Amazon Pay vs Google Pay

June 12, 2023 | Author: Sandeep Sharma

7

Millions of Amazon customers can login and pay on your website with their stored account information on Amazon.com. Login and Pay with Amazon can help you add new customers, increase sales and turn casual browsers into buyers. It’s fast, easy and trusted — leverage the Amazon brand to grow your business.

13

With Google Pay, you can simply unlock your phone like you normally do, place it near a merchant’s contactless terminal, and you’re good to go. Google Pay does all the heavy lifting. You don’t even need to open an app—just tap and go. You’ll also see a payment confirmation and get transaction details right on your phone.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Amazon Pay and Google Pay are two popular digital payment solutions that enable users to make online purchases conveniently and securely.

Amazon Pay is a payment service offered by Amazon, allowing customers to use their Amazon account to make payments on external websites and mobile apps. It offers a seamless checkout experience for users who are already familiar with Amazon's interface and payment process. Amazon Pay is widely accepted by merchants across various industries, and it provides features like one-click purchasing, order tracking, and fraud protection.

Google Pay, on the other hand, is a digital wallet and online payment system developed by Google. It allows users to link their credit or debit cards to the Google Pay app and make purchases both online and in physical stores. Google Pay also enables users to send money to friends and family, make peer-to-peer payments, and store loyalty cards. It offers a simple and intuitive user interface and supports a wide range of merchants, making it convenient for users to make payments across different platforms.

See also: Top 10 Online Payment platforms

Amazon Pay is a payment service offered by Amazon, allowing customers to use their Amazon account to make payments on external websites and mobile apps. It offers a seamless checkout experience for users who are already familiar with Amazon's interface and payment process. Amazon Pay is widely accepted by merchants across various industries, and it provides features like one-click purchasing, order tracking, and fraud protection.

Google Pay, on the other hand, is a digital wallet and online payment system developed by Google. It allows users to link their credit or debit cards to the Google Pay app and make purchases both online and in physical stores. Google Pay also enables users to send money to friends and family, make peer-to-peer payments, and store loyalty cards. It offers a simple and intuitive user interface and supports a wide range of merchants, making it convenient for users to make payments across different platforms.

See also: Top 10 Online Payment platforms

Amazon Pay vs Google Pay in our news:

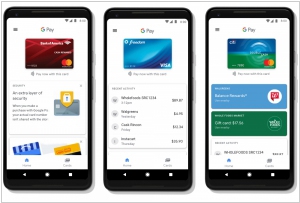

2018. Android Pay becomes Google Pay

Google is consolidating its various payment tools into a unified platform known as Google Pay. The company is introducing the Google Pay app for Android, accompanied by new features aimed at establishing the payment service as widely accessible in both physical stores and online environments. The Google Pay home screen now displays nearby stores where Google Pay is accepted, providing users with relevant payment options. Furthermore, Google is launching a revamped version of the Google Wallet app, now renamed as Google Pay Send, which offers enhanced capabilities for sending and requesting money.

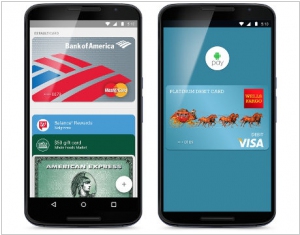

2015. Google launched Android Pay in US

Google has introduced Android Pay, a service that enables users to make payments with a simple tap, whether in applications or physical stores. This new service also incorporates rewards programs for loyal customers. As for the existing Google Wallet service, it will undergo a transformation, serving as a platform for peer-to-peer money transfers, similar to Venmo or Square. Google is striving to catch up with Apple Pay, which made its debut in September 2014. One notable distinction between Google's latest offering and its initial payment product lies in the partnerships that have been forged. American Express, Visa, Mastercard, and Discovery are among the companies supporting Android Pay. Additionally, the system is compatible with over 700,000 stores in the United States that accept "contactless payments," as well as various applications from different companies.

2015. Google Wallet integrates with Shopify and other merchant platforms

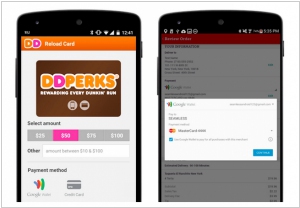

Google Wallet, the mobile payment system, is introducing significant integrations with merchants and merchant platforms. Users of Android apps from Dunkin' Donuts and Seamless, as well as merchants utilizing the Shopify platform to build online stores, can now leverage Google Wallet for seamless payment transactions. In November, Google Wallet also integrated with Papa John's Android app, along with merchant platforms ChowNow and Shopgate. However, the expansion of Google Wallet has been relatively gradual. Prior to this development, only around 30 mobile sites and 30 apps were integrated with the service. Currently, Google Wallet's payment services are available exclusively to users and businesses in the United States. Nevertheless, the company has recently commenced the international extension of another aspect of Wallet—money transfers—to markets beyond the U.S., enabling Gmail users in the UK to access this feature.

2015. Google acquired Softcard to power its Wallet

Following Samsung's acquisition of LoopPay to challenge Apple Pay's dominance in the mobile payments space, Google has also taken a significant step. It has announced the acquisition of technology from the mobile payments app Softcard. Additionally, Google Wallet will soon come pre-installed on Android phones offered by three out of the four largest U.S. carriers later this year. Similar to Google Wallet and Apple Pay, the Softcard app relies on near-field communications (NFC) for its mobile payment functionality. Google Wallet enables users to make purchases at physical retail stores by simply tapping their phones on contactless payment terminals. Despite being introduced prior to Apple Pay, Google's NFC payments system did not achieve the same level of visibility, despite receiving positive reviews.

2014. Amazon launches mobile card reader to compete with PayPal and Square

Amazon has made its entry into the mobile payments market with the introduction of Local Register, a card reader and mobile app designed for small businesses. This new offering directly competes with established players such as Square and PayPal in the rapidly expanding payment transactions market. To get started with Local Register, users are required to register, purchase a $10 card reader, and download the free app, which is accessible through Amazon, Apple, or Google platforms. Upon registration, users will receive a reimbursement of the first $10 in transaction fees, effectively covering the initial reader cost. Amazon is currently launching the product with a limited-time offer to incentivize businesses to join. Companies that sign up before October 31 will be charged a swipe fee of 1.75% until January 1, 2016, which is lower than the 2.75% charged by Square and the 2.7% charged by PayPal's card reader program. Amazon's standard rate for Local Register transactions will be set at 2.5%.

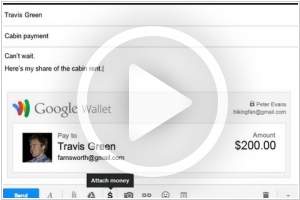

2013. Google integrates Wallet into GMail

Google Wallet was introduced a few years ago as an innovative offline payment service for smartphone users in physical stores. However, this approach did not gain significant traction, even in the United States, due to the limited availability of NFC-enabled smartphones among users and the scarcity of NFC-compatible terminals in stores. Nonetheless, Google decided to retain the promising name by integrating Google Wallet with its online payment service, Google Checkout. As a result, Google Checkout will be phased out, and Google Wallet will become the sole payment service offered by Google. It may come as a surprise, but if you have ever made a purchase on the Play Market, whether it's an app or a book, you already have a Google Wallet account. In the near future, you will likely have the ability to send and receive money to/from other Google Wallet users, similar to PayPal. This can be accomplished simply by sending an email from your Gmail account and attaching the desired amount (as demonstrated in the video). Initially, this feature will be available exclusively in the United States.

2011. Google Wallet: How it works

Today, Google has launched a new service - Google Wallet, which allows to pay for goods in stores with the help of a smartphone. Of course, it's more the future than the present technology even in US. But it's interesting to see how we'll pay in the future. For a user Google Wallet is a mobile application that is installed on a smartphone. In this application you enter your bank card details (or get a card directly from Google) and add your loyalty cards. Then, with your smartphone you go to the store and when approaching the point of sale, launch the Google Wallet application, enter your PIN-code, select a card, tap the terminal with your smartphone, and ... your money fly to the retailer. ***