Braintree vs Square

July 02, 2023 | Author: Sandeep Sharma

Braintree and Square are both prominent payment processing platforms that cater to businesses of different sizes and industries. While they share some similarities, there are key differences between the two.

Braintree, a PayPal company, is a developer-focused payment platform that offers a wide range of customizable tools and APIs. It provides businesses with the flexibility to create tailored payment solutions, support various payment methods, and integrate seamlessly with e-commerce platforms. Braintree places a strong emphasis on developer control, advanced fraud protection, and scalability, making it an attractive choice for businesses with complex payment needs or those looking for extensive customization options.

Square, on the other hand, is a comprehensive payment ecosystem that caters to small and medium-sized businesses. It offers a suite of products and services, including point-of-sale systems, online payment processing, and a range of business management tools. Square focuses on simplicity and ease of use, providing businesses with a user-friendly interface, quick onboarding, and straightforward pricing. It is well-suited for businesses that prioritize simplicity and want an all-in-one solution for their payment processing and business management needs.

The key differences between Braintree and Square lie in their target audience and approach to payment processing. Braintree is geared towards developers and businesses seeking extensive customization, scalability, and control over their payment integration. Square, on the other hand, is designed for small and medium-sized businesses that value simplicity, ease of use, and an integrated ecosystem of payment and business management tools.

See also: Top 10 Payment Processing platforms

Braintree, a PayPal company, is a developer-focused payment platform that offers a wide range of customizable tools and APIs. It provides businesses with the flexibility to create tailored payment solutions, support various payment methods, and integrate seamlessly with e-commerce platforms. Braintree places a strong emphasis on developer control, advanced fraud protection, and scalability, making it an attractive choice for businesses with complex payment needs or those looking for extensive customization options.

Square, on the other hand, is a comprehensive payment ecosystem that caters to small and medium-sized businesses. It offers a suite of products and services, including point-of-sale systems, online payment processing, and a range of business management tools. Square focuses on simplicity and ease of use, providing businesses with a user-friendly interface, quick onboarding, and straightforward pricing. It is well-suited for businesses that prioritize simplicity and want an all-in-one solution for their payment processing and business management needs.

The key differences between Braintree and Square lie in their target audience and approach to payment processing. Braintree is geared towards developers and businesses seeking extensive customization, scalability, and control over their payment integration. Square, on the other hand, is designed for small and medium-sized businesses that value simplicity, ease of use, and an integrated ecosystem of payment and business management tools.

See also: Top 10 Payment Processing platforms

Braintree vs Square in our news:

2021. Square acquires buy-now, pay-later company Afterpay for $29 billion

Square has reached an agreement to acquire Afterpay, an Australian buy-now, pay-later service, in an all-stock transaction valued at approximately $29 billion. This acquisition stands as one of the largest in Australian history. Square has announced its intention to incorporate Afterpay into both Cash App and Seller. Cash App facilitates payments and money transfers for customers, while Seller caters to retailers. Following the integration, Cash App users will have the ability to manage their Afterpay payments directly within the app, and Seller merchants will be able to offer Afterpay as a payment option to their customers.

2020. Square acquires inventory management company Stitch Labs

The financial services, merchant services aggregator, and mobile payment company Square has acquired Stitch Labs, a company that specializes in inventory management software. Square, which is widely used by over 33.5 million small businesses for various purposes like accepting credit card payments, tracking sales and inventory, and obtaining financing, aims to enhance its Seller ecosystem by incorporating Stitch Labs' expertise. Currently, Square's functionality falls short of providing a complete inventory and order management system or fully meeting the needs of advanced Stitch Labs users. However, there is potential for Square to expand its software capabilities in the future with the assistance of the Stitch Labs team. In the meantime, we have compiled a list of the best alternatives to Stitch Labs that are currently available on the market.

2018. Square acquired website builder Weebly

Square, renowned for its payment software, has announced its acquisition of Weebly for a sum of $365 million. Weebly specializes in providing user-friendly website-building tools primarily tailored for small businesses and e-commerce companies. The company has successfully secured $35.7 million in funding. Square's objective in acquiring Weebly is to establish a unified solution that caters to entrepreneurs seeking to establish a robust online and offline business presence. This strategic move will also facilitate Square's global expansion, given that 40 percent of Weebly's 625,000 paid subscribers are based outside of the United States.

2018. Braintree launches Stripe competitor - Extend

PayPal's payment services division, Braintree, is taking steps to enhance its competitive position in the market, particularly against rivals like Stripe. To achieve this, Braintree is introducing a new solution called Extend, which offers a range of tools for seamless integration of Braintree payments with other services commonly utilized by online businesses beyond basic transactions. Extend encompasses features such as loyalty and reward program integration, advanced fraud prevention measures, and support for "contextual commerce," enabling merchants to sell and accept payments on platforms other than their own. Some of these services, including contextual commerce, were already available, powering features like Pinterest's buyable pins. With Extend, Braintree aims to streamline and expand its payment offerings, catering to the evolving needs of online companies.

2017. Mobile POS system Square launched Retail app

Square is introducing an all-new Square Retail app that complements an extensive backend package of tools. This package includes comprehensive inventory management, customer relationship management, and employee tools. The aim of this new offering is to deliver a top-notch retail solution for merchants and shop owners who require more than just the Square Reader and basic Square mobile app. The scalability of this solution allows it to cater to clients ranging from single-location shops to merchants with multiple storefronts and extensive inventory tracking needs. Initially, Square is primarily targeting retailers in the "finished goods" industry, which includes those selling packaged products, apparel with barcodes, as well as items like wine or games.

2016. Square now allows to charge loyal customers without card swiping

Mobile payment processing service Square has introduced a new feature called Card on File, which enables businesses to charge recurring customers without physically swiping their cards or requesting them. This feature benefits customers as well, as they can visit your shop or restaurant without carrying their cards or cash. They can simply choose what they want and leave, while you effortlessly charge the appropriate amount directly from their cards. To avail this service, customers must initially opt in and provide their card information to your company's Square account. Additionally, Card on File allows businesses to charge remote customers even without an internet payment connection. However, it is important to note that this feature comes at a slightly higher cost for businesses, with a fee of 3.5% plus 15 cents, as compared to the standard 2.75% commission for card swiping.

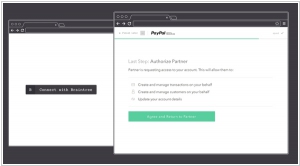

2016. Braintree launches Auth to bring its payments platform to more merchants

PayPal-owned payments platform, Braintree, has introduced Braintree Auth, a system designed to simplify the process of enabling payments on e-commerce platforms. This launch enables e-commerce platform owners, shopping cart providers, and recurring billing services to facilitate credit card, debit card, and PayPal payments on their merchants' online storefronts. Through a unified interface for shoppers, Braintree Auth grants access to customer and transaction data on behalf of the merchants. This strategic move by Braintree demonstrates its efforts to expand its presence in the SMB market, particularly in the face of increasing competition from startups like Stripe.

2015. Square launched a dashboard app for iOS

Mobile payment processing service Square has introduced its second non-consumer application, an iOS dashboard app designed for business owners. This app enables business owners to monitor real-time sales data and gain valuable insights into the performance of their business through analytics. While this app is not intended for the barista on duty, it serves as a valuable tool for owners who need to oversee operations remotely. With this app, business owners can conveniently track stock levels across multiple locations, enabling them to make informed decisions on the go, without the need for a desktop computer.

2015. Square launched payroll service for small businesses

Mobile payment startup Square has introduced Square Payroll, a software solution designed to assist businesses in managing payroll, tracking taxes, and handling other expenses related to both hourly and salaried employees. The pricing for this product is set at $20 per month, with an additional charge of $5 per employee. Square aims to position itself as a relatively straightforward and uncomplicated option within the payroll software market, at least for the time being. The software includes features such as timecard management, tax management, and the capability to handle payments for both hourly and salaried workers, all bundled together at a single price. Square Payroll enters a competitive landscape, facing established players like Intuit's QuickBooks, ADP, Paychex, and others. While some competitors like Wave Accounting offer similar features, they may not provide the complete range of services offered by Square Payroll. For instance, Wave Accounting does not handle tax payments or tax filings, only estimated tax liabilities. Additionally, Wave Accounting offers lower pricing, with two base tiers starting at $10 and $15 plus an additional $4 per employee.

2015. Square's new wireless card reader will accept Apple Pay and work with Android

The newly introduced Square Reader is a compact device in a square shape, specifically designed to enable merchants utilizing a tablet or smartphone to effortlessly accept wireless payments, including Apple Pay and contactless mobile payments. Additionally, it supports payments made through EMV chip cards, which include Europay, MasterCard, and Visa. Priced at $49, this upgraded device surpasses Square's previous $29 merchant reader, offering enhanced functionality and wireless capabilities. It is compatible with recent iPad models, iPhone devices (including the iPhone 4S and newer), and a wide range of Android devices manufactured by Samsung, HTC, Asus, Motorola, LG, Dell, and Toshiba.