Apple Pay vs Samsung Pay

June 04, 2023 | Author: Sandeep Sharma

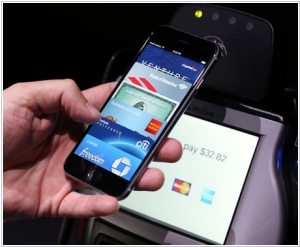

Apple Pay and Samsung Pay are both mobile payment solutions, but they differ in their compatibility, technology, and availability. Apple Pay is a mobile payment service developed by Apple exclusively for Apple devices, including iPhones, iPads, and Apple Watches. It uses near-field communication (NFC) technology to enable contactless payments at compatible payment terminals. Apple Pay is widely accepted by merchants around the world and offers a secure and convenient payment experience. Samsung Pay, on the other hand, is Samsung's mobile payment service available on select Samsung devices, including smartphones and smartwatches. What sets Samsung Pay apart is its additional compatibility with traditional magnetic stripe card readers, thanks to its Magnetic Secure Transmission (MST) technology. This allows users to make payments at almost any payment terminal, regardless of whether it supports NFC. Samsung Pay offers convenience and wider acceptance due to its compatibility with both NFC and magnetic stripe terminals.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

Apple Pay vs Samsung Pay in our news:

2016. Samsung Pay gets in-app payments and Masterpass support

Mobile payment platform Samsung Pay has joined forces with Mastercard to integrate support for Masterpass, a digital wallet solution that securely stores users' payment and shipping information for effortless online transactions. This collaboration enhances the convenience of Samsung Pay by allowing users to retain all their bank cards virtually on their mobile devices and utilize them for contactless payments. The service is set to launch in early 2017, while U.S. Samsung Pay users can anticipate in-app payment support starting in November. By selecting Samsung Pay as their preferred payment method within compatible merchant apps, users can seamlessly complete transactions. Furthermore, the introduction of the Deals feature enables Samsung Pay to automatically identify nearby discounts and coupons available at various retail stores and restaurants, granting users the opportunity to instantly redeem these enticing offers.

2016. Apple takes on PayPal with Apple Pay on the web

Apple has announced that Apple Pay will be introduced to the web in the upcoming fall. This means that Mac users will have the convenience of making online payments in Safari using the "Pay with Apple Pay" button. To authenticate their purchases, users can utilize Touch ID on their iPhone or Apple Watch. Previously, Apple Pay was only available for use in selected iOS apps and physical retail stores. Retail partners will be required to integrate Apple Pay into their checkout process, and Apple has already secured numerous merchants for the payment platform, including Target, Expedia, United Airlines, and more. In addition to this expansion, Apple has revealed plans to launch Apple Pay in Switzerland, France, and Hong Kong during the summer season.

2015. Samsung Pay Launches In The US

Samsung Pay, the payment service developed by the device manufacturer to compete with NFC-based payment systems such as Apple Pay and Android Pay, has now been launched in the United States after its initial release in South Korea. In South Korea, Samsung Pay experienced transaction volumes exceeding $30 million within the first month. This payments platform, built on technology acquired from LoopPay, grants Samsung a potential competitive advantage by not being limited solely to NFC-based payments. Instead, Samsung Pay offers users the flexibility to make payments using their Samsung smartphones through NFC technology, similar to Apple and Google's solutions, or by emulating a magnetic stripe card. This versatility is expected to give Samsung Pay an edge in the short term. Additionally, as payment terminals increasingly support EMV and NFC technology, Samsung Pay will also adapt and continue to function seamlessly with these advancements.

2015. Samsung and MasterCard to launch Samsung Pay together in Europe

Samsung and MasterCard have decided to expand their collaboration by introducing the mobile payment system Samsung Pay in Europe. Powered by LoopPay, a company acquired by Samsung earlier this year as a competitor to Apple Pay, Samsung Pay is set to launch in the United States shortly and has already begun trials in South Korea earlier this month. Smartphones equipped with Samsung Pay will utilize the MasterCard Digital Enablement Service (MDES), the same system employed by iPhone 6 and Apple Watch to enable contactless NFC payments. Notably, one significant distinction between Apple Pay and Samsung Pay is the latter's support for magnetic strip technologies (MST) in existing point-of-sale terminals. This enables retailers to utilize Samsung Pay without upgrading their equipment. Samsung has highlighted that MST compatibility allows it to potentially reach up to 30 million merchants worldwide, subject to the establishment of partnerships with payment providers.

2015. Apple rebrands Passbook to Wallet extends Apple Pay to UK

To align with the updated Apple Pay service, Apple has made the decision to rebrand the Passbook app as Apple Wallet. This name change aims to ensure relevancy and coherence between the two offerings. In addition to the ability to add traditional debit and credit cards, Apple Pay now enables users to include store cards, as well as loyalty and rewards cards, within the Apple Wallet. Retailers such as Kohl's, JC Penney, and BJ's will be among the first to offer compatibility with their own store credit cards through the Apple Pay platform. Moreover, Kohl's, Walgreens, and Dunkin Donuts are introducing rewards cards to the Apple Pay ecosystem. Notably, Apple Pay is expanding its reach to the United Kingdom, where it will soon be compatible with a vast majority of debit and credit cards, covering approximately 70 percent of the country's cards. Additionally, Apple has recently unveiled a partnership with Square, introducing a new card reader specifically designed for small businesses to accept payments via Apple Pay and credit card chip transactions (without support for card swipes).

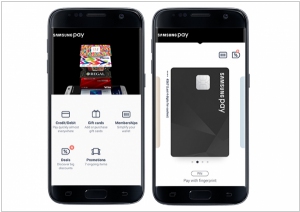

2015. Samsung Pay takes on Apple Pay and Google Wallet

Samsung has made an announcement about the upcoming launch of Samsung Pay, a new mobile payments solution that will be available on the latest Galaxy S6 and S6 edge smartphones during the summer. While Apple and Google were early entrants in the contactless payment market, Samsung Pay addresses significant gaps present in the services offered by Apple Pay and Google Wallet. Samsung Pay utilizes both near-field communications (NFC) and magnetic secure transmission (MST) technology obtained from LoopPay. This unique combination allows Samsung Pay to facilitate secure contactless transactions similar to Apple Pay, while also enabling "swipe" purchases on a majority of older payment terminals that have not adopted NFC technology yet. Samsung has partnered with MasterCard and Visa, along with four major card-issuing banks: JP Morgan Chase, Bank of America, Citi, and US Bank, strengthening its position in the market.

2015. Samsung buys Apple Pay alternative LoopPay

Samsung has completed the acquisition of LoopPay, the mobile payments platform that competes with Apple Pay. LoopPay enables users to conveniently make mobile payments using their smartphones. Unlike Apple Pay, which relies on near-field communications (NFC), LoopPay utilizes magnetic secure transmission (MST), similar to the magnetic strip found on traditional credit cards. Users can securely store their credit card details in LoopPay's app, available on both iOS and Android. However, to process MST payments, customers need to have LoopPay's $59.95 card case or $10 key fob. LoopPay has previously emphasized the superiority and broader acceptance of its platform compared to Apple Pay since it utilizes external hardware instead of requiring merchants to adopt specific technology. Nonetheless, the requirement for additional hardware introduces an extra, potentially cumbersome step during transactions.

2014. Apple launched own payment system Apple Pay

Apple has introduced a wallet feature called Apple Pay to its iPhones. This functionality allows users of iPhone 6 and iPhone 6 Plus to conveniently make payments at retail checkout terminals by simply tapping their devices. To utilize the wallet service, users must have an iPhone equipped with near field communication (NFC) technology and authenticate their transactions using Apple's Touch ID fingerprint authentication. The process of adding a card to Apple Pay involves either scanning the card or manually inputting the card information. Initially, Apple Pay supports purchases at over 220,000 stores across the United States. Prominent participants in this service include Macy's, Bloomingdales, Walgreens, Duane Reade, Subway, and McDonald's. However, it's important to note that many retailers, including the largest one, Wal-Mart Stores Inc., are not currently part of Apple's network. Only a minority of retailers have the necessary machines capable of reading the near-field communication radio signal required for Apple Pay to function.