Top 10: Employee Benefits software

Updated: July 30, 2023

Employee Benefits software is a comprehensive platform designed to streamline and manage various employee benefit programs offered by organizations. This software simplifies the administration of benefits such as health insurance, retirement plans, paid time off, and other perks, providing a centralized platform for employees to access and manage their benefits. Employers can use the software to automate enrollment processes, track benefit usage, and ensure compliance with regulations. Additionally, Employee Benefits software often includes features like self-service portals, where employees can view and update their benefit selections, access important documents, and seek assistance from HR teams. By digitizing and automating the benefits management process, this software not only reduces administrative burden but also improves employee satisfaction and engagement by providing easy access to valuable benefits information and services.

While salary is undoubtedly the main draw in a company’s compensation offer, additional “perks” can help sweeten the deal for current or would-be employees — this could be anything from gym subsidies or an e-bike subscription, to meal allowances and mental well-being support. Employee Benefits software is curating and bundling all these various benefits.

See also: Top 10 Talent Management Systems

See also: Top 10 Talent Management Systems

2023. Coverflex raises a €15M to make employee benefits more flexible and engaging

Coverflex, a Portuguese startup specializing in facilitating flexible compensation for modern companies, has recently secured €15 million in a Series A funding round. The company offers a solution that enables organizations to design tailored employee compensation packages, including health insurance, meal allowances, fringe benefits, and discounts, by aggregating multiple providers. Through its platform, Coverflex allows companies to optimize costs with tax-efficient benefits, while simultaneously providing employees with enhanced value and improving their financial literacy regarding compensation and benefits. Coverflex boasts an impressive client base of 3,600 companies, which includes notable names like Santander, Natixis, OysterHR, Bolt, Emma, Revolut, and Smartex. It currently serves over 70,000 active users, who, on average, utilize the Coverflex platform more than eight times per month.

2022. Cobee raises $41M for an employee benefits ‘superapp’

Cobee, a Spanish startup, has recently secured €40 million in funding. Cobee has developed a comprehensive platform and app that simplifies the organization and accessibility of employee benefits. With features such as a payment card (both physical and virtual) and seamless integration with payroll systems, Cobee aims to streamline the benefits experience for both employers and employees. This sector has seen a surge of innovative startups worldwide, with companies like Swile in France, Forma in the U.S., HealthJoy in Chicago, Perkbox in the U.K., and Sodexo making notable advancements in reimagining benefits delivery. Additionally, Brazil is witnessing a fierce competition between benefits startups Caju and Flash as they strive to offer top-notch services in this space.

2022. HR employee benefits platform Fringe raises $17M to offer customizable perks

Fringe, an HR tech startup that specializes in providing customizable perks and benefits to employees, has recently raised $17 million in funding. Fringe operates a marketplace consisting of approximately 450 vendors, offering a wide range of perks such as virtual fitness, virtual coaching, online therapy, streaming services, and food and grocery delivery. By consolidating stipends and reimbursement platforms, Fringe simplifies the process of managing employee rewards and recognition, peer-to-peer giving, employee donations, and recruiting incentives. The platform generates revenue by charging employers $5 per employee per month, with reduced rates available for larger organizations.

2022. Employee benefits platform Ben raises $16M

Employee benefits platform Ben has successfully raised $16 million in a Series A funding round. Ben operates as a Software-as-a-Service (SaaS) platform, offering a range of essential employment benefits such as life insurance, health coverage, and pension plans. Additionally, it provides lifestyle-oriented perks like gym memberships and work-from-home allowances. While primarily targeting the human resources (HR) domain, Ben bridges the gap between HR and fintech by seamlessly integrating with accounting, HR, and payroll systems. This integration streamlines onboarding and enrollment processes through automation. Employers can utilize the platform to allocate budgets and implement spending controls for individual employee benefits. Furthermore, Ben facilitates the entire payment process to service providers. In addition, Ben offers Mastercards to employees, enabling them to choose the perks they desire while adhering to the company's specified limits.

2021. ThreeFlow raises $45 million to scale its employee benefits placement software

ThreeFlow, a provider of software for insurance brokers specializing in employee benefits, has recently announced the successful completion of its Series B funding round, raising $45 million. ThreeFlow's software product falls under a unique category known as a "benefits placement solution" designed specifically for insurance brokerages. These brokerages consolidate insurance plans from various carriers and offer them to companies.

2021. Swile raises $200 million for its employee benefits card and app

Swile, a French startup offering a payment card for employee benefits including meal vouchers, gift cards, and sustainable mobility vouchers, has recently secured a $200 million Series D funding round. Swile allows employees to link their personal debit card to the Swile app, which automatically charges the personal card when the daily spending limit is exceeded. This integration provides a seamless and improved experience for users, contributing to the product's success. In just four years since its launch, Swile has captured a remarkable 13% market share in France's meal voucher industry, competing against established players such as Edenred, UpDéjeuner, Sodexo's Pass Restaurant, and Apetiz. Swile generates revenue through interchange fees and commissions on affiliates.

2021. Employee leave startup Cocoon launches after raising $20M

Employee leave benefits can often be a complex tangle of company and government policies, but Cocoon has secured $20 million in Series A funding to address this issue and bring clarity and simplicity to both employers and employees. The Cocoon platform is specifically designed to streamline various types of employee leave, including parental, medical, caregiver, and bereavement leave. It takes into account all company, government, and insurance benefits, effectively managing every aspect of the leave process, ranging from compliance to claims management to payroll calculations. Cocoon provides dedicated areas within its platform for both employers and employees. From the employer's perspective, it simplifies compliance and payroll complexities, ensuring that the company understands its payroll obligations while minimizing administrative burdens.

2021. Ben raises $2.5M seed to fix employee benefits for SMEs

Ben, a London-based platform focusing on employee benefits and rewards, has secured $2.5 million in funding. Blending fintech with HR, Ben has developed an employee benefits platform designed to empower small and medium-sized enterprises (SMEs) to provide highly personalized and flexible benefits to their employees. The startup offers a Software-as-a-Service (SaaS) solution for managing benefits, featuring a benefits marketplace and individual debit cards powered by Mastercard for each employee. The aim is to offer employees greater autonomy in selecting their preferred benefits while simplifying the integration of additional benefit providers. This can be facilitated through the marketplace or by whitelisting specific merchants or merchant categories, such as food and drink, travel and mobility, or designated co-working spaces, using the employer-issued Mastercards.

2020. HealthJoy launches its revamped employee benefits assistance platform

HealthJoy, a platform dedicated to maximizing employee benefit utilization, has unveiled its redesigned user interface and technology stack. The updated interface incorporates several new features, including estimated wait times for services like the inbox and healthcare concierge, as well as an enhanced benefits wallet. In response to the ongoing pandemic, HealthJoy has also introduced additional functionalities to assist users, such as facilitating testing, providing online consultations, and offering a guide to nearby in-network healthcare facilities with shorter wait times. Since its launch in 2014, HealthJoy has successfully onboarded over 500 employers onto its platform. To date, the company has raised a total of $53 million in funding.

2019. Payroll software for small business Gusto raised $200M

SMB payroll startup Gusto has successfully raised $200M in Series D funding. This significant investment will be utilized to expand both the company's product line and team. While Gusto primarily focuses on payroll services, it aims to diversify its offerings by introducing two additional products in the future. One area of development revolves around fintech features, such as Flexible Pay. This innovative product enables employees to receive their unpaid wages in advance, with the ultimate aim of reducing their reliance on high-interest payday lenders. The second product category pertains to healthcare, with Gusto aiming to assist SMBs in providing insurance benefits to their employees. Over the past year, Gusto has achieved an impressive milestone by surpassing 100,000 customers. Considering that there are approximately six million small businesses operating in the United States, this demonstrates Gusto's significant market presence and potential impact.

2017. Zenefits simplifies human resources management for SMB

Zenefits, a human resources management service, has recently unveiled a range of updates aimed at streamlining employee management processes, including benefits administration and payroll, by providing user-friendly mobile app functionalities. These improvements come in the wake of a compliance scandal that significantly impacted Zenefits' valuation, prompting the company to strategically reestablish itself among small- to medium-sized businesses through a simplified product offering, diverging from its previous complex desktop dashboard. Additionally, Zenefits is introducing reporting and analytics features for HR managers, enabling them to generate comprehensive reports on employee activities within their organizations. This business intelligence capability is particularly useful in providing HR managers with valuable data insights for presentations to their superiors.

2015. ZenPayroll rebrands as Gusto and takes on Zenefits

Payroll startup ZenPayroll, which now goes by the name Gusto, has broadened its range of services from solely payroll to include additional benefits like health insurance and workers' compensation. This development has sparked a rivalry with Zenefits, a cloud HR benefits company that previously collaborated with Gusto to offer payroll services to its clients. The partnership between Zenefits and Gusto proved crucial earlier this year when ADP, a major player in the payroll industry, terminated its access for Zenefits' small business customers. Zenefits turned to Gusto (previously ZenPayroll) to handle their payroll processing needs. Interestingly, Zenefits is also planning to introduce its own payroll service, mirroring Gusto's offerings. This turn of events has transformed the partnership between these cloud-based startups into a competition, as both aim to provide comprehensive payroll and benefits services on a unified platform.

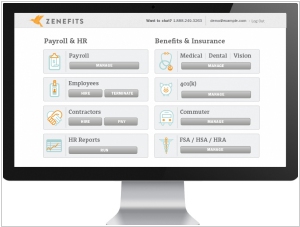

2014. Zenefits - leads the wave of next generation cloud HR services

Zenefits, the cloud HR app, has experienced rapid growth within a short timeframe since its launch just over a year ago. The recent financing has increased its total funding to $84 million since its establishment. Zenefits was founded with the aim of streamlining HR processes for companies by offering a user-friendly interface for both personnel departments and employees, facilitating efficient management of payroll and benefits. While the SaaS platform is free to utilize, Zenefits generates revenue by functioning as an insurance broker.