Amazon Web Services is #1 in Top 10 Public Cloud Platforms

Access a reliable, on-demand infrastructure to power your applications, from hosted internal applications to SaaS offerings. Scale to meet your application demands, whether one server or a large cluster. Leverage scalable database solutions. Utilize cost-effective solutions for storing and retrieving any amount of data, any time, anywhere.

Positions in ratings

#1 in Top 10 Public Cloud Platforms

#1 in Top 10 AI Platforms

Alternatives

The best alternatives to Amazon Web Services are: Google Cloud Platform, Microsoft Azure, Alibaba Cloud

Latest news about Amazon Web Services

2020. AWS launches Amazon AppFlow, its new SaaS integration service

AWS has recently launched Amazon AppFlow, an integration service designed to simplify data transfer between AWS and popular SaaS applications such as Google Analytics, Marketo, Salesforce, ServiceNow, Slack, Snowflake, and Zendesk. Similar to competing services like Microsoft Azure's Power Automate, developers can configure AppFlow to trigger data transfers based on specific events, predetermined schedules, or on-demand requests. Unlike some competitors, AWS positions AppFlow primarily as a data transfer service rather than an automation workflow tool. While the data flow can be bidirectional, AWS's emphasis is on moving data from SaaS applications to other AWS services for further analysis. To facilitate this, AppFlow includes various tools for data transformation as it passes through the service.

2019. AWS launches fully-managed backup service for business

Amazon's cloud platform, AWS, has introduced a new service called Backup, allowing companies to securely back up their data from various AWS services as well as their on-premises applications. For on-premises data backup, businesses can utilize the AWS Storage Gateway. This service enables users to define backup policies and retention periods according to their specific requirements. It includes options such as transferring backups to cold storage for EFS data or deleting them entirely after a specified duration. By default, the data is stored in Amazon S3 buckets. While most of the supported services already offer snapshot creation capabilities (except for EFS file systems), Backup automates this process and adds customizable rules to enhance data protection. Notably, the pricing for Backup aligns with the costs associated with using the snapshot features (except for file system backup, which incurs a per-GB charge).

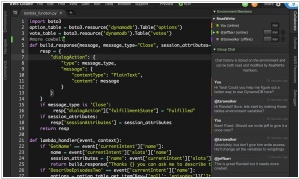

2017. AWS launched browser-based IDE for cloud developers

Amazon Web Services has introduced a new browser-based Integrated Development Environment (IDE) called AWS Cloud9. While it shares similarities with other IDEs and editors like Sublime Text, AWS emphasizes its collaborative editing capabilities and deep integration into the AWS ecosystem. The IDE includes built-in support for various programming languages such as JavaScript, Python, PHP, and more. Cloud9 also provides pre-installed debugging tools. AWS positions this as the first "cloud native" IDE, although competitors may contest this claim. Regardless, Cloud9 offers seamless integration with AWS, enabling developers to create cloud environments and launch new instances directly from the tool.

2017. AWS introduced per-second billing for EC2 instances

In recent years, several alternative cloud platforms have shifted towards more flexible billing models, primarily adopting per-minute billing. However, AWS is taking it a step further by introducing per-second billing for its Linux-based EC2 instances. This new billing model applies to on-demand, reserved, and spot instances, as well as provisioned storage for EBS volumes. Furthermore, both Amazon EMR and AWS Batch are transitioning to this per-second billing structure. It is important to note that there is a minimum charge of one minute per instance, and this change does not affect Windows machines or certain Linux distributions that have their own separate hourly charges.

2017. AWS offers a virtual machine with over 4TB of memory

Amazon's AWS has introduced its largest EC2 machine yet, the x1e.32xlarge instance, boasting an impressive 4.19TB of RAM. This represents a significant upgrade from the previous largest EC2 instance, which offered just over 2TB of memory. These machines are equipped with quad-socket Intel Xeon processors operating at 2.3 GHz, up to 25 Gbps of network bandwidth, and two 1,920GB SSDs. It is evident that only a select few applications require this level of memory capacity. Consequently, these instances have obtained certification for running SAP's HANA in-memory database and its associated tools, with SAP offering direct support for deploying these applications on these instances. It's worth mentioning that Microsoft Azure's largest memory-optimized machine currently reaches just over 2TB of RAM, while Google's maximum memory capacity caps at 416GB.

2014. AWS now supports Docker containers

Amazon has announced the preview availability of EC2 Container Services, a new service dedicated to managing Docker containers and enhancing the support for hybrid cloud in Amazon Web Services. This offering brings forth a range of benefits, including streamlined development management, seamless portability across different environments, reduced deployment risks, smoother maintenance and management of application components, and comprehensive interoperability. It is important to note that AWS is not the first cloud provider to provide support for Docker's open-source engine. Google has recently expanded its support for Docker containers through the introduction of its Google Container Engine, which is powered by its own Kubernetes and was announced just last week during the Google Cloud Platform Live event. Furthermore, Microsoft had previously announced its support for Kubernetes in managing Docker containers in Azure back in August.

2014. Amazon and Microsoft drop cloud prices

Cloud computing is witnessing a continuous decline in costs. Therefore, if you previously assessed the cost-effectiveness of migrating your IT infrastructure to the cloud and determined it to be expensive, it is worth recalculating now. Cloud platforms have significantly reduced their prices, and another round of reductions is currently underway. Starting tomorrow, the pricing for Amazon S3 cloud storage will decrease by 6-22% (depending on the amount of space used), while the cost of cloud server hard drives (Amazon EBS) will drop by 50%. Additionally, Microsoft's cloud platform, Windows Azure, will lower its prices by 20% a month later to ensure they remain slightly below Amazon's. Given these developments, it's worth reconsidering the need to invest in an in-house server when the cost of cloud services is approaching zero.

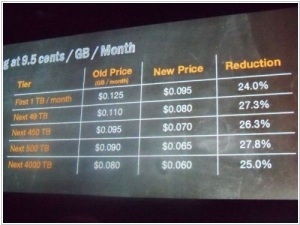

2012. Google and Amazon reduce cloud storage prices. Launch new cloud services

Competition - is good for customers. On Monday, Google reduced prices for its Google Cloud Storage by over 20%, and today, in response, Amazon has reduced prices for its S3 storage by 25%. Obviously, in the near future, Microsoft will also reduce prices for Windows Azure, to bring them to the competitive level - about $0.09/month per GB. The same story occured in March when Amazon lowered prices, and then Microsoft and Google aligned their pricing with Amazon. Because on the cloud platforms market the price is no longer a competitive advantage, but your pricing is higher than the competition - is't a big disadvantage. Some experts already doubt that Amazon and the contenders are earning something on selling gigabytes and gigahertzs. Like in case with the mobile market, the main task of cloud vendors - is to hook up large companies and SaaS-providers to their platforms, even if they should sell computing resources at a loss. ***

2012. Amazon Glacier: Cloud storage service using Humanoid robots

When observing the new service Amazon Glacier, the notion of humanoid robots might naturally come to mind, although it remains just an assumption. This service caters to the long-term storage requirements of archives and backups that businesses may seldom or perhaps never use, but still need to maintain due to specific regulations or corporate guidelines. The key highlight is the remarkably affordable cost of storing data in Amazon Glacier, priced at just 1 cent per month for 1 GB, which is ten times less than Amazon S3. However, accessing files from Glacier necessitates an initial ordering process, followed by a wait time of 3-5 hours before the files become available. During this duration, one might imagine a robotic scenario wherein the hard drive is located in the data center and transported to the control panel. Furthermore, Amazon Glacier customers are limited to downloading only 5% of their data per month, with a charge of $0.12 per GB for data transfers surpassing 1 GB per month.

2012. OpenStack launches. CloudStack departs. Amazon adapts SAP. Azure rebrands

Here is the news digest from the leading cloud platforms. First of all, the open-source platform OpenStack (aka Linux for the clouds) which had been developed for two years by the alliance of IT giants (Rackspace, NASA, Citrix, Intel, AMD, Cisco, Dell, HP, IBM ...) - finally comes to production. Since May 1, it was adapted by RackSpace for its service Rackspace Cloud Files and last week HP launched the public beta of its HP Cloud platform, based on OpenStack. However, a week before the launch the trouble (common for open-source projects) occurred with OpenStack. Citrix, which has been one of the first participants in OpenStack, suddenly decided to grant its own cloud platform - CloudStack - to Apache Software Foundation. Thus, CloudStack not flowed into OpenStack but became a rival project. Citrix explained this decision by the slow OpenStack development and unwillingness of other parties to integrate with Amazon Web Services APIs. ***

2012. AWS Marketplace - cloud app market for Amazon's platform

Better than anybody in the world Amazon can build online stores, so the launch of the cloud app store for Amazon Web Services platform - is very logical move. The question may be only one: what's the point of creating software store for AWS, if AWS can host almost any software in the world? The fact is that AWS Marketplace sells not software but software images, specially created for the AWS (so-called AMI = Amazon Machine Images). Each image in addition to the software contains everything it needs to run (operating system, middleware). And you can install such AMI on Amazon's server with just one click. You do not need to configure the software - everything works out-of-the-box. Thus, developers and IT administrators need less and less brains to start using Amazon's cloud platform. You just need to create an account, go to the app store, add to cart needed software (from the operating system to CRM system) and that's all. ***

2012. Amazon made an atempt to beat Google in the Enterprise Search

Enterprise search engines (which are used mostly by large companies with large data stores) - have always been the prerogative of the large software vendors: SAP, Oracle, IBM, Open Text. Then, of course, the search giant Google came to party and became market leader. But now Google and company will face a new competitor. Amazon is launching a new service on its cloud platform - CloudSearch. At first glance, it seems that Google has nothing to fear. Even though Amazon developers have some experience in search technologies (they somehow developed a search engine for the online store and even launched the own search engine A9). But how can they compete with Google? The problem is that existing enterprise search engines, including Google Enterprise Search, are designed for work in local networks, on local servers. And as corporate data moves to the cloud, they become useless. ***

2012. So Amazon is #1. And who’s next in cloud computing?

GigaOm has published the list of top 7 cloud providers besides Amazon. Why besides Amazon? Because Amazon Web Services for now is far ahead of competitors. AWS is an absolute cloud market leader in all reports of all analytical firms. According to various estimates, AWS runs on 450,000 servers and generates about $1 billion in revenue per year. And who's next? Here are the top 7 the cloud providers by GigaOM: ***

2012. Amazon - gets closer to Windows, OpenStack - closer to Linux

The situation on the cloud (IaaS) platform market more and more reminds us the history of the desktop operating systems (Windows and Linux). On the one hand - open and standard-based platform OpenStack. It's standards this week were supported by two more giants - IBM and Ericsson, that joined the OpenStack alliance. Before them the alliance included Rackspace, Citrix, Intel, AMD, Cisco, Dell, HP. On the other hand - proprietary but already very popular platform Amazon Web Services (AWS). AWS gained it's popularity as a simple and open platform which allows to restore Linux or Windows server and scale it depending on the load. It was relatively easy to move applications of AWS. But as Amazon adds new features to AWS, it lockes clients and partners more and more in its golden cage. ***

2011. Amazon enters PaaS market. Takes on Google, Microsoft and Salesforce

As known, Amazon Web Services - is the leader of IaaS market. It's the service that allows you to rent computing resources for enterprise software or SaaS service hosting. And using it you reserve the required number of servers, configure operating system, install and configure middleware, enable/disable servers depending on the load. This is called IaaS (Infrastructure as a Service). But honestly, IaaS - it's not perfect. In most cases, companies and SaaS providers would not want to handle these servers and other infrastructure themselves. All they want - is that their application worked properly on any load. And they don't care what is under the hood of the cloud platform. This is the primary idea of competing technology - PaaS (Platform as a Service). And it is logical that PaaS platforms are gradually displacing IaaS. ***

2010. Amazon Web Services: Free version for startups

Amazon is intensifying its efforts to attract startups to its cloud platform. Recently, the company introduced a cost-effective service called Amazon Micro Instances, which offers even greater affordability compared to traditional VPS hosting. Moreover, Amazon has just announced that starting from November 1, this service will be free for new customers during their first year. This one-year period provides startups with ample time to determine the viability of their projects and decide whether it is worth investing money into them or abandoning them. Throughout this year, startups will receive a complimentary Linux server with one processor and 613 MB of RAM, along with 10 GB of disk space (Amazon EBS) and 5 GB of online storage (Amazon S3). The complete list of free resources can be found here. It is worth noting that Google App Engine also offers free cloud hosting for startups; however, it imposes significant restrictions on the available programming languages.

2010. Amazon EC2 makes Cloud Computing affordable for all. Takes on Rackspace

Until now, the minimum virtual server (instance) on Amazon EC2 with configuration 1.7 GB RAM / 160 GB - cost 8.5 cents per hour (approximately $61 per month). This amount seemed quite large for most small businesses using web-apps and SaaS startups and kept them from switching from a traditional hosting (or own servers) to the cloud technologies. Some people used Rackspace, which provides the less powerful instances - from 11$ / month for the configuration 256 MB / 10 GB. But today even the most budget conscious small businesses and SaaS startups got the good reason to join the Cloud Computing era, and Rackspace got a new headache - Amazon Micro Instances. ***

2010. Amazon moves own IT-infrastructure to the cloud

It sounds strange, but the IT director of Amazon (the leading cloud platfrom provider) Jennifer Boden is not a fan of cloud computing, like her boss, Jeff Bezos. She looks at the cloud carefully and rationally. That is why, the Amazon's IT infrastructure is still moved to AWS only partially. Moreover, the company did not move in this direction until last year when Amazon VPC (Virtual Private Cloud), which allows to separate an enterprise cloud from the public cloud, appeared. Nevertheless, the process is started, and now Jennifer is speaking at the IT event with the presentation (see above) about how Amazon moves to Cloud Computing. Note that it this concerns not the Amazon's online store but the in-house enterprise apps, like email, financial software, IT management, HRM, etc. ***

2009. Amazon launched MySQL as a Service

Same as last year, right before the Microsoft developer conference PDC (where the company announces the new platform features), Amazon begins to act in order to capture developers' attention. Last year Microsoft showed Windows Azure, and Amazon at the same time unveiled unveiled Windows based EC2 instances. This year Microsoft is going to present the new cloud relational database Azure SQL, and here is Amazon's answer - Amazon RDS (Relational Database as a Service), the new service that provides ready-to-deploy scalable relational database MySQL. ***

2009. Amazon announced Virtual Private Cloud

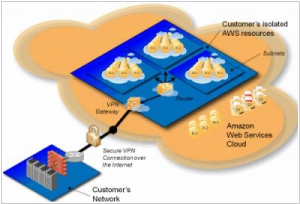

Amazon has introduced a new service called Amazon Virtual Private Cloud, which enables IT departments to establish a connection between a set of isolated AWS resources and their data center using a VPN connection. This innovative solution integrates traditional IT infrastructure with Amazon's EC2 cloud service, forming a hybrid cloud that offers both security and the benefits of cost-effectiveness and scalability. By offering this hybrid approach, Amazon aims to address the growing interest in private clouds while providing an endorsement for their own hybrid cloud strategy. It's important to note that VPC is currently in limited beta and does not yet support the S3 cloud storage service or other components of AWS.

2007. Amazon tweaks S3 storage service pricing

In June, Amazon is planning to implement pricing adjustments for its Simple Storage Service (S3) to incorporate bandwidth expenses. These modifications, effective from June 1, will result in cost reductions for 75 percent of customers, while around 14 percent will experience a increase of over 10 percent compared to current rates, as stated by the company. S3, introduced last year, enables developers to store their application data on Amazon servers. Presently, pricing stands at 15 cents per gigabyte of storage per month and 20 cents per gigabyte of data transferred. The upcoming changes will lower the storage cost to 15 cents per gigabyte-month. Furthermore, the revised structure introduces tiered pricing for downloaded data and introduces a new fee for server requests made over the internet. Amazon explained that separating request costs from data transfer costs allows for reduced bandwidth prices for all customers. The company clarified that no additional pricing changes are planned for the future, beyond this adjustment.

2006. Amazon S3 as Personal Data Backup Option

Jeremy Zawodny, a Yahoo employee known for his technical expertise, has concluded that storing his important data on Amazon's S3 service is more cost-effective than using a server at home. He estimates that building his own server cost around $1400, with monthly expenses of at least $13. Zawodny believes his monthly costs are closer to $35. By transferring his 125 gigabytes of data to S3, he calculates a monthly cost of $18.75. Assuming he adds 1GB of data per month for the next five years and performs 2GB backups every week, he would spend an additional $1.60 every four weeks, totaling $104 over five years. In total, he would pay $1,688, potentially saving $587 over five years by switching to S3. S3 has gained popularity among the geek community, with new applications utilizing the storage service emerging daily. Interarchy, a file transfer client for Mac OS X, has recently added support for WebDAV and Amazon S3. Attendees in the San Francisco Bay Area can learn more about S3 by attending a talk featuring AWS evangelist Jinesh Varia. AWS evangelist Mike Culver will also provide an overview of Amazon Web Services and demonstrate how developers can easily utilize on-demand server capacity in Chicago on October 16, 2006. If you are using S3 for innovative applications or virtual work, the community would be interested to hear about your experiences.

2006. Amazon S3 Will Change the Game

While I share Greg Linden's concerns, I genuinely believe that Amazon's S3 service is a game changer that will significantly impact online storage and open up new possibilities for application development. Although their previous releases like Mechanical Turk and Alexa Search APIs didn't achieve widespread success, what matters most is the disruptive nature of these ideas. Amazon S3 is positioned as storage for the Internet, providing developers with a simple web services interface to store and retrieve data of any size from anywhere on the web. This service leverages Amazon's highly scalable and reliable data storage infrastructure, making it accessible to developers and potentially leading to cheaper consumer-facing storage applications. Although uptake may be slow initially, the pricing (e.g., $15 per month for 100 GB of storage) is compelling enough to attract interest. Amazon's understanding of the web as a platform and their focus on scalability rather than speed position them well to create a foundation for new companies to build upon. While I had considered a similar open storage solution in the past, it wasn't feasible without access to extensive storage resources, making Amazon's S3 service a welcome development. It aligns with my vision of distributed computing as a web service, even though I was initially advised that a P2P approach might not work. This validation of ideas is encouraging. Furthermore, Amazon's initiative lowers the cost of starting a web-based company, as entrepreneurs can leverage user contributions and services like S3 to simplify their role. However, this also means more competition and reliance on third-party providers, akin to the challenges faced by mashup developers. Nevertheless, these services have the potential to become profitable ventures, as demonstrated by entrepreneurs combining Mechanical Turk and S3 to create real businesses. Stay tuned for an example in my upcoming post.