Okta vs OneLogin

August 06, 2023 | Author: Michael Stromann

32

Support enterprise-wide identity management across any app, user or device with Okta - a future-proof cloud service designed for maximum ROI & ease of use. A secure, reliable cloud service for today’s hybrid IT reality. Comprehensive Identity Management that has no alternatives. Across All Apps, Users and Devices. Easy-to-use, Superior ROI. Integrated, Future Proof

Okta and OneLogin are both leading identity and access management (IAM) platforms that help organizations manage user identities, secure access to applications, and streamline authentication processes.

Okta is a comprehensive IAM solution that provides a wide range of features and integrations. It offers single sign-on (SSO), multi-factor authentication (MFA), and user lifecycle management, allowing organizations to centralize user access and enhance security. Okta supports a large number of applications and offers deep integration capabilities with various identity providers and directories.

OneLogin, on the other hand, focuses on delivering an easy-to-use and streamlined IAM experience. It offers features like SSO, MFA, and user provisioning, enabling organizations to secure access to applications and simplify user management. OneLogin emphasizes user-friendly interfaces and seamless integration with popular business applications, making it a popular choice for organizations looking for a user-centric IAM solution.

See also: Top 10 Identity Management platforms

Okta is a comprehensive IAM solution that provides a wide range of features and integrations. It offers single sign-on (SSO), multi-factor authentication (MFA), and user lifecycle management, allowing organizations to centralize user access and enhance security. Okta supports a large number of applications and offers deep integration capabilities with various identity providers and directories.

OneLogin, on the other hand, focuses on delivering an easy-to-use and streamlined IAM experience. It offers features like SSO, MFA, and user provisioning, enabling organizations to secure access to applications and simplify user management. OneLogin emphasizes user-friendly interfaces and seamless integration with popular business applications, making it a popular choice for organizations looking for a user-centric IAM solution.

See also: Top 10 Identity Management platforms

Okta vs OneLogin in our news:

2023. Okta snatches up security firm Spera for over $100M

Okta, a company specializing in identity and access management, is set to acquire the security firm Spera. This strategic move aims to enhance Okta's existing capabilities in identity threat detection and response (ITDR), providing customers with advanced technology to enhance their identity security, posture management, and the ability to identify, detect, and remediate risks effectively. The Spera platform offers tools for identifying silos in software-as-a-service and infrastructure applications, enabling the discovery of vulnerabilities across user populations. It also aids in prioritizing security issues based on regulations, attack vectors, and industry best practices. Beyond security benefits, Spera serves an additional purpose by assisting companies in reducing license costs through the identification and deactivation of dormant accounts.

2023. Okta acquires password manager Uno to develop a personal tier

Okta, the prominent identity management company, has recently acquired Uno, a password management application. According to Okta, Uno's team will play a vital role in expediting the launch of Okta Personal, a consumer-oriented password manager. Uno introduced an app earlier this year, aiming to simplify password management for users through a user-friendly design. The app's primary feature allowed users to execute one-click logins on websites by remembering their credentials and providing quick access to one-time codes through its browser extension. The objective was to streamline security for users, eliminating the need for extensive password management efforts. Okta has confirmed that Uno will no longer be available as a standalone app, and its team will integrate into Okta to enhance the Okta Personal service. Details regarding the financial aspects of the acquisition have not been disclosed by the company.

2021. One Identity has acquired OneLogin, a rival to Okta and Ping Identity

More consolidation is underway in the realm of cybersecurity, particularly concerning services that assist organizations in identity and access management. Today, One Identity, a provider of tools for managing "zero trust" access, log management, and governance services for enterprises, revealed its acquisition of OneLogin. OneLogin, a competitor to companies such as Okta and Ping in the secure sign-on services domain for end users, boasts an impressive customer base of around 5,500 organizations, including renowned names like Airbus, Stitch Fix, AAA, and Pandora.

2021. Okta acquires cloud identity startup Auth0 for $6.5B

Cloud identity company Okta has announced its acquisition of the cloud identity startup Auth0 for a significant $6.5 billion. This deal brings together two companies that approach identity management from different perspectives, creating potential synergies and opportunities in the identity market. Okta specializes in delivering identity and access management (IAM) solutions to organizations, enabling seamless single-sign-on access for employees across various cloud services such as Gmail, Salesforce, Slack, and Workday. On the other hand, Auth0 offers developers an easy-to-use API for implementing single-sign-on functionality, eliminating the need for developers to build IAM tools from scratch. Following the acquisition, Auth0 will continue to operate as an independent unit within Okta, and the two companies will explore integration possibilities in the future.

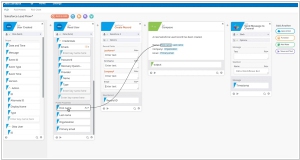

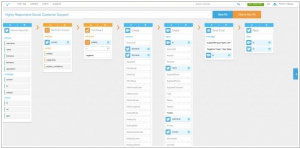

2020. Okta adds new no-code workflows that use identity to trigger sales and marketing tasks

Identity management provider Okta has unveiled new no-code workflows that enable businesses to leverage identity as a trigger for launching customer-centric processes. Okta has developed a range of connectors that simplify the integration of identity with sales and marketing tools within a workflow. In the previous year, Okta introduced Platform Services, which disaggregated various components of the platform and presented them as individual services for larger enterprise customers to leverage as required. This latest development builds upon that concept, allowing users to effortlessly incorporate Okta services into their workflows by dragging and dropping the appropriate connectors, eliminating the need for complex coding or engineering resources.

2020. Okta launches Lifecycle Management Workflows to make building identity-centric processes easy

Okta, the widely-used identity and access management service, has introduced Lifecycle Management Workflows, a novel tool that empowers IT teams to create and oversee automated processes akin to IFTTT (If This Then That), utilizing a user-friendly graphical interface. This new offering extends Okta's existing automation tools, but its distinctive feature lies in enabling IT teams and developers to effortlessly construct intricate workflows centered around identity, encompassing a broad array of applications. Consequently, these teams can easily automate onboarding procedures, ensuring that the establishment of a new Okta account seamlessly triggers relevant processes on third-party platforms such as Box, Salesforce, ServiceNow, and Slack, leading to the swift setup of corresponding accounts on those platforms.

2019. Identity management software Okta introduced end-user-security product

Under the SecurityInsights umbrella, Okta has introduced two new products. The first is UserInsights, designed for end users, while the second is HealthInsights, catering to administrators. UserInsights provides users with valuable information regarding any suspicious activity associated with their accounts, such as unrecognized device logins. In the event of a potential password theft, users can report the incident by clicking the Report button, initiating an automated workflow for further investigation by the company's security team. Additionally, users are strongly advised to change any compromised passwords promptly. HealthInsights functions similarly but targets system-level administrators, offering suggestions to enhance the overall identity security posture of the company.

2019. Okta acquired workflow automation startup Azuqua

Okta has announced its acquisition of Azuqua, a workflow automation startup, for a sum of $52.5 million. In today's dynamic enterprise environment, employees and tasks frequently transition across various applications and services. The integration of automation software with identity and access management presents an opportunity to facilitate seamless movement between these entities. By combining their capabilities, the two companies aim to enable smooth application transitions within complex workflows, reducing the need for repetitive credential input. Product teams will have the ability to incorporate this technology into their own applications, alongside Okta's core authentication and user management tools, in order to create cohesive and integrated customer experiences.

2018. Okta introduced new service - Sign in with Okta

Okta has introduced a new service called "Sign in with Okta," enabling employees to sign into third-party sites and applications using a single set of credentials, similar to how they access their company applications. With the implementation of this new API, developers can easily integrate a few lines of code, granting Okta customers the capability to sign into each other's websites in a manner akin to OAuth, which allows the use of Google or Facebook credentials to log into various consumer sites. Once developers incorporate this functionality, users will encounter a "Sign in with Okta" button when accessing the respective website or service. They can then utilize their Okta login to gain access to these sites based on the specific rules defined by the site owner.

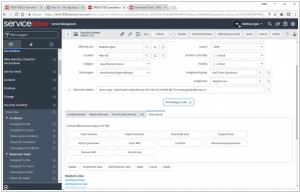

2018. Okta partnered with ServiceNow

In a collaborative effort, Okta and ServiceNow have developed an application to assist ServiceNow customers utilizing security operations tools in identifying and promptly addressing security issues related to identity. Okta has introduced the Identity Cloud for Security Operations app, which is now available in the ServiceNow app store. This app is specifically tailored for customers who utilize both Okta and ServiceNow toolsets. Upon downloading and installing the app, it seamlessly integrates identity information into the ServiceNow security operations interface, granting the operations team easy access to specific details about individuals involved in a security problem. With this integration, there is no need for the operations team to exit their existing tool in search of relevant information, as it is conveniently provided within the interface itself.