Venmo vs Zelle

May 26, 2023 | Author: Sandeep Sharma

11

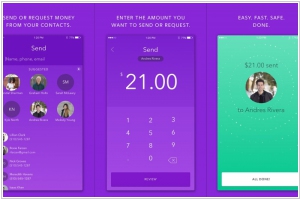

Venmo is a service of PayPal that allows to make and share payments. Venmo uses bank-grade security systems and data encryption to protect you and prevent against any unauthorized transactions or access to your personal or financial information. Sending money on Venmo is completely free as long as you use a bank account, supported debit card, or Venmo balance to fund your payments.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Venmo and Zelle are both popular digital payment platforms, but they have distinct differences in their features, functionality, and target audience.

1. User Interface and Social Integration: Venmo has a more social and interactive user interface, allowing users to add comments, emojis, and share transactions with friends. It creates a social feed that resembles a social media platform. Zelle, on the other hand, has a more streamlined and straightforward interface focused on fast and secure money transfers without the social aspects.

2. Funding Source: Venmo allows users to link their accounts to various funding sources, including bank accounts, credit cards, and debit cards. It also provides a balance within the Venmo app that users can maintain by transferring funds or receiving payments. Zelle, in contrast, is directly linked to users' bank accounts, requiring both the sender and receiver to have a bank account at a participating financial institution.

3. Transaction Speed: Zelle offers near-instantaneous transfers between participating banks, often completing transactions within minutes. Venmo, on the other hand, usually takes one to three business days for funds to be transferred to a bank account. However, Venmo does offer an instant transfer option for a small fee.

4. Availability: Zelle is typically integrated directly into banking apps or accessed through participating financial institutions, making it widely available to bank customers. Venmo, owned by PayPal, is a standalone app that is available to anyone with a U.S. mobile number and bank account.

5. Usage and Target Audience: Venmo is popular among younger users, particularly millennials and Gen Z, due to its social and interactive features. It is commonly used for splitting bills, sharing expenses, and making casual payments among friends. Zelle, on the other hand, targets a broader audience and is often used for more formal transactions, such as paying rent, sending money to family members, or transferring larger amounts.

See also: Top 10 Online Payment platforms

1. User Interface and Social Integration: Venmo has a more social and interactive user interface, allowing users to add comments, emojis, and share transactions with friends. It creates a social feed that resembles a social media platform. Zelle, on the other hand, has a more streamlined and straightforward interface focused on fast and secure money transfers without the social aspects.

2. Funding Source: Venmo allows users to link their accounts to various funding sources, including bank accounts, credit cards, and debit cards. It also provides a balance within the Venmo app that users can maintain by transferring funds or receiving payments. Zelle, in contrast, is directly linked to users' bank accounts, requiring both the sender and receiver to have a bank account at a participating financial institution.

3. Transaction Speed: Zelle offers near-instantaneous transfers between participating banks, often completing transactions within minutes. Venmo, on the other hand, usually takes one to three business days for funds to be transferred to a bank account. However, Venmo does offer an instant transfer option for a small fee.

4. Availability: Zelle is typically integrated directly into banking apps or accessed through participating financial institutions, making it widely available to bank customers. Venmo, owned by PayPal, is a standalone app that is available to anyone with a U.S. mobile number and bank account.

5. Usage and Target Audience: Venmo is popular among younger users, particularly millennials and Gen Z, due to its social and interactive features. It is commonly used for splitting bills, sharing expenses, and making casual payments among friends. Zelle, on the other hand, targets a broader audience and is often used for more formal transactions, such as paying rent, sending money to family members, or transferring larger amounts.

See also: Top 10 Online Payment platforms