SAP ERP vs Workday

May 21, 2023 | Author: Michael Stromann

24

SAP’s intelligent ERP solutions are the Digital Core that enable businesses to integrate end-to-end cross functional next generation business processes so that companies can become intelligent. SAP's cloud ERP solutions use intelligent technologies to help you grow, innovate, and optimize time and resources – no matter the size of your business.

35

Workday is a leading provider of enterprise cloud applications for human resources and finance. Workday delivers human capital management, financial management, and analytics applications designed for the world’s largest organisations. Hundreds of companies, ranging from medium-sized businesses to Fortune 50 enterprises, have selected Workday.

SAP ERP and Workday are two prominent enterprise resource planning (ERP) solutions, but they differ in their approach, target market, and features.

SAP ERP, developed by SAP, is a comprehensive and widely adopted ERP system that covers various functional areas such as finance, human resources, procurement, supply chain management, and more. It offers robust features, scalability, and extensive customization options, making it suitable for large and complex organizations. SAP ERP is known for its deep integration with other SAP products, industry-specific solutions, and global presence.

Workday, on the other hand, is a cloud-based ERP solution that primarily focuses on human capital management (HCM) and finance. It offers features for HR management, payroll, talent management, financial management, and more. Workday is designed with a modern and intuitive user interface, emphasizing user experience and ease of use. It targets medium to large organizations, particularly those with a strong emphasis on HR processes and employee management.

See also: Top 10 Online ERP software

SAP ERP, developed by SAP, is a comprehensive and widely adopted ERP system that covers various functional areas such as finance, human resources, procurement, supply chain management, and more. It offers robust features, scalability, and extensive customization options, making it suitable for large and complex organizations. SAP ERP is known for its deep integration with other SAP products, industry-specific solutions, and global presence.

Workday, on the other hand, is a cloud-based ERP solution that primarily focuses on human capital management (HCM) and finance. It offers features for HR management, payroll, talent management, financial management, and more. Workday is designed with a modern and intuitive user interface, emphasizing user experience and ease of use. It targets medium to large organizations, particularly those with a strong emphasis on HR processes and employee management.

See also: Top 10 Online ERP software

SAP ERP vs Workday in our news:

2023. Workday unveils new HR-focused generative AI features

Workday, the enterprise management platform vendor, has unveiled a set of new generative AI features designed to enhance productivity and simplify business operations. Among the upcoming capabilities is the ability for Workday users to automatically compare signed contracts with those in the system, identifying inconsistencies. Additionally, the platform will enable the creation of personalized knowledge management articles and generate statements of work for service procurement. While most of these additions appear beneficial or at least benign, one feature raises concerns for this reporter: the AI-generated employee work plans. This tool will empower managers to swiftly compile summaries of employees' strengths and areas for improvement, drawing from various stored data sources such as performance reviews, employee feedback, contribution goals, skills, and employee sentiment, among others.

2022. Workday turns more modern and personalized with new interface makeover

Workday, a provider of services for managing people and finances, has announced a comprehensive interface redesign across its product line, aiming to modernize and enhance usability for all users, including frontline workers, managers, and IT professionals. The new interface offers a personalized experience tailored to each user's job role, moving away from a one-size-fits-all approach. This not only simplifies user tasks but also empowers companies to customize the platform to their specific needs. One example of Workday's integration with other systems is its existing integration with Slack. Instead of using the Workday application to request time off, employees can now make the request directly within Slack, automatically routing it to their manager for swift approval. This integration streamlines the process and improves overall efficiency.

2021. Workday to acquire external workforce management startup VNDLY for $510M

Workday plans to acquire VNDLY, a startup valued at $510 million, which specializes in assisting companies with managing their external workforce personnel. Workday is renowned for its capabilities in finance and human resources management, and VNDLY perfectly complements the latter category by providing software designed to streamline contractor management. This feature becomes especially valuable during times when filling full-time job positions proves increasingly challenging. By joining forces, these two companies will enable customers to efficiently oversee both internal and external workers through a unified interface, eliminating the need for HR personnel to switch contexts based on worker types. Moreover, customers will gain the ability to proactively plan for their workforce requirements while effectively addressing compliance and risk factors associated with managing different types of workers.

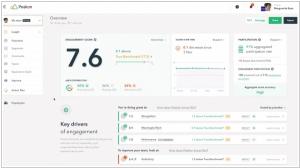

2021. Workday nabs employee feedback platform Peakon for $700M

Workday has announced its acquisition of Peakon, an employee feedback platform, for $700 million. As organizations grow in size and geographic reach, it becomes increasingly difficult for managers to have a comprehensive understanding of their company's dynamics. Peakon addresses this challenge by utilizing weekly surveys to gather targeted feedback on various aspects of the organization. By emphasizing the importance of quality data, Peakon has facilitated the asking of over 153 million questions since its establishment six years ago. This acquisition aligns with Workday's commitment to enhancing its capabilities in employee engagement and feedback analysis.

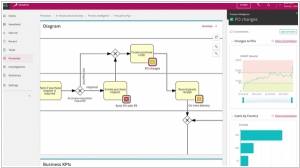

2021. SAP is buying Berlin business process automation startup Signavio

SAP has recently completed its acquisition of Signavio, a business process automation startup, for approximately $1.2 billion. This move reflects SAP's recognition of the value in adopting a more modern and cloud-native approach to address the challenges of enterprise business process automation. The ability to automate business processes through the cloud has gained significant importance, especially during the pandemic when remote work has become prevalent. By incorporating Signavio's cloud-native tool into its portfolio, SAP aims to enhance its capabilities in automating and optimizing business processes. SAP also views Signavio as a valuable addition to its business process intelligence unit, filling a crucial gap in its offerings.

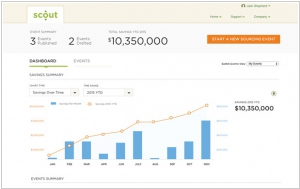

2019. Workday to acquire online procurement platform Scout RFP for $540M

Workday has recently finalized an agreement to acquire Scout RFP, an esteemed online procurement platform, for a significant sum of $540 million. This strategic acquisition serves as a valuable expansion to Workday's existing procurement solutions, namely Workday Procurement and Workday Inventory. Workday is dedicated to becoming a comprehensive, all-encompassing player in the cloud back-office arena, and addressing the gap in procurement has been one of their major priorities. As part of their broader vision for the future of Cloud ERP, Workday strategically invests in portfolio companies that complement their core offerings. In today's definition of ERP, various essential components such as finance, HCM (human capital management), projects, procurement, supply chain, and asset management are included, and Workday is committed to delivering a holistic solution covering these key areas.

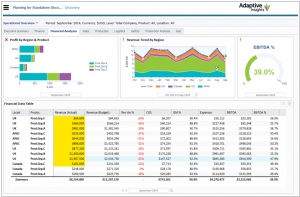

2018. Workday acquired financial modelling startup Adaptive Insights

Cloud-based HRM service Workday is set to acquire Adaptive Insights, a leading provider of cloud-based business planning and financial modeling tools, for a substantial sum of $1.55 billion. This strategic move by Workday aims to position itself as the primary destination for comprehensive back-office services catering to its business clientele. Workday plans to seamlessly integrate Adaptive Insights' robust suite of tools into its existing platform, offering an all-encompassing solution to its customers. With a vast customer base, Adaptive Insights has witnessed remarkable growth, mirroring the rapid expansion of cloud services and the emergence of business intelligence as a dedicated software category. This evolution has resulted in not only CFOs but also a multitude of in-house analysts relying on sophisticated data analytics to facilitate informed decision-making at various levels within organizations.

2018. Workday acquired AI-HR-startup Rallyteam

Workday has recently completed the acquisition of Rallyteam, a startup specializing in assisting companies in retaining skilled employees by matching them with more stimulating internal opportunities. Workday's objective is to assimilate the Rallyteam team into its engineering unit, bolstering its machine learning initiatives and leveraging the extensive expertise the startup has accumulated in connecting employees with engaging internal projects. As a provider of a SaaS platform for human resources and finance, Workday finds the Rallyteam approach highly aligned with its business scope and objectives.

2017. Workday acquired CRM startup Pattern

Financial management and HR software vendor Workday has recently acquired Pattern, a startup based in Redwood City, California. This move positions Workday as a competitor to Salesforce and other similar alternatives. Pattern, a two-year-old company, focused on streamlining customer relationship management for sales professionals. The startup received funding from Felicis Ventures, SoftTech VC, First Round Capital, and several angel investors, with a seed funding round of $2.5 million in the previous year. Workday has a history of strategic acquisitions, including the purchase of big data analytics vendor Platfora and the online learning company Zaption, both in the same year. The specific terms of these acquisitions were not disclosed.

2015. Workday is going to fund machine learning startups

Workday, the provider of finance and human resources SaaS software, has introduced Workday Ventures, a new initiative focused on investing in startups that specialize in machine learning. The program aims to support 10-12 companies this year and has already provided funding to various ventures, including Thinair (a security service), Unbabel (an online translation tool), Metanautix (a company developing tools for analyzing big data), and Jobr (a mobile job search and application tool). Workday is particularly interested in collaborating with early-stage startups that prioritize machine learning. Unlike traditional venture capital firms, Workday's approach to Workday Ventures is strategic rather than purely driven by financial goals.