Top 10 Expense Management software

February 03, 2024 | Editor: Michael Stromann

16

Expense Management software automates the creation of the expense report for employees, provides online review and approval process for managers

1

SAP Concur's easy-to-use business travel and expense management software solution helps your business save time, money and gain control. The Concur booking tool makes business travel a snap—starting with customized options that align with your company policies. You can also upload electronic folios, directly to expense reports. Concur provides full visibility into spend and the ability to ensure policy and regulatory compliance.

2

Simplified expense reporting your employees will love. Streamline the way your employees report expenses, the way expenses are approved, and the way you export that information to your accounting package.

3

Bill.com brings smart AP and AR automation and new bill payment capabilities to your business. The intelligent way to create and pay bills, send invoices, and get paid.

4

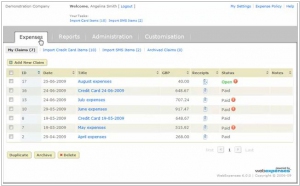

Certify is the leading cloud-based travel and expense report management solution for companies of all sizes. Certify makes expense reports easy by automating the creation of the expense report for the employee, providing online review and approval process for managers, and streamlining the processing and reimbursement process for accountants.

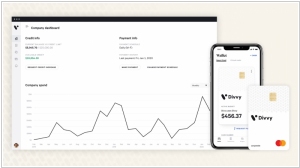

5

Expense Management & Business Budgeting Software. Simplify your business' expense reports with Divvy. Submit expense reports, budget, reimburse employees, and manage virtual cards right from Divvy's platform.

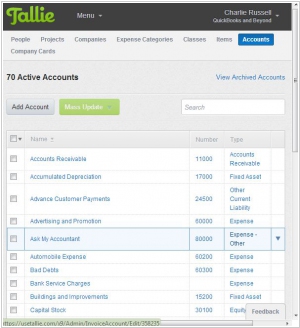

6

Emburse Tallie helps small businesses focus more on work with impact—and less on paperwork for managing expenses.

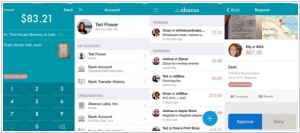

7

Real Time Expense Reporting. Abacus is the easiest way for you to automate how you reimburse your team, reconcile corporate credit cards, and implement your expense policy.

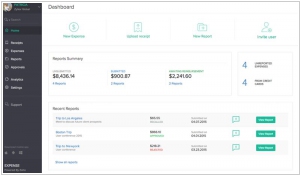

8

Expense reporting doesn't have to be painful. Zoho Expense is a perk for employees, managers, and finance teams. Automate travel and business expense reporting, streamline approvals, gain spend visibility and control.

9

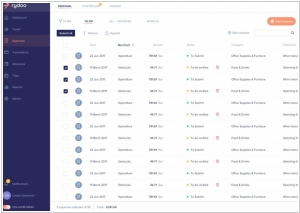

Rydoo is an all-in-one Travel & Expense platform. Book business trips and submit or approve expense claims in real time.

10

Expense management software + AP automation. Automate your expenses, invoice processing + more with our digital business management systems.

11

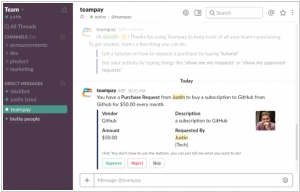

Teampay gives your organization an intuitive workflow and reporting for purchases. This adds security, accountability, and easy approval while giving employees autonomy over their purchasing process.

Latest news about Expense Management software

2022. Sava, a spend management platform for African businesses, gets $2M

Sava, the South African fintech startup empowering small businesses with comprehensive spending management solutions, has successfully secured $2 million in pre-seed funding. Sava's innovative platform integrates bank accounts, mobile wallets, payment systems, and accounting tools into a unified interface. By addressing two critical pain points in business operations—spend management and reconciliations—Sava aims to provide small businesses with the necessary tools to control their expenditures effectively. Additionally, Sava acknowledges that business owners and their teams currently spend significant amounts of time on manual record-keeping and reconciliations, lacking sufficient data for prudent decision-making.

2022. European spend management platform Moss raises $86M

Berlin-based startup Moss has recently secured a significant $86 million Series B funding round (€75 million). The company specializes in providing corporate credit cards tailored for small and medium-sized enterprises, facilitating seamless spending and expense tracking. Positioned as a comprehensive spend management platform, Moss competes in the European market alongside other players like Spendesk, Pleo, and Soldo. What distinguishes Moss from its competitors is its offering of credit cards rather than debit cards. Notably, transactions appear instantly on the Moss dashboard, providing real-time visibility into spending activities.

2021. Pleo picks up $200M to build the next generation of business expense management

A Danish startup called Pleo has recently secured $200 million in funding. Pleo specializes in developing expense management tools specifically designed for small and medium-sized businesses (SMBs). These tools enable SMBs to issue company cards and gain better control over how employees spend money. While many companies in this space have primarily targeted large enterprises, Pleo aims to cater to the needs of SMBs. The company's toolset includes features such as card issuing, invoice payments, and tracking out-of-pocket expenses. These functionalities seamlessly integrate with existing accounting packages, facilitating smoother money management processes. Pleo offers a range of pricing options, starting from a free and limited tier for small customers with up to five users. For larger customers, pricing plans go up to £10 per person per month, and customized packages are available for the largest users.

2021. Mendel secures $35M to tackle LatAm’s corporate spend management problem

Mendel, a solution for managing corporate spending in Latin American enterprises, has announced the successful acquisition of $35 million in debt and equity. Mendel aims to revolutionize corporate spend management by automating the majority of tasks currently performed manually by enterprise CFOs. In essence, it aspires to be a comprehensive platform catering to all B2B spending needs. The corporate spend management sector is becoming increasingly competitive, with Ramp and Brex securing significant funding rounds this year. Additionally, TripActions expanded its offerings beyond travel to encompass general expense management, while Divvy was acquired by Bill.com.

2021. PayEm raises $27M for its answer to the expense report

Israeli company PayEm has successfully raised $27 million. PayEm specializes in developing a spend and procurement platform tailored for high-growth and multinational organizations. The company's advanced technology automates various financial processes, including reimbursement, procurement, accounts payable, and credit card workflows. This comprehensive solution efficiently manages requests, invoices, bill creation, and payment distribution across more than 200 territories, supporting 130 different currencies. By providing real-time visibility, PayEm enables finance teams to monitor employees' expenditure requests and actual spending. For instance, teams can submit customized purchase requests with associated transaction descriptions, going through an approval flow. Simultaneously, the platform continuously reconciles all transactions, eliminating the need for time-consuming paperwork reconciliation at the end of each month.

2021. Spendesk raises $118 million for its corporate spend management service

French startup Spendesk, specializing in spend management solutions, has successfully raised $118 million in funding. Originally incubated by startup studio eFounders, Spendesk initially focused on providing virtual and physical company cards for employees. While corporate cards are prevalent in the United States, many small and medium-sized companies in France face challenges in issuing cards to all their employees. By combining a Software-as-a-Service (SaaS) platform with corporate cards, Spendesk offers a wide range of possibilities. For instance, it enables the implementation of approval workflows for high-value purchases and allows the setting of different budgets for different teams. Over time, Spendesk has expanded its services beyond cards to encompass expense and invoice management. The platform also automates repetitive accounting tasks, such as reminding employees to attach receipts for each transaction. Additionally, Spendesk facilitates data export to popular accounting software such as Xero, Datev, Sage, Cegid, and Netsuite, streamlining financial processes for businesses.

2021. Soldo raises $180M for its business expense management platform

Soldo, a provider of a platform that offers prepaid company cards to employees linked to an automated expense management system, has successfully raised $180 million in funding. Soldo currently serves approximately 26,000 customers across 30 countries, catering to a wide range of businesses, from small and medium-sized enterprises to midmarket enterprises and large multinationals. Prominent companies such as Mercedes Benz, GetYourGuide, Gymshark, Bauli, and Brooks Running are among Soldo's popular clientele. Soldo's platform seamlessly integrates with leading accounting packages like NetSuite, QuickBooks, Zucchetti, and Xero through APIs, providing organizations with enhanced financial management capabilities. Furthermore, Soldo offers integration options with over 50 expense management platforms, including Concur and Expensify.

2021. Pleo raises $150M for its new approach to managing expenses for SMBs

Startup Pleo has successfully raised $150 million for its integrated system, encompassing payment cards, expense management software, and integrated reimbursement and pay-out services. Currently, approximately 17,000 small and medium businesses rely on Pleo's solution, with the medium-sized companies constituting around 1,000 employees. While several players operate in this sector, ranging from established companies like SAP's Concur to upcoming startups like Expensify and newer entrants introducing innovative technology, Pleo differentiates itself by developing a comprehensive system tailored specifically for smaller businesses. Their platform seamlessly integrates all stages of employee expenditure on behalf of the company, resulting in a streamlined and efficient process.

2021. All-in-one expense management platform Jeeves raises $131M

Jeeves, a startup developing an "all-in-one expense management platform" for global startups, has emerged from stealth mode with a total funding of $131 million. Jeeves positions itself as the first "cross country, cross currency" expense management platform, catering to fully remote teams. The platform is currently available in Mexico, its largest market, as well as Colombia, Canada, and the U.S. Additionally, Jeeves is currently in the beta testing phase in Brazil and Chile. Jeeves claims that its platform allows companies to set up their finance function quickly, gaining access to a true corporate card with a 30-day credit period, non-card payment options, and cross-border payment capabilities. Customers can also make repayments in multiple currencies, reducing foreign transaction fees.

2021. Zoho Expense gets new interface, Trips and Expense Audit modules

Zoho has recently unveiled the all-new version of Zoho Expense, an advanced software solution for corporate travel and expense management. The latest update brings a refreshed user interface, accompanied by role-based access control. Users now have the ability to customize the application based on their specific roles, be it admin, submitter, or approver. This feature enables a clear distinction of responsibilities, ensuring that users only have access to relevant modules. The enhanced Trips module centralizes all aspects of business travel, simplifying tasks such as itinerary planning, document accessibility, and flight and hotel bookings. Additionally, the Expense Audit module equips travel and finance teams with the necessary functionalities to enforce policies and maintain compliance standards. With these new enhancements, Zoho Expense aims to provide a comprehensive and tailored solution for efficient corporate travel and expense management.

2020. Expense management vendors unite to form Emburse

A consortium of six leading travel and expense management software vendors, namely Abacus, Captio, Certify, Chrome River, Nexonia, and Tallie, has consolidated into a single entity known as Emburse, with the intention of challenging SAP Concur's dominance. With a global workforce of 750 employees, Emburse aims to serve a user base exceeding 4.5 million business travelers across 14,000 customers spanning 120 countries. This consolidation process has been unfolding over the past few years, with Certify and Chrome River joining forces in the previous year. Prior to that, in 2017, Certify, Nexonia, ExpenseWatch, and Tallie merged under the Certify name, backed by a $125 million investment from K1 Investment Management, with the objective of competing against SAP Concur. In July of the same year, the combined Certify and Chrome River entities acquired Emburse, a startup specializing in virtual and physical cards for business expenses and vendor payments. On the other side of the spectrum, German business software giant SAP acquired Concur for a staggering $8.3 billion in 2015.

2019. Expense management software Zoho Expense integrated with Xero

Zoho Expense simplifies the process of expense reporting through its user-friendly automation features, including receipt auto-scanning, automatic report generation, and customizable approval workflows. However, once the expense management app completes its tasks, the finance team of an organization still needs to account for those expenses. To assist in this aspect, Zoho Expense has collaborated with Xero. Through this integration, expense reporting becomes effortless. Users can effortlessly create expense reports, monitor their status through timely notifications, and gain insights through analytical reports within Zoho Expense. Additionally, apart from reporting expenses, users can establish budgets to effectively manage their cash outflow. By uploading expense receipts or sending them to the receipt inbox in Zoho Expense, the system automatically converts them into expenses. Furthermore, users can configure the automatic generation of reports and seamlessly export them to Xero.

2019. Employee expense management software Teampay raised $12M

The expense management startup, Teampay, based in New York City, has successfully raised $12 million in a series A funding round. Teampay offers a user-friendly platform that empowers employees to make purchases for necessary goods, tools, and services while adhering to defined company policies. Through their experience, Teampay has recognized that while organizations face challenges related to actual purchases, what they truly seek are improved expense management tools that cover a wide range of expenditures, even those outside their premises. As businesses increasingly engage freelancers, providing them with spending power without cumbersome bureaucratic processes becomes crucial. Cumbersome systems can result in decreased salaries, productivity, and cost management savings. Teampay aims to address these challenges and offer a comprehensive solution.

2017. Zoho Expense gets Windows app

Zoho Expense has expanded its capabilities by introducing compatibility with Windows 10 Desktop. This means that users can now conveniently access the expense reporting software directly from their Windows desktop environment. Zoho Expense for Windows 10 desktop offers a range of impressive features, including a comprehensive dashboard, automated scanning of expense receipts, support for multiple currencies, tracking mileage expenses, managing travel allowances (per diems), itemized expense tracking, monitoring advances received, and customized approvals.

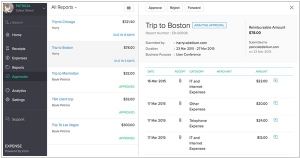

2015. Expensify added new travel site integrations

Expense management service Expensify is taking a further step in simplifying expense reports by announcing integrations with various travel-related services. Instead of forwarding travel receipts to receipts@expensify.com, users now have the option to book their trips through the partner service of their preference. The booking information will automatically be transmitted to Expensify for reporting purposes. This feature not only saves users the hassle of manually compiling expense reports for business trips but also addresses the issue of "leakage," where an increasing number of individuals are booking their travel outside of standard corporate systems. Expensify's initial travel partners include NuTravel, Egencia, Locomote, NexTravel, Uber, Priceline, Hipmunk, and Rocket Trip. The company also plans to incorporate GetThere, Amadeus, Atlas Travel, and Airbnb in the future.

2015. Zoho launched expense tracking app Zoho Expense

Zoho has introduced its latest application, Zoho Expense, designed to streamline and automate the process of expense reporting. This innovative tool eliminates the need for manual data entry, accelerates report approvals, and seamlessly integrates with other business applications, promoting enhanced productivity across various business functions. Zoho Expense boasts a range of features, including the ability to convert receipts into data through automated scanning, syncing credit card statements with a simple click, and ensuring zero data entry during expense creation. Approving expense reports becomes effortless with one-click approvals and rejections. Managers can conveniently access and review expense report details in a centralized location, facilitating direct communication and collaboration within Zoho Expense, eliminating the need for lengthy email threads and phone calls. Moreover, Zoho Expense is seamlessly integrated with Zoho Books and Zoho CRM. The service offers a monthly plan priced at $15 for up to 10 users per month, while mobile apps are available for free on iOS, Android, and Windows platforms.

2014. Expense management service Expensify targets Concur customers

Facebook has recently introduced a new advertising platform known as Atlas, which focuses on targeting users across various websites using their Facebook information. Facebook acquired Atlas from Microsoft last year. This platform aims to compete with Google's AdWords by allowing advertisers to display ads that track users on both web and mobile platforms. Advertisers have the flexibility to purchase ads on external websites and apps while also having the option to integrate the Facebook social network. Instead of relying on cookies, Facebook utilizes the user's Facebook login details. Although this approach may not be well-received by Facebook users, it presents an alternative for advertisers and serves as a competitor to Google AdWords.

2014. SAP acquires travel and expense management service Concur

SAP has made a significant move by acquiring Concur, the expense and travel management solution, for a whopping $8.3 billion. Concur boasts an impressive user base of approximately 25 million individuals across more than 150 countries. Interestingly, in 2011, Concur itself acquired the travel organizer TripIt. This acquisition places SAP in control of Concur and allows them to claim ownership of 50 million cloud users. As part of this agreement, Concur will collaborate with SAP to develop mobile applications that are contextually aware, while SAP will begin utilizing Concur's travel and expense management services. The acquisition is projected to conclude either in the fourth quarter of this year or the first quarter of 2015.