Supply Chain Management software

Updated: July 30, 2023

Supply Chain Management (SCM) software is a powerful tool that enables organizations to optimize and streamline their supply chain processes from procurement to delivery. This specialized software provides end-to-end visibility and control over the entire supply chain, facilitating efficient inventory management, demand forecasting, and supplier collaboration. SCM software allows businesses to track and analyze supply chain performance, identify bottlenecks, and make data-driven decisions to improve efficiency and reduce costs. It also helps in ensuring product quality, compliance with regulations, and timely delivery, enhancing customer satisfaction. With features for real-time tracking and analytics, SCM software enables organizations to respond quickly to changing market demands and disruptions. By leveraging Supply Chain Management software, businesses can enhance supply chain resilience, reduce lead times, and optimize inventory levels, ultimately achieving greater operational efficiency and competitiveness in the global marketplace.

See also: Top 10 Online ERP software

See also: Top 10 Online ERP software

2023. Logistics startup Slync raises $24M

Supply chain management software startup Slync has secured $24 million in funding. Slync's core objective is to streamline supply chain operations by connecting disparate shipping and logistics systems, allowing for the ingestion and processing of data to automate repetitive processes. By leveraging various data sources, including enterprise resource management systems, customer relationship management systems, transport management systems, visibility service providers, email, PDFs, and spreadsheets, Slync aims to extract and highlight critical information for users. The platform provides collaboration tools and role-based workflows to facilitate effective communication and information sharing among stakeholders. Slync's comprehensive approach aims to enhance visibility, efficiency, and collaboration within supply chain management.

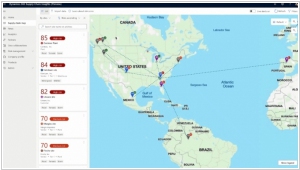

2022. Leta, a Kenyan supply chain and logistics SaaS provider, raises $3M

Leta, a B2B supply chain and logistics SaaS provider based in Kenya, has recently secured $3 million in pre-seed funding. Since its launch last year, Leta has been focused on optimizing fleet management and now aims to expand its operations in West Africa while continuing to scale in its existing markets. Leta's advanced route and load optimization technology is specifically designed to enhance the efficiency of goods delivery and reduce the number of vehicles required for distribution, resulting in cost savings and improved competitiveness. Moreover, the platform offers real-time tracking capabilities, allowing businesses to monitor drivers, track specific goods, optimize truck loading, measure journey time, and calculate distances traveled. This comprehensive solution empowers companies to streamline their logistics operations and make data-driven decisions to maximize efficiency and customer satisfaction.

2022. Makersite lands $18M to help companies manage product supply chains

Makersite, a platform that strives to provide rapid impact assessments in the realms of sustainability, compliance, and risk to support corporate decision-making, has successfully secured $18 million in funding. Makersite aims to bridge the gap between subject matter experts who possess knowledge of environmental standards, cost factors, regulatory compliance, and risk considerations, and the decision-makers who wield control over the product supply chain. Leveraging its extensive database, Makersite can automatically establish contextual connections to construct a comprehensive model of products and their supply chains. These models encompass not only the composition of a product, but also the manufacturing processes of each component or ingredient, spanning from resource extraction to the factory floor.

2022. Supplier management startup Stimulus closes $2.5M seed round

SaaS startup Stimulus has announced the successful completion of an oversubscribed $2.5 million seed funding round. Founded by Tiffanie Stanard in 2017, the company initially focused on revolutionizing the supply chain industry. Stimulus developed a product that equips establishments with the necessary tools and data to select, compare, and establish partnerships with product suppliers and vendors. The outcome is a comprehensive solution that helps businesses reduce costs by avoiding incompatible suppliers while also introducing diverse vendors to companies that may have overlooked them in the past. With Stimulus, users can discover suppliers using various search criteria, such as industry, company size, location, product, and certification. The platform enables the evaluation of current or potential suppliers who meet the specific criteria required by your organization. Additionally, Stimulus provides a centralized platform to manage supplier relationships, including project status, budget, and supplier status, streamlining the entire process in one place.

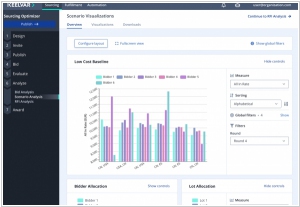

2022. Keelvar raises $24M to automate procurement in the supply chain

Supply chain technology companies have gained significant prominence amidst ongoing shortages, offering solutions to a persistent problem. One of these notable vendors is Keelvar, based in Cork, Ireland, which provides a supply chain analytics platform. Keelvar assists customers in making informed decisions for their supply chains by evaluating various sourcing scenarios. The platform enables customers to gather and analyze a wide range of procurement bid information from both direct and indirect suppliers. Based on specific criteria and constraints, Keelvar facilitates the examination of multiple awarding scenarios. (Direct procurement refers to spending on goods and services directly contributing to tangible profit, while indirect procurement encompasses expenditure on goods and services necessary for day-to-day operations.) Additionally, the platform allows customers to initiate and manage bidding events efficiently. Keelvar's algorithms effectively analyze data related to supply chain disruptions and vendors, ensuring the extraction of valuable information while offering recommendations.

2021. Microsoft announces new tools to modernize supply chain and manufacturing

Microsoft is introducing the Microsoft Cloud for Manufacturing, a new solution tailored for the manufacturing industry. Additionally, they are launching Dynamics 365 Supply Chain Insights, a tool that enhances supply chain visibility and provides intelligence to address issues proactively. The manufacturing cloud aims to gather signals and alert manufacturers about potential supply shortages, while the Supply Chain Insights tool helps identify and resolve issues along the supply chain before they become bottlenecks. Together, these solutions enhance agility and flexibility for manufacturing companies.

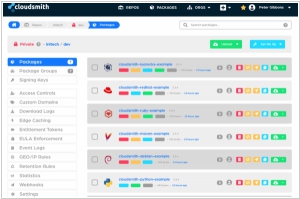

2021. Software supply chain platform Cloudsmith raises $15M

Cloudsmith, a cloud platform dedicated to software supply chain management, has secured $15 million in Series A funding. This Belfast-based startup offers businesses the ability to efficiently manage all incoming software through the cloud, eliminating the need for dedicated in-house support staff, as well as the associated requirements such as staffing, VPNs, and licenses. Cloudsmith takes pride in its software's capability to scan for security vulnerabilities. The company boasts a diverse customer base across Europe, the United States, the Middle East, and Australia, including renowned organizations such as the Internet Systems Consortium, Carta, and Font Awesome. With its innovative solution, Cloudsmith streamlines software management processes while ensuring security, making it an invaluable asset for businesses worldwide.

2020. Coupa Software snags Llamasoft for $1.5B to bring together spending and supply chain data

Coupa Software, a publicly traded company specializing in assisting large corporations in spending management, has announced its acquisition of Llamasoft, an 18-year-old Michigan-based company focused on aiding large enterprises in supply chain management. The purchase was valued at $1.5 billion. Llamasoft recently introduced its latest AI-driven platform designed for intelligent supply chain management. This specific feature caught the attention of Coupa, as it sought a supply chain application to complement its existing spend management capabilities.

2020. Craft raises $10M to apply some intelligence to supply chain

Craft, the enterprise intelligence company, has announced the successful closure of a $10 million Series A financing round. The funds will be utilized to develop a comprehensive "supply chain intelligence platform" that enables companies to effectively monitor and optimize their supply chain and enterprise systems. Unlike many existing business intelligence products that require clients to provide their own data, Craft's data platform comes pre-loaded with information sourced from thousands of financial and alternative sources. It includes over 300 data points that are regularly updated through a combination of Machine Learning and human validation. Craft faces competition from established players such as Dun & Bradstreet, Bureau van Dijk, and Thomson Reuters. However, Craft differentiates itself by offering real-time data from diverse sources, including operating metrics, human capital, and risk metrics, rather than solely focusing on financial data about public companies.

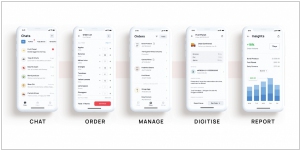

2020. Tinvio, a communication platform for supply chain merchants, gets $5.5M

As a supply chain merchant, it can be challenging to manage communication with buyers using various methods such as emails, text messages, and paper invoices. To simplify this process, Tinvio, a startup based in Singapore, has raised $5.5 million to develop a communication and commerce platform specifically designed for order management. Tinvio primarily caters to small and mid-sized merchants, with a significant customer base in the food and beverage (F&B), retail, and healthcare supply industries. One of Tinvio's key features is its ability to integrate with existing channels like email, SMS, or WhatsApp, allowing merchants to continue receiving orders through familiar means. By consolidating these orders within a single application, Tinvio creates a real-time digital ledger, streamlining invoice tracking, fulfillment processes, and financial management for merchants.

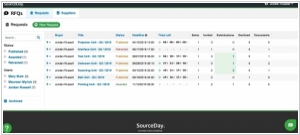

2020. SourceDay closes $12.5 million for its supply chain management software

SourceDay, a provider of supply chain management software, has announced a successful funding round, raising $12.5 million. The company specializes in developing software solutions that facilitate the management of relationships between businesses and their raw material suppliers for direct spending requirements. With a customer base that includes over 6,000 manufacturers, distributors, and suppliers, SourceDay aims to utilize the raised funds to enhance its existing tools and offer additional support to customers in effectively mitigating supply chain risks.

2019. Workday to acquire online procurement platform Scout RFP for $540M

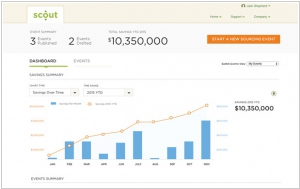

Workday has recently finalized an agreement to acquire Scout RFP, an esteemed online procurement platform, for a significant sum of $540 million. This strategic acquisition serves as a valuable expansion to Workday's existing procurement solutions, namely Workday Procurement and Workday Inventory. Workday is dedicated to becoming a comprehensive, all-encompassing player in the cloud back-office arena, and addressing the gap in procurement has been one of their major priorities. As part of their broader vision for the future of Cloud ERP, Workday strategically invests in portfolio companies that complement their core offerings. In today's definition of ERP, various essential components such as finance, HCM (human capital management), projects, procurement, supply chain, and asset management are included, and Workday is committed to delivering a holistic solution covering these key areas.

2012. SAP acquires Ariba and sets the new record for cloud deals

Let's continue observing the fierce competition between SAP and Oracle as they invest substantial sums of money in their race for dominance in the cloud industry. To recap, Oracle initially acquired the CRM-system RightNow for $1.5 billion, followed by SAP's acquisition of the talent management solution SuccessFactors for $3.4 billion. Oracle then joined in by acquiring the HRM-system Taleo for $1.9 billion. Now, it's SAP's turn to make a significant purchase, and they have not failed to deliver. At a staggering price of $4.3 billion (setting a new record in the cloud market), SAP has acquired Ariba. SAP states that Ariba is the second-largest SaaS provider in terms of revenue (with $444 million in revenue last year). Ariba specializes in providing b2b e-commerce solutions for large companies listed in the Fortune 500. In other words, Ariba offers a SaaS service that facilitates collaborative supply chain and distribution channel management for business partners.