QuickBooks vs Xero

July 02, 2023 | Author: Michael Stromann

18

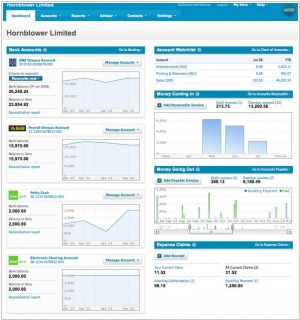

Xero is accounting software for small business. Like alternatives, Xero allows to manage invoicing, reconciliation, accounts payable, bookkeeping and more. Share access to your latest business numbers with your team & your accountant – so everyone is up to speed. Xero accounting software lets you work anywhere.

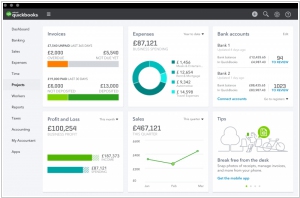

QuickBooks and Xero are two leading cloud-based accounting software solutions, each with its own strengths and features. QuickBooks is a widely used accounting software that offers comprehensive features for small to medium-sized businesses. It provides functionalities such as invoicing, expense tracking, inventory management, payroll processing, and advanced reporting. QuickBooks also offers industry-specific versions to cater to different business types. Xero, on the other hand, is known for its user-friendly interface and ease of use. It provides similar accounting features as QuickBooks, including invoicing, expense tracking, and payroll processing. Xero also offers strong collaboration features, allowing multiple users to access and collaborate on financial data.

See also: Top 10 Online Accounting software

See also: Top 10 Online Accounting software

QuickBooks vs Xero in our news:

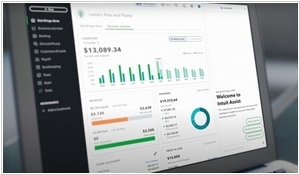

2023. Intuit launches generative AI–powered digital assistant for small businesses and consumers

Intuit, the prominent U.S. financial and accounting software company, has introduced its inaugural customer-centric generative AI-driven solution known as Intuit Assist. Functioning as a digital assistant, it is seamlessly integrated into Intuit's suite of platforms and products, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. With a consistent user interface, Intuit Assist leverages contextual datasets to deliver personalized recommendations to the company's vast customer base of over 100 million small businesses and consumers worldwide. This innovative offering also facilitates human assistance through Intuit's live platform when necessary. The digital assistant was created using GenOS, Intuit's proprietary operating system based on generative AI, which was launched in June to empower developers in incorporating AI across the company's product portfolio.

2020. Intuit acquires inventory management software TradeGecko

Intuit, a US-based business and financial software company, has made a deal to purchase TradeGecko, a Singaporean software-as-a-service company specializing in online inventory and order management software for small businesses. The acquisition, valued at $80 million, aims to combine TradeGecko's inventory and order management capabilities with Intuit's QuickBooks accounting platform. This integration will enable QuickBooks Online customers to effectively launch and oversee products across online and offline sales channels. Additionally, they will be able to handle orders and inventory fulfillment from different channels and multiple inventory locations, as stated in the announcement.

2017. Intuit acquired time-tracker TSheets

Intuit, the company renowned for products like QuickBooks, has recently made a significant acquisition. They have acquired TSheets, a time-tracking service and employee scheduling app with a customer base exceeding 35,000, for a total of $340 million. Given the substantial overlap in their target markets, primarily catering to small and medium-sized businesses, it's evident that QuickBooks and TSheets complement each other. In fact, Intuit reveals that the two companies already share 12,000 customers, indicating an existing synergy. This acquisition is not primarily aimed at acquiring new customers but rather at enhancing the QuickBooks ecosystem. It's worth noting that TSheets already integrates with QuickBooks. Throughout my discussions with Intuit in recent months, it has become apparent that their current product plans revolve around minimizing friction, particularly in relation to QuickBooks, aligning with their commitment to creating seamless experiences for their users.

2017. Xero integrated with spending tracker Curve

Accounting software provider Xero has joined forces with Curve, a fintech startup that enables users to consolidate multiple bank cards into a single card and easily monitor their spending. The objective of this collaboration is to simplify the process of expense filing by reducing unnecessary complexities. Through the integration, users now have the option to connect the Curve app to Xero, allowing expenditures made using the Curve card to be automatically synced with the accounting software, eliminating the need for manual entry of each expense.

2015. Cloud accounting service Xero raises $111M

New Zealand-based online accounting software firm Xero has successfully secured a $110.8 million funding round with the aim of expanding its presence in the North American market. Including this latest investment, Xero has raised a total of over $240 million from various investors. Xero specializes in offering online accounting software tailored for small and medium-sized businesses, as well as accountants. Recognizing that many small businesses still relied on basic accounting systems or even Excel spreadsheets, Xero anticipated the future shift towards cloud-based solutions. By providing a platform that enables small businesses, accountants, and bookkeepers to perform accounting tasks online and through mobile devices, Xero has revolutionized the way they operate.

2015. Xero launched cloud payroll service in US

Cloud accounting startup Xero has unveiled a new product that expands its reach into the back-office realm by offering cloud-based payroll and tax software. Known as Xero Payroll, this solution specifically caters to the needs of over 5 million small businesses in the United States with less than 20 employees. Payroll management can often pose a significant financial burden for these employers, costing between $200 and $500 per month when outsourced to third-party providers. Apart from the outsourcing expenses, there is also the risk of human errors and potential penalties due to incomplete or inaccurate information. Xero Payroll aims to address these challenges by providing small and medium-sized businesses (SMBs) with a cloud-based platform similar to its accounting software. This platform enables seamless employee payment processing and facilitates the electronic filing of state and federal payroll taxes.

2014. Intuit acquired cloud integration service ItDuzzit

Intuit is further expanding its cloud platform for small and medium-sized businesses (SMB) through the acquisition of itDuzzit, a startup offering integration tools for connecting various web and mobile apps within enterprises. This can be likened to the functionality of IFTTT but tailored for business needs. Intuit's intention is to incorporate itDuzzit into its QuickBooks platform, which not only provides accounting services but also offers a growing range of additional services for businesses. itDuzzit competes with similar platforms like Zapier and Cloudwork. The platform currently supports integration with numerous apps, including Asana, Box, Coinbase, Freshbooks, PayPal, and Shopify, with the promise of adding more apps in the future. In essence, this acquisition allows Intuit to provide its customers with a seamless way to utilize these integrated apps on its platform, alongside Intuit software, even if Intuit doesn't have a direct hand in each of those services.

2014. Intuit buys Lettuce for $30M to add inventory and order management to Quickbooks

Intuit has expanded its portfolio by acquiring Lettuce, a platform designed for online order and inventory management, aiming to solidify its position as the leading provider of cloud-based office solutions for small and medium businesses. Unlike typical acquisitions where the purchased product is either shut down or its technology repurposed for a new service, Intuit plans to keep Lettuce functioning as an independent application. Additionally, Intuit intends to enhance the integration of Lettuce into its flagship small and medium business accounting product, Quickbooks, building upon the existing integration to provide a more comprehensive solution.

2013. Xero Launches New Features and Plans for a Payroll Solution

Xero, the cloud-based accounting solution designed for small businesses, has introduced a range of new features. One of the notable additions is Xero Touch, an updated version of its mobile app for Apple's iOS7. With Xero Touch, users can conveniently perform various tasks directly from their smartphones, such as checking bank transactions, creating invoices, and communicating with their accountant. Additionally, Xero has introduced Xero Files, a user-friendly drag and drop application. This feature enables users to easily upload and attach files such as invoices, expense receipts, contracts, and more, making them readily accessible and organized within the system. Furthermore, Xero Purchase Orders now allows businesses to create purchase orders in a similar manner to how they can generate invoices in Xero. The pricing for Xero's services starts at $19 per month for small businesses, which may vary depending on the volume of invoices and payments processed.

2008. Intuit launches QuickBooks Online Edition

Intuit dominates the accounting software industry, with its flagship product QuickBooks enjoying immense popularity among small and medium-sized businesses, boasting over three million users. In response to the increasing demand for web-based and online accessible solutions, Intuit introduced QuickBooks Online Edition (QBOE). Although QBOE has been available for several years, its adoption has been gradual yet steady. QBOE fulfills essential business requirements, offering comprehensive double-entry accounting capabilities that enable accurate balance sheets, profit and loss statements, and trial balances. The home screen serves as the starting point for users, distinguishing QBOE from other online accounting applications that aim to present a "dashboard view" of the business. Instead, QBOE presents a process diagram-style interface, allowing users to navigate through different functional areas of the accounting system. The Basic edition of QBOE provides fundamental features such as accounts receivable, expense tracking, and check printing, albeit with somewhat limited functionality considering its $10 monthly cost. On the other hand, the Plus version enriches the offering with additional features like estimates and invoice customization, time tracking, recurrent billing, budgeting, and online billing.