Apple Pay vs Venmo

June 12, 2023 | Author: Sandeep Sharma

11

Venmo is a service of PayPal that allows to make and share payments. Venmo uses bank-grade security systems and data encryption to protect you and prevent against any unauthorized transactions or access to your personal or financial information. Sending money on Venmo is completely free as long as you use a bank account, supported debit card, or Venmo balance to fund your payments.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Apple Pay and Venmo are both popular digital payment platforms that offer convenient and secure ways to send and receive money. However, there are key differences between the two services.

1. Accessibility: Apple Pay is an integrated payment system that works seamlessly with Apple devices, including iPhones, iPads, Apple Watches, and Macs. It allows users to make purchases in physical stores, online, and within apps using their Apple devices. On the other hand, Venmo is a standalone payment app available for both iOS and Android devices. It provides users with the ability to send and receive money directly from their bank accounts or Venmo balance.

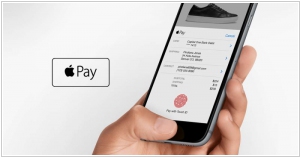

2. Payment Types: Apple Pay primarily focuses on contactless payments and in-app purchases. Users can add their debit or credit cards to their Apple Wallet and use their devices to make secure payments with a simple tap or a facial/Touch ID verification. In contrast, Venmo is designed for person-to-person payments. It allows users to send money to friends, split bills, and make payments for goods and services within the app. Venmo also has a social aspect, allowing users to see and interact with their friends' transactions.

3. Integration: Apple Pay integrates with various merchants, apps, and websites, making it a convenient payment option for a wide range of businesses. Many popular retailers and online platforms accept Apple Pay as a payment method. Venmo, on the other hand, is primarily focused on peer-to-peer payments and is commonly used for informal transactions between friends or acquaintances. While Venmo does offer some integrations with select merchants, its primary use case remains person-to-person payments.

4. Security and Privacy: Both Apple Pay and Venmo prioritize security and provide encryption and tokenization to protect users' payment information. Apple Pay uses secure authentication methods like Face ID, Touch ID, and device-specific unique codes, while Venmo utilizes multi-factor authentication and privacy settings to control the visibility of transactions. It's important to note that Apple Pay offers additional security measures like biometric authentication and secure element technology due to its integration with Apple's hardware ecosystem.

See also: Top 10 Online Payment platforms

1. Accessibility: Apple Pay is an integrated payment system that works seamlessly with Apple devices, including iPhones, iPads, Apple Watches, and Macs. It allows users to make purchases in physical stores, online, and within apps using their Apple devices. On the other hand, Venmo is a standalone payment app available for both iOS and Android devices. It provides users with the ability to send and receive money directly from their bank accounts or Venmo balance.

2. Payment Types: Apple Pay primarily focuses on contactless payments and in-app purchases. Users can add their debit or credit cards to their Apple Wallet and use their devices to make secure payments with a simple tap or a facial/Touch ID verification. In contrast, Venmo is designed for person-to-person payments. It allows users to send money to friends, split bills, and make payments for goods and services within the app. Venmo also has a social aspect, allowing users to see and interact with their friends' transactions.

3. Integration: Apple Pay integrates with various merchants, apps, and websites, making it a convenient payment option for a wide range of businesses. Many popular retailers and online platforms accept Apple Pay as a payment method. Venmo, on the other hand, is primarily focused on peer-to-peer payments and is commonly used for informal transactions between friends or acquaintances. While Venmo does offer some integrations with select merchants, its primary use case remains person-to-person payments.

4. Security and Privacy: Both Apple Pay and Venmo prioritize security and provide encryption and tokenization to protect users' payment information. Apple Pay uses secure authentication methods like Face ID, Touch ID, and device-specific unique codes, while Venmo utilizes multi-factor authentication and privacy settings to control the visibility of transactions. It's important to note that Apple Pay offers additional security measures like biometric authentication and secure element technology due to its integration with Apple's hardware ecosystem.

See also: Top 10 Online Payment platforms

Apple Pay vs Venmo in our news:

2016. Apple takes on PayPal with Apple Pay on the web

Apple has announced that Apple Pay will be introduced to the web in the upcoming fall. This means that Mac users will have the convenience of making online payments in Safari using the "Pay with Apple Pay" button. To authenticate their purchases, users can utilize Touch ID on their iPhone or Apple Watch. Previously, Apple Pay was only available for use in selected iOS apps and physical retail stores. Retail partners will be required to integrate Apple Pay into their checkout process, and Apple has already secured numerous merchants for the payment platform, including Target, Expedia, United Airlines, and more. In addition to this expansion, Apple has revealed plans to launch Apple Pay in Switzerland, France, and Hong Kong during the summer season.

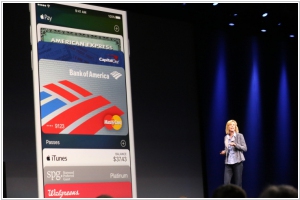

2015. Apple rebrands Passbook to Wallet extends Apple Pay to UK

To align with the updated Apple Pay service, Apple has made the decision to rebrand the Passbook app as Apple Wallet. This name change aims to ensure relevancy and coherence between the two offerings. In addition to the ability to add traditional debit and credit cards, Apple Pay now enables users to include store cards, as well as loyalty and rewards cards, within the Apple Wallet. Retailers such as Kohl's, JC Penney, and BJ's will be among the first to offer compatibility with their own store credit cards through the Apple Pay platform. Moreover, Kohl's, Walgreens, and Dunkin Donuts are introducing rewards cards to the Apple Pay ecosystem. Notably, Apple Pay is expanding its reach to the United Kingdom, where it will soon be compatible with a vast majority of debit and credit cards, covering approximately 70 percent of the country's cards. Additionally, Apple has recently unveiled a partnership with Square, introducing a new card reader specifically designed for small businesses to accept payments via Apple Pay and credit card chip transactions (without support for card swipes).

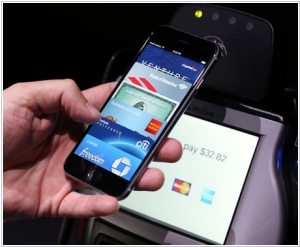

2014. Apple launched own payment system Apple Pay

Apple has introduced a wallet feature called Apple Pay to its iPhones. This functionality allows users of iPhone 6 and iPhone 6 Plus to conveniently make payments at retail checkout terminals by simply tapping their devices. To utilize the wallet service, users must have an iPhone equipped with near field communication (NFC) technology and authenticate their transactions using Apple's Touch ID fingerprint authentication. The process of adding a card to Apple Pay involves either scanning the card or manually inputting the card information. Initially, Apple Pay supports purchases at over 220,000 stores across the United States. Prominent participants in this service include Macy's, Bloomingdales, Walgreens, Duane Reade, Subway, and McDonald's. However, it's important to note that many retailers, including the largest one, Wal-Mart Stores Inc., are not currently part of Apple's network. Only a minority of retailers have the necessary machines capable of reading the near-field communication radio signal required for Apple Pay to function.