Adyen vs Checkout.com

May 26, 2023 | Author: Sandeep Sharma

Adyen and Checkout.com are both prominent payment processing platforms, but they have distinct differences in their features, global reach, and target markets.

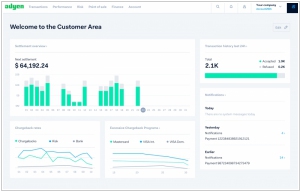

Adyen is a comprehensive payment solution that offers a wide range of features including global payment processing, fraud detection, risk management, and omnichannel capabilities. It provides a unified platform for accepting payments online, in-store, and on mobile devices. Adyen's strength lies in its global reach, supporting a vast array of payment methods and currencies, making it ideal for businesses with international operations.

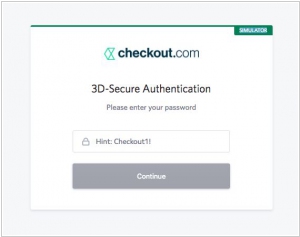

Checkout.com, on the other hand, is a flexible and scalable payment processing platform that focuses on delivering a seamless payment experience. It offers a robust API-driven solution that allows businesses to accept payments across various channels and optimize the checkout process. Checkout.com places emphasis on providing advanced fraud prevention measures, real-time data analytics, and customizable payment flows to meet specific business needs.

The key differences between Adyen and Checkout.com lie in their scope, global reach, and specialization. Adyen is renowned for its extensive global coverage and comprehensive payment capabilities, making it suitable for businesses with a worldwide presence. Checkout.com excels in delivering a streamlined and customizable payment experience, prioritizing fraud prevention and real-time analytics.

See also: Top 10 Payment Processing platforms

Adyen is a comprehensive payment solution that offers a wide range of features including global payment processing, fraud detection, risk management, and omnichannel capabilities. It provides a unified platform for accepting payments online, in-store, and on mobile devices. Adyen's strength lies in its global reach, supporting a vast array of payment methods and currencies, making it ideal for businesses with international operations.

Checkout.com, on the other hand, is a flexible and scalable payment processing platform that focuses on delivering a seamless payment experience. It offers a robust API-driven solution that allows businesses to accept payments across various channels and optimize the checkout process. Checkout.com places emphasis on providing advanced fraud prevention measures, real-time data analytics, and customizable payment flows to meet specific business needs.

The key differences between Adyen and Checkout.com lie in their scope, global reach, and specialization. Adyen is renowned for its extensive global coverage and comprehensive payment capabilities, making it suitable for businesses with a worldwide presence. Checkout.com excels in delivering a streamlined and customizable payment experience, prioritizing fraud prevention and real-time analytics.

See also: Top 10 Payment Processing platforms

Adyen vs Checkout.com in our news:

2021. Checkout.com raises $450 million and reaches $15 billion valuation

Payments company Checkout.com has successfully concluded a Series C funding round, raising $450 million. The company aims to establish an all-in-one solution for payment-related services, encompassing transaction acceptance, processing, and fraud detection. Its primary focus is on serving large merchants, offering a highly customizable product that can be seamlessly integrated as an infrastructure partner within their own offerings.