Freshbooks vs Xero

May 19, 2023 | Author: Michael Stromann

13

FreshBooks is an online invoicing software as a service for freelancers, small businesses, agencies, and professionals. The product includes a myriad of other related features, such as time tracking, expense tracking, recurring billing, online payment collection, the ability to mail invoices through the U.S. Post, and support tickets.

18

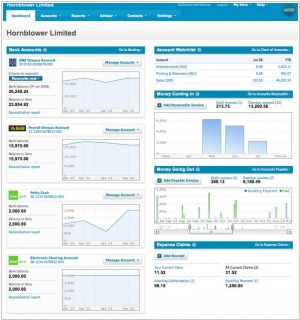

Xero is accounting software for small business. Like alternatives, Xero allows to manage invoicing, reconciliation, accounts payable, bookkeeping and more. Share access to your latest business numbers with your team & your accountant – so everyone is up to speed. Xero accounting software lets you work anywhere.

FreshBooks and Xero are both popular cloud-based accounting software solutions, but they have key differences in their features and approach. FreshBooks is primarily designed for small businesses and freelancers, offering features like invoicing, expense tracking, time tracking, and basic accounting functionalities. It focuses on user-friendly interface and simplicity, making it suitable for those who want a straightforward accounting solution. On the other hand, Xero is a more comprehensive accounting software targeting small to medium-sized businesses. It offers features like invoicing, bank reconciliation, inventory management, payroll, and extensive reporting capabilities. Xero emphasizes flexibility and scalability, providing a robust accounting platform for businesses with more complex financial needs.

See also: Top 10 Online Accounting software

See also: Top 10 Online Accounting software

Freshbooks vs Xero in our news:

2017. Xero integrated with spending tracker Curve

Accounting software provider Xero has joined forces with Curve, a fintech startup that enables users to consolidate multiple bank cards into a single card and easily monitor their spending. The objective of this collaboration is to simplify the process of expense filing by reducing unnecessary complexities. Through the integration, users now have the option to connect the Curve app to Xero, allowing expenditures made using the Curve card to be automatically synced with the accounting software, eliminating the need for manual entry of each expense.

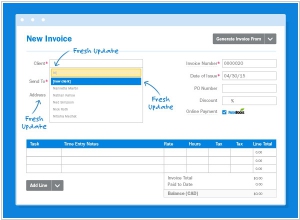

2015. Freshbooks allowed to invoice clients faster

FreshBooks, the online accounting software, has introduced three enhancements to streamline your billing process. The addition of a search box at the top of the list allows you to quickly find specific clients by typing their names, ensuring that only relevant results are displayed. Creating a new client directly from the New Invoice screen is now more convenient as the "New Client" field is prominently positioned at the top of your client list, simplifying the process of adding new clients. Additionally, any updates made to a client's contact information, such as their address or phone number, will be instantly reflected on all unsent invoices for that client. Previously sent invoices will retain the original information by default, but you have the option to manually update them if necessary. This improvement eliminates the need for redundant data entry, which is particularly beneficial for efficiency-minded users.

2015. Cloud accounting service Xero raises $111M

New Zealand-based online accounting software firm Xero has successfully secured a $110.8 million funding round with the aim of expanding its presence in the North American market. Including this latest investment, Xero has raised a total of over $240 million from various investors. Xero specializes in offering online accounting software tailored for small and medium-sized businesses, as well as accountants. Recognizing that many small businesses still relied on basic accounting systems or even Excel spreadsheets, Xero anticipated the future shift towards cloud-based solutions. By providing a platform that enables small businesses, accountants, and bookkeepers to perform accounting tasks online and through mobile devices, Xero has revolutionized the way they operate.

2015. Xero launched cloud payroll service in US

Cloud accounting startup Xero has unveiled a new product that expands its reach into the back-office realm by offering cloud-based payroll and tax software. Known as Xero Payroll, this solution specifically caters to the needs of over 5 million small businesses in the United States with less than 20 employees. Payroll management can often pose a significant financial burden for these employers, costing between $200 and $500 per month when outsourced to third-party providers. Apart from the outsourcing expenses, there is also the risk of human errors and potential penalties due to incomplete or inaccurate information. Xero Payroll aims to address these challenges by providing small and medium-sized businesses (SMBs) with a cloud-based platform similar to its accounting software. This platform enables seamless employee payment processing and facilitates the electronic filing of state and federal payroll taxes.

2013. Xero Launches New Features and Plans for a Payroll Solution

Xero, the cloud-based accounting solution designed for small businesses, has introduced a range of new features. One of the notable additions is Xero Touch, an updated version of its mobile app for Apple's iOS7. With Xero Touch, users can conveniently perform various tasks directly from their smartphones, such as checking bank transactions, creating invoices, and communicating with their accountant. Additionally, Xero has introduced Xero Files, a user-friendly drag and drop application. This feature enables users to easily upload and attach files such as invoices, expense receipts, contracts, and more, making them readily accessible and organized within the system. Furthermore, Xero Purchase Orders now allows businesses to create purchase orders in a similar manner to how they can generate invoices in Xero. The pricing for Xero's services starts at $19 per month for small businesses, which may vary depending on the volume of invoices and payments processed.

2009. FreshBooks comes to Salesforce AppExchange

FreshBooks, the widely used Web-based invoicing software, has made an exciting announcement regarding its integration with Salesforce.com CRM. This collaboration proves to be a perfect match, particularly for sales-related activities. With the introduction of the FreshBooks Connector for Salesforce, enterprises can seamlessly generate invoices for contacts or opportunities directly within their CRM system. The functionality of converting contacts and opportunities in Salesforce.com into invoices appears to be a straightforward process. Moreover, apart from facilitating the transfer of data between platforms, the Connector establishes a dedicated tab within your CRM, allowing you to track activities related to your 20 most recent invoices. While the app offers a 15-day free trial, subsequent usage comes at a cost of $50 per month per organization.

2009. FreshBooks adds collaboration features

FreshBooks, a software-as-a-service (SaaS) invoice application, is introducing a networking capability to its software, enabling direct collaboration between freelancers and small businesses within the program and facilitating the sharing of information. With the new "Contractor" feature, FreshBooks users can now create and collaborate on client projects across different FreshBooks accounts, allowing multiple users to access various accounts simultaneously. Previously, collaboration on projects across the internet was not possible within FreshBooks. Additionally, the Contractor feature offers real-time project tracking, providing businesses with visibility into a contractor's ongoing progress on a project.

2009. FreshBooks - online billing for small business

There are numerous online billing services available on the Web, each offering their own unique blend of usability and relevance to businesses. However, if you're seeking a straightforward solution that simplifies monitoring your billing cycles, FreshBooks is an excellent starting point. FreshBooks streamlines the management of clients, projects, and, most importantly, invoices. This tool facilitates the generation of recurring invoices and automates the billing process for customers. Furthermore, it is relatively cost-effective, with the option to use basic invoicing for free or pay up to $149 per month to grant additional employees access to the account. In addition to the ability to import from and export to QuickBooks and CSV files, FreshBooks seamlessly integrates with popular payment processing solutions like PayPal. Its intuitive design enables swift completion of invoicing tasks. However, the most valuable feature lies in its tracking capabilities. If you currently employ a rudimentary billing system, you may encounter difficulties in remembering when payments were made or received. FreshBooks eliminates this issue by providing a menu pane that displays outstanding and historical payments, allowing you to stay informed about incoming revenue. Moreover, if you have concerns about the appearance of your invoices, you have the freedom to customize them according to your preferences, including the option to incorporate your company logo.

2008. Online Invoicing Service FreshBooks Takes Industry Benchmarks Public

FreshBooks, an online invoicing and business time management service, is introducing quarterly anonymized benchmarks for various industries such as web development, IT, design, and marketing. The purpose is to provide the public with concrete financial statistics specific to each sector, enabling businesses to set and achieve goals. FreshBooks is leveraging data from its extensive clientele to offer these benchmarks, recognizing that understanding one's performance relative to others is crucial in a competitive industry. While too much data can be overwhelming, FreshBooks' generalized approach benefits both contributors and consumers by providing perspective and insights for company managers. With over 500,000 users, FreshBooks has accumulated substantial data over the past year and a half, allowing them to compile valuable information. While there is a sales pitch involved, the provided benchmarks have significant value, attracting a majority of users who appreciate FreshBooks' transparent approach. Overall, this move by FreshBooks is considered a smart and positive decision, offering concise and helpful benchmarks to assist businesses.

2007. Freshen Up Your Invoicing with Basecamp-Freshbooks Integration

FreshBooks, the online invoicing and time tracking tool, has recently announced its integration with Basecamp, providing a fresh and improved invoicing experience for Basecamp users. With this integration, users can now directly invoice their projects through their FreshBooks account, leading to increased productivity. FreshBooks has carefully selected two workflow scenarios that cater to the needs of 80% of users. The first integration allows users to generate invoices based on time entries or To-Do lists. The second integration enables Basecamp projects to seamlessly transition into FreshBooks projects, with Basecamp's To-Dos becoming tasks in FreshBooks. This integration promises to expedite the invoicing process and streamline invoicing tasks for Basecamp users. Setting up the integration through the user-friendly FreshBooks interface appears to be a straightforward process.