PayPal vs Stripe

January 14, 2024 | Author: Sandeep Sharma

34

PayPal is an international e-commerce business allowing payments and money transfers to be made through the Internet. Online money transfers serve as electronic alternatives to paying with traditional paper methods, such as cheques and money orders. PayPal is the faster, safer way to send money, make an online payment, receive money or set up a merchant account.

27

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

PayPal and Stripe are two leading online payment platforms that offer businesses and individuals convenient ways to process digital transactions. PayPal, with its extensive global reach, provides a comprehensive suite of services including payment processing, invoicing, and money transfers. It is widely recognized and accepted, offering both customers and merchants a familiar and trusted payment solution. Stripe, on the other hand, focuses on providing a developer-friendly payment infrastructure with robust APIs and customizable tools. It offers seamless integration options for businesses to incorporate payment processing directly into their websites or applications. Stripe emphasizes flexibility and scalability, catering to the needs of businesses of all sizes, from startups to enterprise-level organizations.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

PayPal vs Stripe in our news:

2024. PayPal launches Tap to Pay on iPhone for business

PayPal has announced the rollout of "Tap to Pay" for merchants utilizing iPhones through the Venmo and Zettle applications in the U.S. This feature, facilitated by PayPal, enables businesses to accept contactless card and digital wallet payments directly on their iPhones without incurring extra expenses or requiring additional hardware. Following its introduction for Android phone merchants eight months prior, Tap to Pay allows merchants not only to accept payments from cards or digital wallets such as Apple Pay or Google Pay but also to incorporate taxes, receive tips, issue receipts, and process refunds seamlessly. PayPal assures that funds from transactions are promptly deposited into the merchant's Venmo or PayPal Zettle account. For each sale via the tap-to-pay method across Zettle and Venmo, PayPal applies a charge of 2.29% + 9¢.

2024. PayPal to pilot new AI-powered updates including Smart Receipts

PayPal is incorporating AI-driven personalization features. Among the introduced enhancements is the "CashPass" cash-back program, known as "Smart Receipts," which offers personalized recommendations, improved checkout and guest experiences. Additionally, the company is rolling out Venmo improvements tailored for small businesses and a new merchant offers platform. The CashPass feature within the app provides customers with access to a multitude of personalized cash-back offers, utilizing AI to curate recommendations based on individual shopping behaviors. Users can easily click on preferred offers, shop at the respective brand, and complete transactions using PayPal. The app will regularly present new offers, encouraging users to check for updates frequently.

2023. PayPal launches PYUSD stablecoin for payments and transfers

PayPal revealed its own stablecoin, named PayPal USD (PYUSD), designed for facilitating payments and transfers. Issued by Paxos Trust Company, PYUSD is secured by U.S. dollar deposits, short-term U.S. Treasuries, and comparable cash equivalents. The stablecoin's gradual rollout to U.S. customers represents a groundbreaking move by a major U.S. financial institution. Eligible U.S. PayPal users can now engage in various transactions using PYUSD, such as transferring it between PayPal and compatible external wallets, making person-to-person payments, funding purchases at checkout, and converting supported cryptocurrencies to and from PYUSD. PayPal emphasizes transparency by disclosing exchange rates and associated fees during cryptocurrency transactions, including crypto checkouts.

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Stripe, the privately-held payments company, has recently completed the acquisition of TaxJar, a well-known provider of cloud-based tax services. TaxJar's suite of services enables businesses to automatically calculate, report, and file sales taxes. An important aspect of TaxJar is its ability to navigate various geographies and the complex sales tax regulations associated with each, making it a valuable resource for online businesses. Stripe plans to integrate TaxJar's technology into its revenue platform, alongside its existing tools such as Stripe Billing for subscriptions and Radar for fraud prevention. Additionally, Stripe envisions leveraging AI and other technologies to automate further functions and potentially introduce new services. While TaxJar will be integrated with Stripe's offerings, businesses will still have the option to use TaxJar directly for their tax-related needs.

2020. PayPal to let buying and selling cryptocurrencies

PayPal has received a conditional BitLicense from the New York State Department of Financial Services and has collaborated with cryptocurrency company Paxos to introduce a new service. This development enables PayPal users in the United States to purchase, hold, and sell cryptocurrencies. Additionally, PayPal has plans to expand this service to more countries in the future. Initially, the supported cryptocurrencies will include Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. Users will have the ability to connect their PayPal accounts to engage in buying and selling cryptocurrencies.

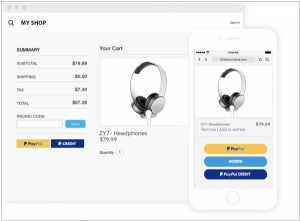

2018. PayPal Checkout improves personalization

PayPal has unveiled an innovative checkout technology designed for e-commerce websites, enabling the dynamic presentation of the most suitable payment method for individual customers. Instead of cluttering the checkout page with multiple payment options, PayPal Checkout now features "smart payment buttons" that adapt and display the appropriate set of choices based on each customer's location and preferences. This empowers retailers to seamlessly incorporate alternative payment methods, including local wallets and country-specific options, alongside the traditional PayPal button, offering a more tailored and convenient payment experience.

2018. PayPal integrates with Gmail and other Google services

Earlier this year, Google consolidated its payment services into a unified platform called Google Pay, aiming to streamline transactions across its ecosystem and encourage increased usage. Building upon this, Google has now announced a significant integration with PayPal. Users who link their PayPal accounts to their Google Play accounts will have the convenience of making payments and settling bills through PayPal without the need for separate logins or leaving Google services. This deep integration, expected to launch later this year, will encompass popular apps such as Gmail, YouTube, Google Store, and any services utilizing Google Pay. Not only will it support payments, but it will also facilitate peer-to-peer transfers. This collaboration aims to enhance user experience, making transactions seamless and effortless within the Google ecosystem.

2018. PayPal acquired Square of Europe - iZettle

PayPal is making a significant move to strengthen its position in point-of-sale transactions, small businesses, and international markets, aiming to compete with Square, Stripe, and other payment providers. The company has officially announced its acquisition of iZettle, a Stockholm-based payments provider often referred to as the "Square of Europe," in an all-cash deal valued at $2.2 billion. Similar to Square, iZettle has successfully established a strong presence in the point-of-sale market by offering a card-reading dongle that seamlessly connects with smartphones or tablets. This has enabled smaller businesses, previously deterred by high card processing costs, to accept card payments. iZettle has also expanded its services to include various financial solutions for these businesses, ranging from inventory management to loans. By acquiring iZettle, PayPal aims to enhance its capabilities and broaden its reach in the evolving payment landscape.

2018. Stripe launched online billing tool

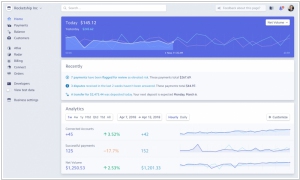

Stripe is introducing a billing solution tailored for online businesses. This new product enables these businesses to efficiently manage recurring subscription revenue and invoicing within the Stripe platform, streamlining their operations. The aim is to replace previously manual methods of invoicing or assembling various subscription tools, offering a seamless experience similar to charging for products on Stripe. This launch is partially motivated by customer requests for a unified solution that consolidates invoices and subscription expenses. As an enterprise company, Stripe prioritizes understanding customer needs while simultaneously innovating to provide elegant solutions for problems that small businesses may not have anticipated.

2017. PayPal acquired small business lending service Swift Financial

Global payments processing company PayPal has reached an agreement to acquire Swift Financial, a provider of working capital solutions for small business owners. This strategic acquisition will enhance PayPal's existing product, Working Capital, by providing advanced tools and capabilities. PayPal initially introduced its Working Capital offering for businesses in 2013. Since then, competitors such as Square and Kabbage have emerged, offering their own credit lines to small business customers. Recognizing this evolving landscape, PayPal has decided to acquire Swift Financial, aiming to strengthen its underwriting capabilities and expand the range of data it can leverage to evaluate the creditworthiness of its customers. This move will ultimately increase the amount of capital that PayPal can offer to its customers.