FinancialForce vs Xero

June 04, 2023 | Author: Michael Stromann

9

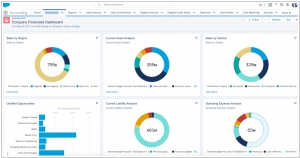

FinancialForce cloud ERP is a comprehensive and innovative financial management system that takes a fresh approach to a traditional business function. This online accounting application combines the power of the Force.com cloud with a groundbreaking accounting system design. FinancialForce Accounting is native to Salesforce CRM.

18

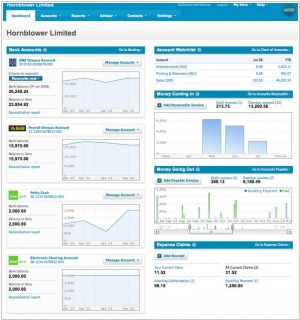

Xero is accounting software for small business. Like alternatives, Xero allows to manage invoicing, reconciliation, accounts payable, bookkeeping and more. Share access to your latest business numbers with your team & your accountant – so everyone is up to speed. Xero accounting software lets you work anywhere.

FinancialForce and Xero are both cloud-based accounting software solutions, but they differ in their target markets, features, and integrations.

FinancialForce is a comprehensive financial management system built on the Salesforce platform. It offers a range of accounting features, including general ledger, accounts payable and receivable, billing, revenue recognition, and financial reporting. FinancialForce is designed for medium to large organizations that utilize Salesforce CRM and seek a tightly integrated financial solution.

Xero, on the other hand, is a user-friendly accounting software primarily aimed at small and medium-sized businesses. It provides features for invoicing, bank reconciliation, expense tracking, inventory management, and financial reporting. Xero offers an intuitive interface, easy accessibility, and a wide range of integrations with third-party applications, making it suitable for businesses that prioritize simplicity and flexibility.

See also: Top 10 Online ERP software

FinancialForce is a comprehensive financial management system built on the Salesforce platform. It offers a range of accounting features, including general ledger, accounts payable and receivable, billing, revenue recognition, and financial reporting. FinancialForce is designed for medium to large organizations that utilize Salesforce CRM and seek a tightly integrated financial solution.

Xero, on the other hand, is a user-friendly accounting software primarily aimed at small and medium-sized businesses. It provides features for invoicing, bank reconciliation, expense tracking, inventory management, and financial reporting. Xero offers an intuitive interface, easy accessibility, and a wide range of integrations with third-party applications, making it suitable for businesses that prioritize simplicity and flexibility.

See also: Top 10 Online ERP software

FinancialForce vs Xero in our news:

2017. Xero integrated with spending tracker Curve

Accounting software provider Xero has joined forces with Curve, a fintech startup that enables users to consolidate multiple bank cards into a single card and easily monitor their spending. The objective of this collaboration is to simplify the process of expense filing by reducing unnecessary complexities. Through the integration, users now have the option to connect the Curve app to Xero, allowing expenditures made using the Curve card to be automatically synced with the accounting software, eliminating the need for manual entry of each expense.

2015. FinancialForce cloud ERP raises $110M to take on SAP and Oracle

FinancialForce, the cloud-based ERP solution built on the Salesforce1 platform, has announced a successful funding round, securing an additional $110 million in investment. As the cloud computing industry continues to mature, we are witnessing a growing trend of back-office functions, such as ERP, transitioning to the cloud and gaining significant traction. Traditionally, this market has been dominated by established players like SAP, Oracle, and Microsoft. However, cloud-based providers like FinancialForce and NetSuite are starting to make their presence felt. FinancialForce, in particular, stands out as an intriguing player in the field. While it positions itself as the logical ERP choice for Salesforce customers, it has also established itself as a strong offering in its own right. Leveraging the capabilities of Force.com, FinancialForce not only integrates seamlessly with Salesforce but also provides a credible and independent ERP solution.

2015. Cloud accounting service Xero raises $111M

New Zealand-based online accounting software firm Xero has successfully secured a $110.8 million funding round with the aim of expanding its presence in the North American market. Including this latest investment, Xero has raised a total of over $240 million from various investors. Xero specializes in offering online accounting software tailored for small and medium-sized businesses, as well as accountants. Recognizing that many small businesses still relied on basic accounting systems or even Excel spreadsheets, Xero anticipated the future shift towards cloud-based solutions. By providing a platform that enables small businesses, accountants, and bookkeepers to perform accounting tasks online and through mobile devices, Xero has revolutionized the way they operate.

2015. Xero launched cloud payroll service in US

Cloud accounting startup Xero has unveiled a new product that expands its reach into the back-office realm by offering cloud-based payroll and tax software. Known as Xero Payroll, this solution specifically caters to the needs of over 5 million small businesses in the United States with less than 20 employees. Payroll management can often pose a significant financial burden for these employers, costing between $200 and $500 per month when outsourced to third-party providers. Apart from the outsourcing expenses, there is also the risk of human errors and potential penalties due to incomplete or inaccurate information. Xero Payroll aims to address these challenges by providing small and medium-sized businesses (SMBs) with a cloud-based platform similar to its accounting software. This platform enables seamless employee payment processing and facilitates the electronic filing of state and federal payroll taxes.

2013. Xero Launches New Features and Plans for a Payroll Solution

Xero, the cloud-based accounting solution designed for small businesses, has introduced a range of new features. One of the notable additions is Xero Touch, an updated version of its mobile app for Apple's iOS7. With Xero Touch, users can conveniently perform various tasks directly from their smartphones, such as checking bank transactions, creating invoices, and communicating with their accountant. Additionally, Xero has introduced Xero Files, a user-friendly drag and drop application. This feature enables users to easily upload and attach files such as invoices, expense receipts, contracts, and more, making them readily accessible and organized within the system. Furthermore, Xero Purchase Orders now allows businesses to create purchase orders in a similar manner to how they can generate invoices in Xero. The pricing for Xero's services starts at $19 per month for small businesses, which may vary depending on the volume of invoices and payments processed.