Carbonite vs Druva

August 11, 2023 | Author: Michael Stromann

17

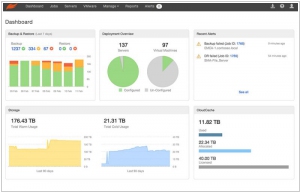

Carbonite is an online backup service, available to Windows and Mac users, that backs up documents, e-mails, music, photos, and settings. Carbonite keeps small businesses and home offices running smoothly. We offer a comprehensive suite of affordable services for data protection, recovery and anytime, anywhere accessibility. From running your small business to running your household, our goal is to provide secure and affordable cloud backup for all your files.

Carbonite and Druva are both cloud-based backup and data protection solutions, but they differ in their focus, features, and target users. Carbonite is a comprehensive backup solution that caters to both individuals and businesses. It offers a range of backup options for servers, endpoints, databases, and virtual machines, providing reliable protection for critical data. Carbonite emphasizes features like continuous data protection, hybrid backup, and disaster recovery capabilities. It also offers flexible storage options and robust security measures to ensure data integrity. On the other hand, Druva is a cloud-native data protection platform that focuses on backup, archival, and governance of data across endpoints, cloud applications, and data centers. Druva's key strengths lie in its comprehensive coverage of cloud-based applications such as Microsoft 365, Google Workspace, and Salesforce, along with its integrated backup and disaster recovery capabilities. Druva also emphasizes advanced features like global deduplication, data governance, and compliance management.

See also: Top 10 Online Backup services

See also: Top 10 Online Backup services

Carbonite vs Druva in our news:

2021. Online Backup service Druva raises $147M

Announcing the closure of a $147 million funding round at a valuation exceeding $2 billion, Druva specializes in offering cloud data backup services. Earlier this month, the official announcement was made regarding the partnership between Dell and Druva, a collaboration that was initially reported in January of this year. The alliance with Dell positions Druva with a substantial customer base to target for future sales opportunities. This strategic move has the potential to significantly bolster the growth of the company, solidifying its position as a prominent player in the industry.

2019. OpenText buys online backup firm Carbonite for $1.42B

Carbonite, a company specializing in data backup, has recently entered into a purchase agreement with OpenText, a prominent enterprise information management firm, for a substantial amount of $1.42 billion. In recent years, Carbonite has transitioned from its traditional data backup focus to becoming a proactive and defensive security company. To strengthen its security offerings and defend against emerging threats such as ransomware, Carbonite made strategic acquisitions. In February, the company acquired endpoint security firm Webroot for $618.5 million in an all-cash transaction. Just a year prior, Carbonite purchased cloud backup service Mozy for $145 million. These acquisitions have contributed to Carbonite's evolution and expansion into the security domain.

2017. Cloud data management startup Druva raised $80M

Druva, a platform that specializes in backup and data protection for around 4,000 business networks, including endpoints, infrastructure, and applications, has secured $80 million in funding. The company aims to strengthen its focus on offering data management and protection solutions for enterprises utilizing public cloud platforms. This puts Druva in direct competition with industry giants like EMC, Commvault, and Veritas, as well as other data management startups like Rubrik. With this latest funding round, Druva's total raised capital approaches $200 million. To put this into perspective, one of its competitors, Rubrik, achieved a valuation of $1.3 billion after raising $180 million earlier this year. Druva was last valued at approximately $637.5 million during its previous funding round in 2016 (raising $51 million). The company reports a remarkable growth rate of over 300% in the past year, boasting prominent customers such as Continental, Emerson, Flex, and Fujitsu.