2Checkout vs Braintree

May 26, 2023 | Author: Sandeep Sharma

10

Accept Credit Cards, PayPal, and Debit Cards. With our international payment processing features, you have the opportunity to sell globally and reach a truly international audience. We give your customers the option to select from any of 15 languages and 26 currencies through the checkout process giving them a familiar and comfortable experience.

2Checkout and Braintree are two popular payment gateway providers, each with its own set of features and advantages.

2Checkout is a comprehensive payment platform that offers a range of payment solutions suitable for businesses of all sizes. It provides support for online payments, subscription billing, global payment methods, and multi-currency transactions. 2Checkout emphasizes a user-friendly experience with features like customized checkout, fraud prevention, and recurring billing. It offers flexible pricing options, including transaction-based and subscription-based models, making it suitable for businesses with varying transaction volumes.

Braintree, on the other hand, is a developer-focused payment gateway that provides robust tools and APIs for businesses to build and customize their payment experiences. It offers seamless integration with e-commerce platforms and supports various payment methods, including credit cards, digital wallets, and local payment options. Braintree is known for its developer-friendly approach, advanced security measures, and comprehensive documentation.

The key differences between 2Checkout and Braintree lie in their target market and approach to integration. 2Checkout caters to businesses of all sizes and offers a comprehensive solution with a user-friendly interface. Braintree, with its developer-centric focus, appeals to businesses that require customization and control over the payment process.

See also: Top 10 Payment Processing platforms

2Checkout is a comprehensive payment platform that offers a range of payment solutions suitable for businesses of all sizes. It provides support for online payments, subscription billing, global payment methods, and multi-currency transactions. 2Checkout emphasizes a user-friendly experience with features like customized checkout, fraud prevention, and recurring billing. It offers flexible pricing options, including transaction-based and subscription-based models, making it suitable for businesses with varying transaction volumes.

Braintree, on the other hand, is a developer-focused payment gateway that provides robust tools and APIs for businesses to build and customize their payment experiences. It offers seamless integration with e-commerce platforms and supports various payment methods, including credit cards, digital wallets, and local payment options. Braintree is known for its developer-friendly approach, advanced security measures, and comprehensive documentation.

The key differences between 2Checkout and Braintree lie in their target market and approach to integration. 2Checkout caters to businesses of all sizes and offers a comprehensive solution with a user-friendly interface. Braintree, with its developer-centric focus, appeals to businesses that require customization and control over the payment process.

See also: Top 10 Payment Processing platforms

2Checkout vs Braintree in our news:

2018. Braintree launches Stripe competitor - Extend

PayPal's payment services division, Braintree, is taking steps to enhance its competitive position in the market, particularly against rivals like Stripe. To achieve this, Braintree is introducing a new solution called Extend, which offers a range of tools for seamless integration of Braintree payments with other services commonly utilized by online businesses beyond basic transactions. Extend encompasses features such as loyalty and reward program integration, advanced fraud prevention measures, and support for "contextual commerce," enabling merchants to sell and accept payments on platforms other than their own. Some of these services, including contextual commerce, were already available, powering features like Pinterest's buyable pins. With Extend, Braintree aims to streamline and expand its payment offerings, catering to the evolving needs of online companies.

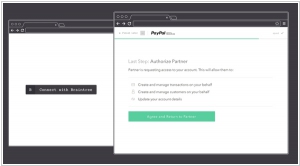

2016. Braintree launches Auth to bring its payments platform to more merchants

PayPal-owned payments platform, Braintree, has introduced Braintree Auth, a system designed to simplify the process of enabling payments on e-commerce platforms. This launch enables e-commerce platform owners, shopping cart providers, and recurring billing services to facilitate credit card, debit card, and PayPal payments on their merchants' online storefronts. Through a unified interface for shoppers, Braintree Auth grants access to customer and transaction data on behalf of the merchants. This strategic move by Braintree demonstrates its efforts to expand its presence in the SMB market, particularly in the face of increasing competition from startups like Stripe.

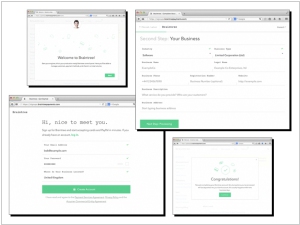

2014. Braintree enables super easy sign-up for merchants (including Europe)

PayPal's payment processing service Braintree is introducing a new service that simplifies the merchant sign-up process. Now, merchants can join the platform by providing just their email address, URL, and a brief company description. Additionally, Braintree is extending its offering to Europe, allowing merchants to conduct the first $50,000 worth of transactions (in the local currency equivalent) without incurring any commission fees. This streamlined approach contrasts with the traditional method of setting up payment systems, particularly in Europe, where banks often require physical documentation for account approval. Instead, Braintree employs a combination of algorithms and human intelligence to assess the legitimacy of a company based on the provided information. This innovative approach enables Braintree to efficiently evaluate and onboard legitimate merchants onto its platform.