looking to sell digital goods or are interested in drop shipping — Shopify has a complete solution for you.

4

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

5

The world's first integrated mobile POS with EMV, NFC, and on-screen PIN entry. All Clover products are purpose-built for POS and feature sleek designs with brushed aluminum and white glass accents.

6

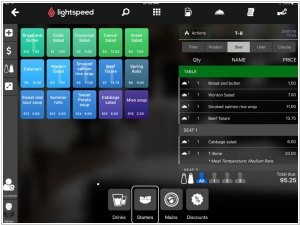

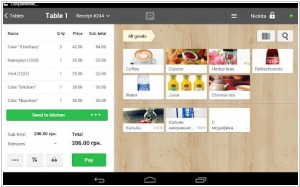

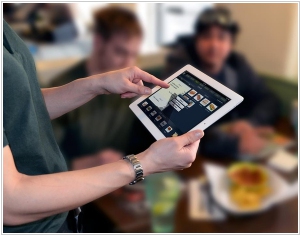

Lightspeed is the leading provider of cloud-based POS software. Our customers typically see a 20% growth in sales after their first year. Now is the time to join the growing list of independent businesses that choose Lightspeed POS to handle their everyday needs. Lightspeed Restaurant allows you to create your menu in seconds, update your floor plan directly in the system, impress customers with photos of items and allow your staff to focus on creating a unique restaurant experience.

7

With SumUp you now can accept card payments everywhere in a simple, secure and affordable way with your smartphone or tablet.

8

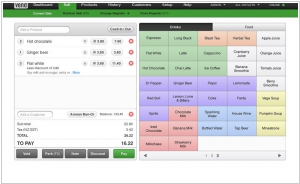

Zettle by PayPal is a one-stop shop for cutting-edge commerce tools — offering everything you need to take quick payments, ease day-to-day management, and get the funding to grow. Accept credit card payments on the go with Zettle. All you need is a smartphone or a tablet and our free app.

9

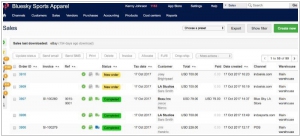

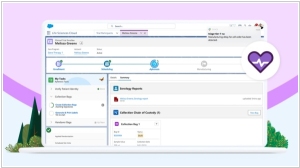

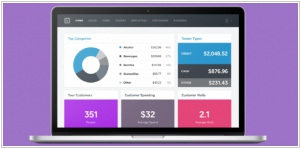

Brightpearl gives you a central hub to help you manage the heart of your business - orders, inventory, customer data, accounting and reporting all together in one place. Reduce manual operations and manage your orders from multiple sales channels in one place. Enjoy full print, pick, pack and ship functionality and integrate with multiple leading carriers globally.

10

The first wired ethernet connectivity for iPad POS systems. Manage multiple devices universally from any remote location. Save time with reports that explain your business progress and projection to you. Keep business up and running during an Internet slow-down or power outage

11

Vend is retail POS software, inventory management, ecommerce & customer loyalty for iPad, Mac and PC. Easily manage and grow your business in the cloud.

12

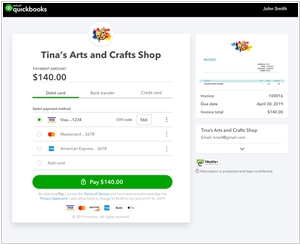

Manage all kinds of payments, all in one place. Take payments via cards, ACH, Apple Pay, PayPal, and Venmo. No matter how you get paid, manage it all in QuickBooks so you never miss a thing.

13

PayAnywhere Mobile allows you to accept Visa, MasterCard, American Express, Discover and PayPal cards all at the same low rate, wherever and whenever you're doing business. The free credit card reader transforms your Apple or Android smartphone or tablet into a mobile credit card reader. Offering ease of use, the most robust mobile payments processing app, and live customer support, PayAnywhere will take your business where it needs to go.

14

LS Retail is a world-leading developer and provider of all-in-one business management software solutions. Our high-quality, cost-effective and highly configurable software solutions help retailers, hospitality and forecourt businesses worldwide to optimize their business practices, increase revenue and satisfy old and new customers – easier, simpler and faster.

15

Point of Sale and Inventory Management for cafes, restaurants, and stores. All-in-one cloud POS system software that combines solutions for front-office, inventory, finances, analytics, CRM. Set up in 15 minutes.

Latest news about Retail management and POS software

2022. Nigerian retail automation platform Bumpa raises $4M

Bumpa, a startup dedicated to constructing the necessary infrastructure for empowering online commerce and enabling African small business owners to initiate, oversee, and expand their businesses through mobile devices, has successfully raised $4 million in seed funding. By integrating with Meta, Bumpa enables its merchants to seamlessly link their Instagram and Facebook accounts to the Bumpa app. This integration allows them to receive direct messages (DMs) from their customers and respond using the Bumpa app. Additionally, the integration facilitates product sharing and selling, invoice and receipt sharing, sales recording, storage of buyer information, and payment requests via the Bumpa app, all while reflecting these interactions within their customers' Instagram DMs. Nowadays, small businesses in Nigeria are presented with numerous options, including Bumpa, for digitizing their operations, such as bookkeeping, invoicing, and inventory management. Other platforms in this space include Pastel, Kippa, and OZÉ.

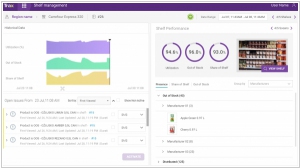

2021. Retail analytics company Trax raises $640M

Retail analytics company Trax, known as a unicorn in the industry, foresees a continued openness to technological innovation in the retail sector even beyond the pandemic. Recently, the Singapore-based company announced a significant milestone by raising $640 million in Series E funding. The funding will be utilized to further develop Trax's product portfolio, which combines computer vision and cloud-based software to assist brick-and-mortar stores in effectively managing their inventory, merchandising, and overall operations. Trax's flagship product, Retail Watch, leverages a powerful combination of computer vision, machine learning, and hardware such as cameras and autonomous robots. It collects real-time data about product availability on store shelves, offering insights to retailers. Retail Watch proactively sends alerts when stock levels are running low, detects and rectifies pricing errors, and verifies compliance with planograms—a visual merchandising tool that outlines product display plans. Currently, Retail Watch primarily focuses on center shelves, commonly used for packaged goods, but Trax has plans to expand its coverage to include fresh food and produce categories, ensuring comprehensive shelf management solutions for retailers.

2020. Brightpearl raises $33M to boost its platform for retailers

Brightpearl has secured $33 million in funding to accelerate its growth as a platform that empowers retailers to optimize their operations and drive sales. The startup specializes in developing a comprehensive solution that encompasses financial management, CRM, fulfillment, inventory and sales order management, purchasing and supplier management, as well as warehousing and logistics. The recent Series C funding round was led by Sage, a strategic partnership that will enable both companies to assist retail and e-commerce customers in leveraging top-notch cloud finance and retail management solutions. By combining their expertise, Sage and Brightpearl are committed to supporting businesses on their digital transformation journey, enhancing efficiency and success in the retail industry.

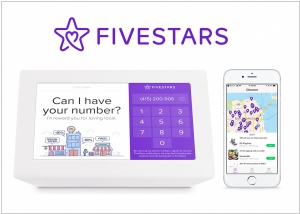

2020. Small business payments and marketing startup Fivestars raises $52.5M

Fivestars, a company that provides software solutions for small business payments and marketing, has recently secured $52.5 million in funding. Fivestars offers a comprehensive platform that includes its own payment product, seamless integration with various point-of-sale systems, marketing automation capabilities for delivering personalized messages to customers, and a vast network of 60 million shoppers. This extensive network enables cross-promotion among different businesses within the Fivestars ecosystem. Notably, the company has experienced significant growth during the pandemic, with 1 million new shoppers joining the network every month.

2020. Cosmose, a platform that analyzes foot traffic in physical stores, gets $15M

Cosmose, a leading provider of foot traffic tracking services for offline stores to analyze customer behavior, has successfully raised $15 million in a Series A funding round. The company offers three key products: Cosmose Analytics, which monitors and analyzes customer movements within physical retail stores; Cosmose AI, a data analytics and prediction platform that empowers retailers to create targeted marketing campaigns and drive sales growth; and Cosmose Media, a solution for precise targeting of online advertisements.

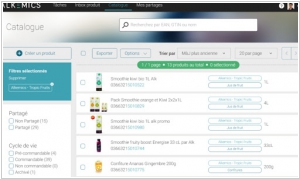

2020. Alkemics picks up €21M for its supplier-retailer collaboration platform

Alkemics, a platform based in Paris that facilitates brand collaboration and product launches with retailers, has successfully secured €21 million in Series C funding. Alkemics partners with major grocery retailers in France and the U.K., including E.Leclerc, Intermarché, Casino, Tesco, and Ocado, offering them digital solutions for their commercial processes. With a network encompassing over 17,000 brands, Alkemics connects retailers with multinational suppliers like Nestlé, as well as local producers, streamlining the onboarding and launch of new products. The platform essentially digitizes various aspects of "supplier-retailer relations," covering product discovery, listings, and sales across multiple channels.

2020. Phos, the UK fintech that offers a software-only POS for smartphones, raises €1.3M

Phos, a fintech company based in the U.K., has secured €1.3 million in funding for its software-only Point of Sale (PoS) solution, enabling merchants to accept payments directly on their smartphones without requiring additional hardware. With this recent funding, Phos has raised a total of €2.5 million to date, which will be allocated towards expanding the development team. The company's growth plans involve introducing new features, including 'PIN on Phone,' a Software Development Kit (SDK), and an integrated loyalty system. Established in 2018, Phos has developed software that transforms any NFC-equipped Android device into a payments terminal, eliminating the need for extra hardware and reducing overall ownership costs. The startup highlights the swift deployment of its solution, emphasizing its phone and bank agnostic nature, enabling any bank to act as the acquirer.

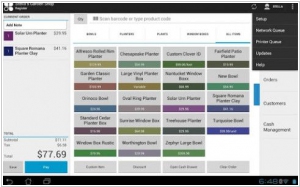

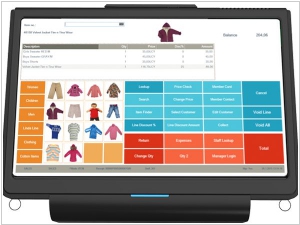

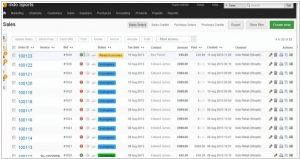

2017. Mobile POS system Square launched Retail app

Square is introducing an all-new Square Retail app that complements an extensive backend package of tools. This package includes comprehensive inventory management, customer relationship management, and employee tools. The aim of this new offering is to deliver a top-notch retail solution for merchants and shop owners who require more than just the Square Reader and basic Square mobile app. The scalability of this solution allows it to cater to clients ranging from single-location shops to merchants with multiple storefronts and extensive inventory tracking needs. Initially, Square is primarily targeting retailers in the "finished goods" industry, which includes those selling packaged products, apparel with barcodes, as well as items like wine or games.

2016. Square now allows to charge loyal customers without card swiping

Mobile payment processing service Square has introduced a new feature called Card on File, which enables businesses to charge recurring customers without physically swiping their cards or requesting them. This feature benefits customers as well, as they can visit your shop or restaurant without carrying their cards or cash. They can simply choose what they want and leave, while you effortlessly charge the appropriate amount directly from their cards. To avail this service, customers must initially opt in and provide their card information to your company's Square account. Additionally, Card on File allows businesses to charge remote customers even without an internet payment connection. However, it is important to note that this feature comes at a slightly higher cost for businesses, with a fee of 3.5% plus 15 cents, as compared to the standard 2.75% commission for card swiping.

2015. Mobile POS service iZettle expands to small business loans

Mobile payments provider iZettle, renowned for its mobile card readers enabling small-scale merchants to accept card payments, is diversifying its offerings by venturing into the realm of small business loans. The company has introduced a capital advance solution named iZettle Advance, exclusively available to selected iZettle customers seeking financial support for business expansion. The loan amount will be determined based on individual business circumstances, taking into account factors such as monthly or annual revenue, information which iZettle already possesses due to its involvement in processing the customers' card payments.

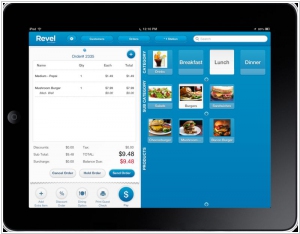

2015. iPad POS platform Revel gets $13.5 million funding

iPad point-of-sale company Revel Systems has successfully secured $13.5 million in funding to facilitate its expansion efforts in Asia and Europe. Setting itself apart from other tablet-based POS systems, Revel is incorporating a comprehensive range of features into its software suite, enabling it to not only handle payment processing but also manage deliveries and shipping. This strategic move allows Revel to compete with enterprise software solutions like Micros System, which was acquired by Oracle for approximately $5.3 billion last year. Furthermore, Revel has recently introduced Ethernet connections to cater to clients operating in environments where wireless connections may be unreliable, such as sports stadiums and government agencies.

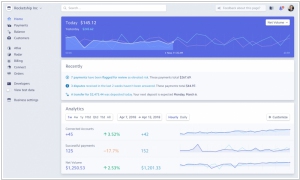

2015. Square launched a dashboard app for iOS

Mobile payment processing service Square has introduced its second non-consumer application, an iOS dashboard app designed for business owners. This app enables business owners to monitor real-time sales data and gain valuable insights into the performance of their business through analytics. While this app is not intended for the barista on duty, it serves as a valuable tool for owners who need to oversee operations remotely. With this app, business owners can conveniently track stock levels across multiple locations, enabling them to make informed decisions on the go, without the need for a desktop computer.

2015. Square launched payroll service for small businesses

Mobile payment startup Square has introduced Square Payroll, a software solution designed to assist businesses in managing payroll, tracking taxes, and handling other expenses related to both hourly and salaried employees. The pricing for this product is set at $20 per month, with an additional charge of $5 per employee. Square aims to position itself as a relatively straightforward and uncomplicated option within the payroll software market, at least for the time being. The software includes features such as timecard management, tax management, and the capability to handle payments for both hourly and salaried workers, all bundled together at a single price. Square Payroll enters a competitive landscape, facing established players like Intuit's QuickBooks, ADP, Paychex, and others. While some competitors like Wave Accounting offer similar features, they may not provide the complete range of services offered by Square Payroll. For instance, Wave Accounting does not handle tax payments or tax filings, only estimated tax liabilities. Additionally, Wave Accounting offers lower pricing, with two base tiers starting at $10 and $15 plus an additional $4 per employee.

2015. iPad POS software Lavu raised $15M

Lavu, a provider of iPad-centric point of sale systems, has successfully raised $15 million in new funding, with Aldrich Capital Partners leading the investment. Lavu offers a modern and tailored solution specifically designed for the unique requirements of restaurants, bars, nightclubs, quick-serve establishments, and other businesses in the hospitality industry. Notably, Lavu achieved profitability just two months after its inception. The company operates on a revenue model that includes a licensing fee, averaging around $1,000 per point of sale (POS) terminal, along with a recurring monthly fee based on the restaurant's size. Presently, Lavu is being utilized by over 4,000 restaurants across 86 countries, with regions like Australia, Thailand, and Singapore demonstrating particularly high adoption rates. Unlike Square, another popular POS option for restaurant owners, Lavu does not impose service provider transaction fees. This distinction is crucial, as a 2 percent transaction fee, on average, can quickly accumulate for businesses processing substantial monthly transaction volumes in the tens of thousands.

2015. Mobile payment service SumUp raised $45M

European mobile payment startup SumUp has recently secured additional funding, bringing its total investments to $45 million. As a competitor to Square, iZettle, and Rocket Internet's Payleven, SumUp intends to utilize this investment to enhance its hardware offerings, similar to Square's approach. Unlike other companies such as iZettle, SumUp has strategically developed its business to achieve vertical integration. This includes the development of its own hardware solutions instead of relying on external partnerships. Currently, SumUp operates in 13 markets, encompassing 12 European countries and Brazil. The company also has plans to expand into two more markets by the end of the year, including Sweden, which is iZettle's home market.

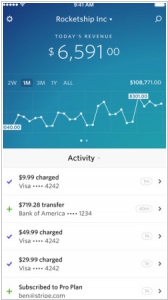

2015. Stripe released iPhone app for monitoring payment activity

Stripe, a payment acceptance service for businesses, has introduced an iPhone app that enables businesses to conveniently track purchases and user activity. This app offers the same functionality as Stripe's existing online dashboard but presents it in a mobile-friendly interface. Users can configure notifications to receive alerts whenever a payment or purchase occurs, as well as set up a daily summary for an overview of the day's activities. Additionally, Stripe's iPhone app includes a search function for easy access to specific information. This mobile application proves to be a valuable tool for busy business owners who may find themselves on the go, whether stuck in traffic, traveling in a taxi, using ride-sharing services like Uber or Lyft (remember not to use your phone while driving), or commuting on public transportation. It provides a quick and convenient way to stay updated on the latest developments in their business.

2015. Square's new wireless card reader will accept Apple Pay and work with Android

The newly introduced Square Reader is a compact device in a square shape, specifically designed to enable merchants utilizing a tablet or smartphone to effortlessly accept wireless payments, including Apple Pay and contactless mobile payments. Additionally, it supports payments made through EMV chip cards, which include Europay, MasterCard, and Visa. Priced at $49, this upgraded device surpasses Square's previous $29 merchant reader, offering enhanced functionality and wireless capabilities. It is compatible with recent iPad models, iPhone devices (including the iPhone 4S and newer), and a wide range of Android devices manufactured by Samsung, HTC, Asus, Motorola, LG, Dell, and Toshiba.

2015. Revel adds Ethernet connection to its iPad POS system

Revel is a leading provider of iPad point-of-sale (POS) systems and was among the early adopters of Apple Pay. While the company primarily focuses on mobile payments, it also aims to attract businesses that have concerns about relying solely on Wi-Fi for financial transactions. In order to appeal to larger retail enterprises and encourage them to replace traditional cash registers with iPads, Revel is introducing wired Ethernet connections. This new feature, known as Revel Ethernet Connect, allows for failover connections between Wi-Fi and cabled Ethernet, ensuring uninterrupted service by seamlessly switching between the two in case of any connectivity issues. Revel claims to be the first iPad POS provider to offer this capability. The Revel Ethernet Connect hardware is currently available for purchase at $250, and starting from June 15, it will be included as part of Revel's iPad POS system.

2015. Indian mobile payments startup MobiKwik raises $25M

The surge of e-commerce in India has catalyzed the emergence of numerous startups capitalizing on the growing smartphone adoption to offer mobile payment solutions. Earlier this year, Alibaba made a significant investment in Paytm, valuing it at a billion dollars. Now, MobiKwik has secured $25 million in funding, betting on the potential of a network of physical retail outlets to expand its digital services to a wider audience. MobiKwik proudly claims to possess a nationwide network comprising over 100,000 merchants. Through these merchants, customers can conveniently load funds into their digital wallets and make in-person payments. In addition to its focus on facilitating payments, MobiKwik has taken a cue from Paytm and applied for a payment banking license. The company aims to disrupt the financial services landscape in India by leveraging mobile technology to reach individuals who have been underserved by traditional banking networks.

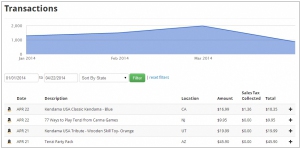

2014. Square adds sales tax reporting through TaxJar

Mobile payment provider Square has partnered with TaxJar to offer integrated tax calculation and reporting services for local and state sales taxes. Users can easily connect their accounts on both platforms. However, it's important to note that this integration does not come free of charge. Businesses conducting less than 1,000 transactions per month will be billed $9.95 monthly, with pricing scaling up based on transaction volume. Square emphasizes that this service is retroactive, meaning that it can calculate sales tax for past transactions as well as future ones. The inclusion of TaxJar provides two significant benefits for Square. Firstly, it offers businesses an additional feature that simplifies the often complex task of managing sales taxes, potentially attracting more users to choose Square for their payment processing needs. Secondly, for existing businesses, this integration may serve as an incentive to remain loyal to Square, utilizing its services for transactions and other business-related needs.

2014. Square adds analytics tools for small business

Mobile payments provider Square is set to launch Square Analytics, a complimentary set of tools that seamlessly integrate with its existing register products, which include Inventory, Invoices, and the recently introduced Appointments. Leveraging the data already collected by Square on a small business's sales, Square Analytics provides real-time updates on product performance, peak sales times throughout the day, customer count, and more. Even for retailers who prefer not to constantly monitor the latest data, Square Analytics offers data summaries via email at their preferred frequency. Each email also includes spreadsheets containing all the data captured by Square's tools for further analysis. Additionally, Square Analytics can be integrated with a retailer's accounting software, enabling the connection of their account with services like Quickbooks or Xero.

2014. New Square reader accepts chip-enabled cards

Payment processing provider Square has unveiled a new mobile card reader that is capable of accepting chip cards. While the appearance of the new reader closely resembles its predecessor and remains conveniently pocket-sized, it offers significantly enhanced functionality. This advanced reader not only enables users to process payments but also serves as a powerful tool in combating card fraud and safeguarding sensitive data. Square empowers small business owners to accept credit card payments through various mobile devices like iPhones, iPads, and Android smartphones. One notable difference is that the new reader requires charging and includes a USB port. Despite the additional step of keeping the product powered, the benefits of enhanced data protection and security make it a worthwhile endeavor for merchants. The new Square reader will be available for pre-order later this year.