Amazon Pay vs Apple Pay

June 04, 2023 | Author: Sandeep Sharma

7

Millions of Amazon customers can login and pay on your website with their stored account information on Amazon.com. Login and Pay with Amazon can help you add new customers, increase sales and turn casual browsers into buyers. It’s fast, easy and trusted — leverage the Amazon brand to grow your business.

Amazon Pay and Apple Pay are both digital payment solutions, but they differ in their ecosystem, device compatibility, and user experience. Amazon Pay is a payment service provided by Amazon that allows customers to use their Amazon account to make purchases on third-party websites or apps. It offers a seamless checkout experience, leveraging the trust and convenience of customers' existing Amazon credentials. Amazon Pay can be used on various devices and platforms, making it widely accessible. On the other hand, Apple Pay is a mobile payment and digital wallet service developed by Apple. It is specifically designed for Apple devices, including iPhones, iPads, and Apple Watches, and utilizes near-field communication (NFC) technology for contactless payments. Apple Pay offers a secure and effortless way to make purchases both in-store and online using compatible Apple devices.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

Amazon Pay vs Apple Pay in our news:

2016. Apple takes on PayPal with Apple Pay on the web

Apple has announced that Apple Pay will be introduced to the web in the upcoming fall. This means that Mac users will have the convenience of making online payments in Safari using the "Pay with Apple Pay" button. To authenticate their purchases, users can utilize Touch ID on their iPhone or Apple Watch. Previously, Apple Pay was only available for use in selected iOS apps and physical retail stores. Retail partners will be required to integrate Apple Pay into their checkout process, and Apple has already secured numerous merchants for the payment platform, including Target, Expedia, United Airlines, and more. In addition to this expansion, Apple has revealed plans to launch Apple Pay in Switzerland, France, and Hong Kong during the summer season.

2015. Apple rebrands Passbook to Wallet extends Apple Pay to UK

To align with the updated Apple Pay service, Apple has made the decision to rebrand the Passbook app as Apple Wallet. This name change aims to ensure relevancy and coherence between the two offerings. In addition to the ability to add traditional debit and credit cards, Apple Pay now enables users to include store cards, as well as loyalty and rewards cards, within the Apple Wallet. Retailers such as Kohl's, JC Penney, and BJ's will be among the first to offer compatibility with their own store credit cards through the Apple Pay platform. Moreover, Kohl's, Walgreens, and Dunkin Donuts are introducing rewards cards to the Apple Pay ecosystem. Notably, Apple Pay is expanding its reach to the United Kingdom, where it will soon be compatible with a vast majority of debit and credit cards, covering approximately 70 percent of the country's cards. Additionally, Apple has recently unveiled a partnership with Square, introducing a new card reader specifically designed for small businesses to accept payments via Apple Pay and credit card chip transactions (without support for card swipes).

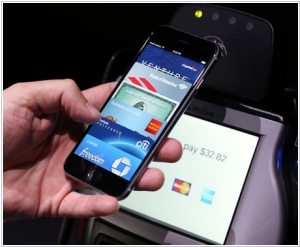

2014. Apple launched own payment system Apple Pay

Apple has introduced a wallet feature called Apple Pay to its iPhones. This functionality allows users of iPhone 6 and iPhone 6 Plus to conveniently make payments at retail checkout terminals by simply tapping their devices. To utilize the wallet service, users must have an iPhone equipped with near field communication (NFC) technology and authenticate their transactions using Apple's Touch ID fingerprint authentication. The process of adding a card to Apple Pay involves either scanning the card or manually inputting the card information. Initially, Apple Pay supports purchases at over 220,000 stores across the United States. Prominent participants in this service include Macy's, Bloomingdales, Walgreens, Duane Reade, Subway, and McDonald's. However, it's important to note that many retailers, including the largest one, Wal-Mart Stores Inc., are not currently part of Apple's network. Only a minority of retailers have the necessary machines capable of reading the near-field communication radio signal required for Apple Pay to function.

2014. Amazon launches mobile card reader to compete with PayPal and Square

Amazon has made its entry into the mobile payments market with the introduction of Local Register, a card reader and mobile app designed for small businesses. This new offering directly competes with established players such as Square and PayPal in the rapidly expanding payment transactions market. To get started with Local Register, users are required to register, purchase a $10 card reader, and download the free app, which is accessible through Amazon, Apple, or Google platforms. Upon registration, users will receive a reimbursement of the first $10 in transaction fees, effectively covering the initial reader cost. Amazon is currently launching the product with a limited-time offer to incentivize businesses to join. Companies that sign up before October 31 will be charged a swipe fee of 1.75% until January 1, 2016, which is lower than the 2.75% charged by Square and the 2.7% charged by PayPal's card reader program. Amazon's standard rate for Local Register transactions will be set at 2.5%.