Oracle Sales is #20 in Top 10 Online CRM software

Engage customers earlier and accelerate and close more deals using Oracle Sales Cloud's complete, innovative, and proven sales solution. Sales Cloud takes advantage of Oracle’s best-in-class cloud portfolio to offer a complete ecosystem of sales tools

Positions in ratings

#20 in Top 10 Online CRM software

Alternatives

The best alternative to Oracle Sales is Salesforce

Latest news about Oracle Sales

2011. Ellison conitues bumping Benioff: Oracle buys RightNow CRM

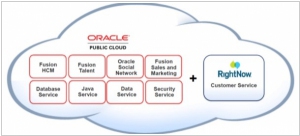

As you probably remember, recently Oracle's boss Larry Ellison decided to give a lesson to Salesforce CEO Marc Benioff for his attacks on Oracle. At the recent Oracle OpenWorld conference Ellison not only banned Benioff in the event program but also announced the public cloud platform Oracle Public Cloud, which will provide either PaaS or SaaS services, including CRM (ie, will compete directly with Salesforce CRM / Force.com). However, it was shown only on the presentetion slides and Benioff had every reason to just joke at Ellison in his Twitter and sleep peacefully. But today, the Oracle's threat has become very real: Oracle for $1.5 billion has acquired RightNow, one of the leading SaaS CRM vendors. ***

2011. Ellison to Benioff: That's your Cloud is False Cloud

A year ago at Oracle's OpenWorld conference the Salesforce CEO, Mark Benioff, took the stage to criticize Oracle's cloud technologies. He said that clouds can't be sold in metalic boxes, and in fact - these are false cloud, and everyone should beware of them. And thought the Oracle's boss, Larry Ellison, joked back then, but the offense remained in his mind. This year, he decided to revenge. First, he unexpectedly canceled the scheduled and paid Benioff's session at the OpenWorld. Of course, this didn't scare Benioff - he immediately organized the alternative session in the restaurant across the street. And, of course, the main topic of his speech was Oracle's false cloud, and near the restaurant people were walking with banners "The Cloud Must Go On". ***

2010. RightNow: CRM is dead

Surprise! Jason Mittelstaedt, CMO at RightNow (the company that for a long time has been among leaders of the CRM industry) says that nobody wants to hear about CRM anymore, because they have heard it all and no longer believe the promises of CRM vendors. According to Jason, last year, the annual CRM Conference, which was held by Gartner and sponsored by RightNow - was the dead event and attracted minimal public interest. Vendors were showing the presentations that they have given seven years ago. Jason argues that CRM is a bit old hat, and it is time for a new generation of software that RightNow calls CX (Customer Experience). RightNow is not a pioneer in Customer Experience theme. Industry players have been talking about CEM (Customer Experience Management) already for a couple of years. So, what's the difference between CEM and CRM? ***

2009. RightNow announced money-back guarantee

RightNow has enhanced its SaaS CRM capabilities by introducing a money-back guarantee. The company is committed to meeting its on-demand "up-time" promise to customers, and if it fails to do so, it will refund their money. Greg Gianforte, CEO of RightNow, expressed confidence in the company's performance commitments and stated that they are offering a SaaS model that they stand behind financially. In the event that RightNow falls short of its 99.9 percent up-time target, it will provide a partial refund of its clients' subscription fees.

2008. Oracle puts 'social' in corporate CRM

Oracle, the enterprise software giant, has integrated social networking features into its latest customer relationship management (CRM) offerings, enabling the applications to emulate popular social networking sites such as Facebook, Friendster, and LinkedIn. The new social CRM applications aim to leverage the widespread adoption of social networking and adapt it for corporate use. Oracle's senior CRM networking collaboration and mobility executive, Prasad Rai, highlighted the ongoing wave of innovations in the CRM space, including the transformation of corporate CRM applications to mimic social networking sites. He emphasized that social networking sites, originally designed for information sharing, can now be used as business tools. Oracle recognized that while companies have their own CRM applications, most of them lack support for social networking functions. As a response, Oracle unveiled its collection of social CRM applications called Oracle Social Apps, which enable companies to solve business problems using Web 2.0 and social applications. One key feature integrated into the social CRM applications is the ability for traditional CRM tools to understand conversations, an area where social networking sites excel. Oracle also introduced social sales modules, such as Sales Prospector, Sales Campaigns, and Sales Library, which tightly integrate with existing social networking sites to provide employees with relevant customer information. The social CRM applications can be deployed on Apple's iPhone as a separate mobile CRM tool. Oracle is targeting the new social CRM offerings at local service industries, the business process outsourcing (BPO) industry, financial markets, and small and midsize businesses (SMBs). The applications are priced at $70 per user per month and are available through cloud computing or a software as a service (SaaS) delivery model.

2008. New Oracle software targets Salesforce

The latest software offering, Oracle CRM on Demand 15, is an enhanced version of a product obtained through Oracle's acquisition of Siebel Systems in 2005. This on-demand software from Oracle is designed to assist companies in effectively managing their customer resources. It introduces a browser-based interface and can be customized to run on various mobile devices such as BlackBerrys, seamlessly integrating with personalized Google and Yahoo pages. One notable feature of this release is the addition of what Oracle refers to as "Social CRM" capabilities, encompassing social networking and collaboration tools. A key component of Oracle CRM's new social features is a feature called Sticky Notes. With this functionality, users can annotate any object, such as an account in a specific salesperson's portfolio, and subscribe to the associated message stream. This enables team members to follow and actively participate in conversations related to that specific object, all coordinated within the new Message Center functionality.

2006. Oracle's on-demand lineup adds Siebel, PeopleSoft tools

Oracle has rebranded and relaunched two technologies it acquired through mergers, unveiling Oracle PeopleSoft Enterprise On Demand and Oracle On Demand for Siebel CRM. The PeopleSoft-based service offers a range of tools for human resources, finance, procurement, marketing, and sales. On the other hand, the Siebel CRM tool provides order management and analytics capabilities for various industry sectors. This move aligns with the trend among business application vendors to offer their software as hosted services. SAP and Microsoft have also entered this space, with SAP launching its CRM on-demand service earlier this year and Microsoft planning to introduce its own hosted on-demand CRM service in the coming year.

2005. RightNow targets Siebel customers

RightNow Technologies has announced an enticing offer for Siebel customers amidst the uncertainty caused by Oracle's impending acquisition of Siebel. The hosted applications company revealed on Wednesday that it will provide six months of its customer relationship management (CRM) system free of charge. This offer effectively reduces the cost of a two-year Siebel contract by 25 percent. By making this move, RightNow aims to capture a larger share of the market for corporate customers. In August, the company introduced RightNow CRM 7.5, an upgraded version designed to enhance marketing, sales, and service functions. Additionally, RightNow offers a suite of voice automation software known as RightNow Voice. This strategy of offering incentives to entice customers away from a competitor is not new for Oracle. In the past, Oracle's acquisition of PeopleSoft prompted TomorrowNow to launch a campaign targeting PeopleSoft support customers. Similarly, when Oracle outbid SAP for the acquisition of Retek, SAP initiated a targeted campaign to attract Retek customers.

2005. Oracle to acquire Siebel for $5.8 billion

Oracle is set to acquire Siebel Systems, its rival, in a significant deal valued at $5.8 billion. The primary objective behind this mega-deal, according to Oracle executives, is to establish a substantial foothold to compete against SAP, the world's largest vendor of business applications. Siebel Systems specializes in customer relationship management (CRM) software, and its acquisition by Oracle will result in the addition of 4,000 customers and 3.4 million CRM users. Larry Ellison, the CEO of Oracle, stated that the decision to pursue this deal was driven, in part, by requests from partners and customers, including General Electric. These stakeholders desired a single accountable company for their applications and sought a streamlined integration process. Oracle has been active in acquisitions throughout the year, including the purchase of retail software maker Retek for nearly $500 million in April. In early July, Oracle acquired pricing specialist ProfitLogic for an undisclosed amount, and just last month, the company invested $650 million in Indian banking software maker I-flex Solutions.

2005. RightNow pins enterprise hopes on new CRM

RightNow Technologies aims to enhance its presence in the enterprise market by introducing a new version of its customer relationship management (CRM) system. The company has launched RightNow CRM 7.5, which offers significant improvements across three key areas of CRM applications: marketing, sales, and service. Additionally, RightNow has unveiled two new add-on CRM products designed to streamline telephone sales operations and provide robust business intelligence tools for customer service operations. Analysts foresee a rising demand for hosted business tools in the enterprise market, creating opportunities for RightNow and other competitors to secure more contracts with larger customers.

2005. Siebel updates hosted CRM, again

Siebel Systems has released Siebel CRM OnDemand Release 8, the latest update to its online hosted software, with new tools for workplace collaboration and product marketing. The CRM package includes features such as group calendars, task management applications, collaboration tools, relationship tracking, and marketing segmentation capabilities. Siebel has faced challenges from competitors like Salesforce.com in the hosted CRM market, but the company aims to differentiate itself by offering flexibility to customers with both hosted and on-premises CRM options. Laurent Pacalin, General Manager of CRM products at Siebel, emphasized the importance of choice and the underlying data structure in meeting customer demands. The company sees its hosted offerings as a key opportunity for growth.

2005. Siebel updates subscription service

Siebel Systems, a software company, has unveiled the latest edition of its subscription-based customer information system, known as Siebel CRM OnDemand Release 7. This updated service incorporates new call center applications obtained through the acquisition of Ineto Services, a software start-up, last year. The introduction of the OnDemand service, aimed directly at competitor Salesforce.com, took place approximately a year ago. The new Release 7 version is currently accessible in the United States at a cost of $150 per user per month.

2005. Siebel fine-tunes subscription software

On Tuesday, Siebel Systems unveiled version 6 of its subscription software, known as Siebel OnDemand, which includes enhanced features tailored for industries such as banking, medical, computer, and automotive companies. The subscription service provides businesses with access to a Siebel customer information system for a monthly fee of $70, or $100 for the specialized versions. Introduced in collaboration with IBM a year ago, the latest release introduces a "sales process coach" tool that assists sales professionals in acquiring new customers. Additionally, the software offers improved data exporting capabilities to Microsoft Excel spreadsheets and Word documents, while also expanding language support to include Chinese, Japanese, and Korean.

2004. Siebel jumps into software rental market

Siebel Systems, a leading provider of customer relationship management (CRM) software, is adapting to the growing trend of renting computing systems for running corporate software. While Siebel traditionally sold packaged software, it now recognizes the demand for hosted CRM services, such as its own Siebel OnDemand. To differentiate itself from purely hosted CRM companies like Salesforce.com, Siebel offers a hybrid approach that allows customers to mix and match, running some CRM systems in-house while utilizing Siebel's hosted service for other areas. This flexibility appeals to smaller customers, and Siebel is expanding its offerings by adding features like analytics, loyalty management systems, and messaging systems. IDC predicts that software subscriptions, like the Salesforce model, will experience significant growth, and Siebel aims to capitalize on this trend while continuing to serve customers with packaged CRM software.

2004. Siebel predicts rise in hosting services

During a teleconference discussing Siebel Systems' financial performance, CEO Tom Siebel predicted that up to 15 percent of customer relationship management (CRM) software sales would involve application hosting services in the coming years. Siebel, who recently entered the CRM hosting market, expressed confidence in Siebel's ability to become a major player in software hosting, similar to its dominance in the CRM software market. With the CRM software market projected to exceed $3.5 billion in license revenue by 2006, this forecast represents a significant portion of the market. Siebel's entry into the software-as-a-service field came through partnerships with IBM and British Telecommunications, who agreed to host and sell Siebel's OnDemand software. The company also made acquisitions, including Salesforce rival Upshot and hosted contact center software company Ineto Services. Siebel's OnDemand product has garnered substantial interest, with 5,000 sales leads and 500 companies expressing interest. Despite competition from Salesforce, Siebel remained optimistic about their hosting business. However, the executives refrained from providing financial guidance for the second half of 2004 and were cautious about predicting an IT spending recovery due to the unpredictable economy.

2003. Siebel, BT connect on CRM on-demand service

British Telecommunications (BT) and Siebel Systems have expanded their partnership to allow BT to resell Siebel's OnDemand service to small and medium-sized businesses in the UK. OnDemand is a web-based customer relationship management (CRM) system that is licensed on a per-user, per-month basis, eliminating the need for businesses to manage the associated hardware and software. The Siebel product is a rebranded version of UpShot, a CRM package acquired by Siebel. BT will host the CRM service through its Contact Central arm, directly competing with Salesforce.com and potentially IBM, another major Siebel OnDemand reseller. While the service is expected to be fully released in mid-February, beta customers will be testing it before the end of the year. This partnership builds upon BT's existing relationship with Siebel, as it already has over 60 Contact Central customers.

2003. Siebel taps Sun for hosted CRM plan

Siebel Systems has partnered with Sun Microsystems to expand the distribution of its new pay-by-the-month software program, Siebel CRM OnDemand. Sun is assisting Siebel in finding application-hosting partners as part of its utility computing initiative. While IBM was announced as the initial hosting services partner for Siebel's OnDemand product, the agreement is not exclusive, and Siebel is seeking additional partnerships to enhance its distribution network. Sun, known for its variable pricing structure based on actual server usage, is actively pursuing alliances with IT services companies to support Siebel's expansion efforts. The specifics of the Siebel-Sun agreement, such as pricing and bundling arrangements, have not been disclosed. Analysts acknowledge the strategic move by Siebel to engage distribution partners but emphasize the challenges of managing multiple partnerships and maintaining consistent service levels. Siebel's OnDemand products target small and midsize companies seeking an alternative to expensive software licenses and consulting fees. This venture marks Siebel's second foray into the hosted-software business model, following the discontinuation of Sales.com, a similar service, two years ago.

2003. Siebel, IBM team up for hosted CRM - Siebel CRM On Demand

Siebel Systems and IBM have joined forces to introduce a hosted software solution, aiming to capture a portion of the IT expenditure of small and midsize businesses. The product, known as Siebel CRM OnDemand, represents an endeavor to deliver customer relationship management systems via the web, rather than through conventional software licensing. The companies anticipate that corporate clients in need of CRM applications would prefer accessing them online, avoiding the lengthy process of licensing and deployment. The software will be priced at $70 per customer per month, with a targeted release date by the end of the year. Initially, Siebel will focus on companies that have already implemented its products. An executive from Siebel highlighted the benefit of swift implementation for new users, enabling them to promptly set up and utilize their CRM systems.

2000. Salesforce.com launch presages Siebel rivalry

Tonight's launch party for Salesforce.com is expected to kick off a David-and-Goliath battle in Silicon Valley, with CEO Marc Benioff envisioning his company as a potential competitor to software giant Siebel Systems. Salesforce.com offers a web-based service that equips salespeople with tools for lead tracking, customer account management, report generation, and performance comparison. The key distinction lies in the delivery model: Salesforce.com operates strictly as an online service, priced at approximately $50 per month for the first five users and $50 per month per additional user, accessed through a browser. In contrast, Siebel primarily offers client-server software for desktop computers, albeit with partnerships with application service providers (ASPs) for web hosting. The software industry is currently divided over the shift from buying to renting software, making the upcoming battle between the two companies significant. Despite Siebel's market share and impressive clientele, Salesforce.com believes its service's simplicity and cost-effectiveness will prevail. However, challenging Siebel's dominance will be no easy feat, as the market is projected to reach $16.8 billion by 2003. Siebel's competitors, Vantive and Clarify, have already been acquired, while SAP and Oracle are beginning to make inroads. Interestingly, both Siebel and Benioff are former Oracle executives, and Salesforce.com has notable investors, including Oracle CEO Larry Ellison. Although the market is still evolving, the goal of seamlessly integrating customer data throughout the entire sales process remains elusive.