2Checkout vs WePay

May 26, 2023 | Author: Sandeep Sharma

10

Accept Credit Cards, PayPal, and Debit Cards. With our international payment processing features, you have the opportunity to sell globally and reach a truly international audience. We give your customers the option to select from any of 15 languages and 26 currencies through the checkout process giving them a familiar and comfortable experience.

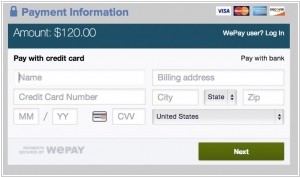

2Checkout and WePay are both payment platforms, but they differ in their target audience, features, and integration capabilities. 2Checkout, also known as 2Checkout Avangate, is a global payment gateway that focuses on providing e-commerce solutions for digital products and software. It offers features such as recurring billing, global payment acceptance, and advanced fraud prevention. 2Checkout is designed for businesses that sell software, digital goods, or online services. On the other hand, WePay is a payment platform that caters to small businesses and organizations. It offers a simplified onboarding process, intuitive user interface, and built-in risk and compliance features. WePay aims to provide a user-friendly experience and streamline the payment setup process, making it suitable for non-technical users.

See also: Top 10 Payment Processing platforms

See also: Top 10 Payment Processing platforms

2Checkout vs WePay in our news:

2014. WePay launches payment processing API to compete with Stripe

WePay, a payment processing service catering to marketplaces, crowdfunding platforms, and other online transaction facilitators, is entering the competition against Stripe by introducing a new product. Called WePay Clear, this white-label, API-based service operates similarly to Stripe and also offers a fraud protection guarantee. WePay Clear is available on both desktop web and mobile apps, and it has already been launched in the United States with Freshbooks as its initial partner. The pricing structure for WePay Clear follows a flat rate, matching that of Stripe at 2.9% + $0.30 per transaction. However, WePay may adjust these rates on a case-by-case basis depending on the partnership arrangement.