Customer Data Analytics and Management software

Updated: November 18, 2023

A Customer Data Platform (CDP) is a specialized software that serves as a centralized and unified repository for collecting, integrating, and managing customer data from various sources and touchpoints. CDPs are designed to help businesses create a comprehensive and detailed profile of each customer, incorporating data from interactions, behaviors, transactions, and preferences across multiple channels such as websites, mobile apps, social media, and offline interactions. By consolidating customer data, CDPs provide marketers and other business users with a holistic view of customers, enabling them to personalize marketing campaigns, improve customer engagement, and make data-driven decisions. CDPs play a vital role in enhancing customer experiences, fostering customer loyalty, and driving business growth by facilitating targeted marketing, segmentation, and the delivery of relevant content to customers throughout their journey with the company.

See also: Top 10 Online CRM software

See also: Top 10 Online CRM software

2023. Simon Data is putting customer data to work with $54M Series D

The adoption of the customer data platform (CDP) as a standard method for collecting and leveraging first-party customer data is evident. Simon Data, established in 2015, has consistently aspired to be more than a mere repository for customer data, providing ready-to-use applications alongside the flexibility for customers to create customized applications. The current business landscape reflects a widespread acknowledgment of this vision, with every company now emphasizing the development of applications, be it in the form of machine learning models or other applications. Investors are attuned to these trends, as exemplified by the recent announcement of Simon Data securing a $54 million Series D funding round.

2022. MadKudu lands $18M for its lead scoring platform

MadKudu, a company specializing in the development of a customer data platform, has recently secured $18 million in Series A funding. MadKudu's primary focus is on lead scoring, providing sales teams with valuable insights to identify high-quality leads and prioritize their efforts effectively. By leveraging advanced analytics and analyzing customer product usage data, MadKudu has built what they claim to be the "largest product-led growth (PLG) data set in the world." With notable customers such as Dropbox, Cloudera, Amplitude, Plain, Unity, and Miro, MadKudu's solution has gained recognition and adoption among leading organizations. By harnessing the power of data analysis, MadKudu empowers sales teams to optimize their lead management process and concentrate their efforts on the most promising opportunities.

2021. Blotout raises $3M to build privacy-focused customer data platform

In the face of an increasing number of privacy regulations, such as GDPR and CCPA, companies are actively seeking solutions that not only enhance their understanding of customers but also facilitate compliance with these laws in a more efficient manner. To address this challenge, Blotout has recently secured a $3 million seed round of funding. Blotout offers a unique approach wherein their solution can be installed on a preferred cloud platform, such as Amazon, Microsoft, or Google. By capturing data as it enters the system, Blotout enables the collection of permissions and ensures compliance with each relevant law, all while granting customers full control over their data. This innovative solution helps alleviate the burden of labor-intensive compliance processes and provides companies with a streamlined approach to managing customer data.

2021. InfoSum raises $65M as organizations embrace secure data sharing

InfoSum, a startup based in London, has successfully raised $65 million in Series B funding. The company offers a decentralized platform for secure data sharing among organizations. Utilizing patented technology, InfoSum's data collaboration platform connects customer records across different companies without the need to move or share the actual data. This approach addresses security concerns and ensures compliance with existing privacy laws, including GDPR. Earlier this year, the platform was enhanced with the introduction of InfoSum Bridge. This product significantly expands the customer identity linking capabilities of the platform by connecting advertising identifiers and the platform's own "bunkered" data sets. The aim is to enhance ad targeting based on first-party data.

2021. Customer data platform Lexer raises $25.5M

The COVID-19 pandemic has prompted a significant surge in online shopping, necessitating retailers to swiftly analyze customer data to stay competitive in the face of rivals such as Amazon. Lexer, a customer data platform based in Melbourne, Australia, offers assistance to brands in effectively managing their data by consolidating it onto a single platform. This streamlined approach simplifies the analysis process, particularly benefiting small to medium-sized brands. The company recently announced the successful completion of a Series B funding round, raising $25.5 million. This funding will support Lexer's expansion efforts in Australia, the United States, and Southeast Asia.

2021. Census raises $16M Series A to help companies put their data warehouses to work

Census, a startup specializing in facilitating the synchronization of customer data between data warehouses and various business tools such as Salesforce and Marketo, has successfully raised $16 million in a Series A funding round. The company emphasizes the significance of the modern data stack, which incorporates data warehouses like Amazon Redshift, Google BigQuery, and Snowflake as its foundation, providing businesses with the necessary tools for data extraction and transformation (such as Fivetran and dbt), as well as data visualization capabilities (like Looker). Census acts as an intermediary layer that bridges the gap between the data warehouse and the business tools, enabling companies to extract valuable insights from their data. This allows users to seamlessly synchronize their product data with marketing tools like Marketo or CRM services like Salesforce, streamlining their data management processes.

2021. Iteratively raises $5.4M to help companies build data pipelines they can trust

As companies accumulate larger volumes of data, ensuring its quality and trustworthiness has become increasingly crucial. After all, an analytics pipeline is only as reliable as the data it gathers, and messy data or bugs can lead to significant issues downstream. Iteratively, a startup dedicated to assisting businesses in constructing dependable data pipelines, has recently secured $5.4 million in seed funding. Iteratively specializes in managing event streaming data for product and marketing analytics, which typically flows into platforms like Mixpanel, Amplitude, or Segment. Positioned at the data source, such as within an app, Iteratively validates and directs the data to the appropriate third-party solutions employed by the company. By doing so, Iteratively helps ensure the accuracy and reliability of the data driving critical business insights.

2020. Hightouch raises $2.1M to help businesses get more value from their data warehouses

Hightouch, a SaaS service specializing in data synchronization across sales and marketing tools, has emerged from stealth mode and announced a successful $2.1 million seed funding round. With the growing adoption of data warehouses such as Snowflake, Google's BigQuery, and Amazon Redshift, businesses now possess a centralized repository for their customer data. Traditionally, this data has been primarily used for analytical purposes. However, there is significant value in leveraging it for operational functions, such as empowering different business teams to drive marketing campaigns or enabling product personalization. Hightouch offers a solution that empowers users to create SQL queries and seamlessly transfer the resulting data to various destinations, including popular platforms like Salesforce for CRM or Marketo for marketing purposes. Additionally, Hightouch ensures compatibility by transforming the data into the required format for each destination platform, facilitating smooth and efficient data integration.

2020. Adobe expands customer data platform to include B2B sales

The customer data platform (CDP) is a relatively recent concept that revolves around aggregating data about individual consumers from various channels into a comprehensive record. This enables businesses to provide more relevant content and personalized experiences based on in-depth knowledge. Recognizing the absence of such data consolidation in the business-to-business (B2B) market, Adobe has announced its plans to develop a CDP specifically tailored for B2B customers. Adobe is actively collaborating with early adopters of the product and anticipates entering the beta phase before the end of the upcoming month. The general availability (GA) release is scheduled for the first half of next year.

2020. Grouparoo raises $3M to build open source customer data integration framework

Startup Grouparoo has secured a $3 million seed investment for its open-source framework aimed at simplifying developers' access to and utilization of customer data. The company's framework enables seamless synchronization of customer data from databases or warehouses to various SaaS tools required by businesses. Once installed, Grouparoo allows users to define important customer properties and create relevant segments. For instance, users can segment high-earning individuals in San Francisco, complete with their names and addresses. Grouparoo then facilitates the transfer of this data to marketing tools like Marketo or Zendesk, empowering these tools to identify VIP customers based on the provided data.

2020. Harbr raises $38.5M to help enterprises share big data securely

Modern organizations possess vast amounts of data that they collect and utilize internally, but many are now seeking opportunities to share these valuable resources with external parties to enhance their business prospects. Enter Harbr, a startup that has developed a secure platform for facilitating big data exchange. Recently, the company successfully raised $38.5 million in a Series A funding round. Harbr's platform offers enterprises a means to leverage data stored in data lakes and warehouses, which they already employ for analytics and business intelligence purposes. The primary objective is to prepare and secure this data for enterprise data exchange, whether it involves internal departments within a large organization or external third parties. This involves establishing a "clean room" environment, equipping it with tools to facilitate accessibility for third parties, and potentially transforming it into a data marketplace should that be the desired outcome.

2020. Sales partnership platform Crossbeam raises $25M

When sales teams collaborate with other companies, they often engage in account mapping, a process of identifying shared customers and potential prospects. Typically, this activity is carried out manually and tracked using spreadsheets. However, Crossbeam has revolutionized partnership data integration by introducing automation. This innovation has garnered significant attention, leading to a successful $25 million Series B investment. Crossbeam has experienced consistent growth, with over 900 companies already utilizing the platform. The inherent networking effect within Crossbeam facilitates seamless expansion, as new companies join and invite partners who, in turn, invite more partners. This creates a perpetual sales cycle with minimal effort required.

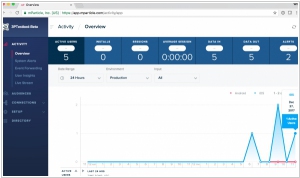

2020. RudderStack raises $5M seed round for its open-source Segment competitor

RudderStack, a startup that provides an open-source alternative to customer data management platforms such as Segment, has recently secured a seed funding round of $5 million. Additionally, the company has announced its acquisition of Blendo, an integration platform that assists businesses in transforming and transferring data from various sources to databases. Similar to its larger counterparts, RudderStack aids businesses in consolidating their customer data, which is typically generated and managed across multiple platforms. By providing a more comprehensive view of this data, RudderStack enables businesses to derive greater value from it.

2020. Census raises $4.3M seed to put product info in cloud data warehouses to work

Data automation platform Census has recently announced a seed funding round of $4.3 million. Census provides a solution that simplifies the distribution of product data for data teams by building a layer on top of data warehouses. This enables easy access to valuable product data and unlocks the potential of data stored across various systems. Census focuses on syncing data directly from popular cloud data warehouses such as Snowflake, BigQuery, and Redshift. The primary objective is to empower users to leverage this data by removing complexities associated with extracting it from the warehouse and automating its utilization. Census collaborates closely with early customers' data teams to streamline the process of extracting and utilizing warehouse data in a more efficient and automated manner.

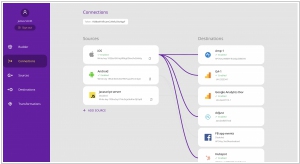

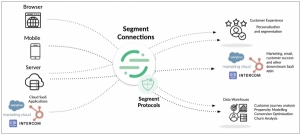

2020. Segment allows non-technical users to collect customer data in minutes

Segment, the world's leading customer data platform (CDP), has introduced Visual Tagger, a user-friendly point-and-click tool. Visual Tagger enables individuals without technical expertise to effortlessly gather data on customer interactions with their websites, eliminating the need for coding. Through Visual Tagger, Segment users can track customer engagement and website interactions by simply clicking on the desired elements, without relying on engineering assistance. Subsequently, Segment users can effortlessly direct this data to more than 300 top-tier tools, leveraging it to obtain valuable insights, make informed product decisions, and enhance personalized customer experiences while prioritizing user privacy and preferences.

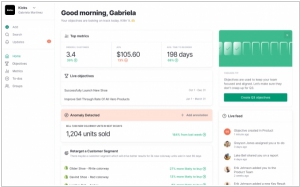

2020. Yaguara nabs $7.2M seed to help e-commerce companies understand customers better

Yaguara, a startup dedicated to assisting e-commerce companies in gaining a deeper understanding of their customers to deliver more impactful experiences, has successfully secured $7.2 million in funding. Yaguara's core approach revolves around the integration of data, ensuring that all relevant information is consolidated in the appropriate location. By aggregating data from numerous sources, including performance marketing, e-commerce statistics, fulfillment, and unit economics, Yaguara enables businesses to have a comprehensive, real-time view of their data within a unified platform. Moreover, the platform leverages this unified dataset to provide predictive and prescriptive insights and recommendations to individual users across different teams. This empowers organizations to drive targeted outcomes throughout the company, based on a comprehensive understanding of their data.

2020. mParticle raises $45M to help marketers unify customer data

mParticle, a company that specializes in assisting organizations such as Spotify, Paypal, and Starbucks in managing their customer data, has successfully secured $45 million in Series D funding. With the increasing importance of privacy regulations and the shift away from cookie-based browser tracking, mParticle's platform, which utilizes modern data infrastructure, has become highly sought-after by brands seeking to deliver personalized customer experiences while complying with regulations. Since its establishment in 2013, mParticle has witnessed the emergence of an entire industry dedicated to customer data platforms (CDPs), providing marketers with tools to consolidate data from various sources and create a unified view of their customers. Even major players in the industry, including Adobe and Salesforce, have introduced their own CDPs as part of their comprehensive marketing clouds.

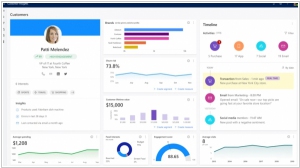

2020. Microsoft introduced its customer data platform inside Dynamics 365

Microsoft has made a significant announcement regarding its Dynamics 365 product line, in response to the growing volume of enterprise data and the need to collect and analyze it effectively to enhance customer experiences. The company is introducing new features to its customer data platform (CDP), a concept that has gained traction among major vendors and a growing number of startups. The CDP consolidates customer data from various systems into a single location, simplifying the understanding of customer interactions. The ultimate objective is to leverage this knowledge to deliver enhanced customer experiences. Microsoft's CDP is known as Customer Insights. It is important to note that Microsoft is not the only player in this domain. Other prominent companies like Adobe, Salesforce, and SAP offer similar products for similar reasons, as part of their marketing toolsets.

2020. Retina raises $2.5M for its AI-powered customer analysis software

Closely examining customer behavior and their potential lifetime value has led to a successful funding round of $2.5 million for Los Angeles-based startup Retina. With Retina's Shopify app, vendors can effectively process data and obtain predictive insights on customer lifetime value. Even for sellers not integrated with Shopify, Retina offers the option to analyze their data and provide valuable predictions on customer value. The analysis performed by Retina takes into account factors such as recency, frequency, and churn rates to map out customer acquisition strategies. The software collects relevant data by analyzing transaction logs from customer data or payment platforms, as stated by a company spokesperson.

2020. Customer data platform ActionIQ raises $32M

ActionIQ, a company specializing in leveraging customer data for businesses, has secured $32 million in Series C funding. Founded in 2014, the company has already attracted an impressive clientele including The New York Times, Conde Nast, American Eagle Outfitters, Vera Bradley, and Pandora Media. ActionIQ's notable investors include Sequoia Capital and Andreessen Horowitz. For businesses seeking insights into customer behavior, such as identifying customers who require retention efforts or those ready for an upgrade to a paid subscription, ActionIQ offers a comprehensive platform. The company distinguishes itself by providing self-serve tools tailored to enterprises, eliminating the need for extensive consulting or IT services. ActionIQ's platform empowers businesses to take intelligent actions across various channels, driving effective engagement with customers.

2019. Acquia nabs CDP startup AgilOne

Acquia has successfully completed the acquisition of AgilOne, a startup specializing in customer data platforms (CDPs). CDPs have gained significant popularity among customer experience vendors due to their ability to gather data from multiple channels, enabling a comprehensive understanding of customers. The objective is to provide meaningful content to customers based on their known preferences, ultimately increasing the accuracy of targeting efforts. Integrating CDP capabilities into Acquia's platform will empower its customers to unify data across diverse tools within their technology stack, resulting in enhanced and personalized customer experiences.

2019. Customer data management company Amperity raises $50M

Amperity, the company that has secured $50 million in funding, specializes in the ability to remotely gather and organize every piece of atomic-level data associated with a customer, creating a comprehensive customer 360 view. Amperity empowers businesses to leverage their customer data more effectively. For instance, a company with a branded credit card can utilize this technology to send targeted offers based on customer activity, while a retailer can send promotions specifically tailored to online-only customers in order to drive them to physical stores. It's important to note that Amperity exclusively utilizes first-party data collected directly by the brand itself, without relying on third-party data acquired from other companies. Notably, Amperity has already attracted an impressive lineup of clients, including Starbucks, Gap Inc., TGI Fridays, and Planet Fitness.

2019. Customer data analytics software Heap raised $55M

Heap, the startup aiming to disrupt the analytics market, has secured a substantial $55 million in funding. Boasting a customer base of over 6,000 companies, including Twilio, AppNexus, Harry’s, WeWork, and Microsoft, Heap's total funding now stands at an impressive $95.2 million. This influx of capital will be utilized to support the company's global expansion efforts, as well as bolster its product, engineering, and go-to-market teams. Heap distinguishes itself by offering a groundbreaking approach to automating analytics for businesses, empowering various teams within organizations to access the data necessary for informed and intelligent decision-making.

2019. Salesforce acquires data visualization company Tableau for $15.7B

Salesforce has made a significant acquisition by purchasing Tableau in an all-stock deal worth $15.7 billion. This strategic move marks Salesforce's expansion beyond CRM software and into the realm of advanced analytics. While Salesforce had previously pursued the acquisition of LinkedIn (which was acquired by Microsoft), the Tableau deal enables Salesforce to enhance its customer engagement and data intelligence capabilities, similar to what LinkedIn could have offered. Additionally, this acquisition positions Salesforce to compete with Google's recent announcement of acquiring Looker, further reinforcing its market presence.

2018. Zoho Analytics got AI-powered Assistant

Zoho Analytics now incorporates Zia, an AI-powered intelligent assistant. With Zia, you can effortlessly ask questions in natural language, such as "Provide me with support tickets received this month, categorized by product and region" or "Give me sales data by country and channel." Zia translates these inquiries into complex SQL queries in the backend and suggests multiple relevant reports. You can save the most suitable suggestion directly as a report. Additionally, the new version of Zoho Analytics streamlines data analysis across various applications, enabling the creation of interactive reports and dashboards. It accurately predicts future trends based on historical data. Furthermore, Zoho Analytics introduces seven new connectors for popular business apps. Each connector includes over 100 pre-built reports and KPI dashboards specific to different domains, offering immediate benefits to users.

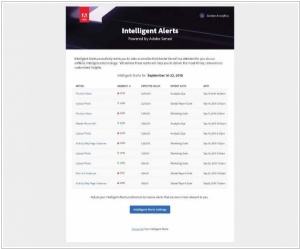

2018. Adobe introduced AI assistant for Adobe Analytics

Adobe has unveiled Intelligent Alerts, an AI-powered virtual assistant designed to enhance the capabilities of Adobe Analytics by assisting users in uncovering valuable insights that may have gone unnoticed. This intelligent assistant works by delivering alerts to analysts, which they can explore to gain deeper understanding and additional insights. If the analyst is unsatisfied with the results, they have the ability to fine-tune the system, allowing it to learn and adapt to their specific data requirements over time. Users have the flexibility to configure the frequency and quantity of alerts they receive. Intelligent Alerts is part of Adobe's broader artificial intelligence platform, known as Sensei, which aims to infuse intelligence throughout the entire range of Adobe products.

2010. Salesforce goes into amoral crowdsourcing

Nowadays the confidentiality of personal information is not so important. Especially for sales guys, like Salesforce's management. Today, Salesforce has acquired Jigsaw, which TechCrunch's Mike Arrington at first called evil and then simply amoral. Jigsaw - is a huge (21 million) online database of contacts and companies, filled by crowdsourcing: users add contact information of other people (without their knowledge) usually from business cards. When the service appeared in 2006, it paid people $1 for each added contact. Then Jigsaw sell the access to contacts database to companies using cold calling (or spammers). And there was no way to remove your contacts from the service. ***