Venmo vs WePay

June 08, 2023 | Author: Sandeep Sharma

11

Venmo is a service of PayPal that allows to make and share payments. Venmo uses bank-grade security systems and data encryption to protect you and prevent against any unauthorized transactions or access to your personal or financial information. Sending money on Venmo is completely free as long as you use a bank account, supported debit card, or Venmo balance to fund your payments.

Venmo and WePay are both popular online payment platforms, but they have some key differences in terms of their target audience and functionality. Venmo is primarily designed for person-to-person payments and is widely used for splitting bills, sending money to friends, and making small transactions. It provides a social aspect where users can see and interact with their friends' payment activities. WePay, on the other hand, is more focused on enabling online payments for businesses and organizations. It offers features like seamless integration with e-commerce platforms, event registration, and fundraising tools, making it a suitable choice for businesses and nonprofits. While Venmo is more consumer-oriented, WePay caters to the needs of merchants and provides a robust payment infrastructure for online transactions.

See also: Top 10 Payment Processing platforms

See also: Top 10 Payment Processing platforms

Venmo vs WePay in our news:

2014. WePay launches payment processing API to compete with Stripe

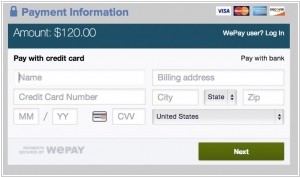

WePay, a payment processing service catering to marketplaces, crowdfunding platforms, and other online transaction facilitators, is entering the competition against Stripe by introducing a new product. Called WePay Clear, this white-label, API-based service operates similarly to Stripe and also offers a fraud protection guarantee. WePay Clear is available on both desktop web and mobile apps, and it has already been launched in the United States with Freshbooks as its initial partner. The pricing structure for WePay Clear follows a flat rate, matching that of Stripe at 2.9% + $0.30 per transaction. However, WePay may adjust these rates on a case-by-case basis depending on the partnership arrangement.