Apple Pay vs Bitcoin

May 29, 2023 | Author: Sandeep Sharma

2

Open source P2P money. Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network. Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Apple Pay and Bitcoin are fundamentally different in terms of their nature, functionality, and purpose. Apple Pay is a digital payment service developed by Apple that enables users to make secure transactions using their Apple devices, such as iPhones, iPads, or Apple Watches. It relies on traditional financial systems and facilitates transactions in fiat currency, allowing users to link their credit or debit cards to their Apple Pay account. Bitcoin, on the other hand, is a decentralized digital currency that operates on a peer-to-peer network called blockchain. It functions independently of any central authority or financial institution, allowing users to send and receive funds directly without the need for intermediaries. Bitcoin transactions are verified and recorded on the blockchain, providing transparency and security.

See also: Top 10 Online Payment platforms

See also: Top 10 Online Payment platforms

Apple Pay vs Bitcoin in our news:

2016. Apple takes on PayPal with Apple Pay on the web

Apple has announced that Apple Pay will be introduced to the web in the upcoming fall. This means that Mac users will have the convenience of making online payments in Safari using the "Pay with Apple Pay" button. To authenticate their purchases, users can utilize Touch ID on their iPhone or Apple Watch. Previously, Apple Pay was only available for use in selected iOS apps and physical retail stores. Retail partners will be required to integrate Apple Pay into their checkout process, and Apple has already secured numerous merchants for the payment platform, including Target, Expedia, United Airlines, and more. In addition to this expansion, Apple has revealed plans to launch Apple Pay in Switzerland, France, and Hong Kong during the summer season.

2015. Apple rebrands Passbook to Wallet extends Apple Pay to UK

To align with the updated Apple Pay service, Apple has made the decision to rebrand the Passbook app as Apple Wallet. This name change aims to ensure relevancy and coherence between the two offerings. In addition to the ability to add traditional debit and credit cards, Apple Pay now enables users to include store cards, as well as loyalty and rewards cards, within the Apple Wallet. Retailers such as Kohl's, JC Penney, and BJ's will be among the first to offer compatibility with their own store credit cards through the Apple Pay platform. Moreover, Kohl's, Walgreens, and Dunkin Donuts are introducing rewards cards to the Apple Pay ecosystem. Notably, Apple Pay is expanding its reach to the United Kingdom, where it will soon be compatible with a vast majority of debit and credit cards, covering approximately 70 percent of the country's cards. Additionally, Apple has recently unveiled a partnership with Square, introducing a new card reader specifically designed for small businesses to accept payments via Apple Pay and credit card chip transactions (without support for card swipes).

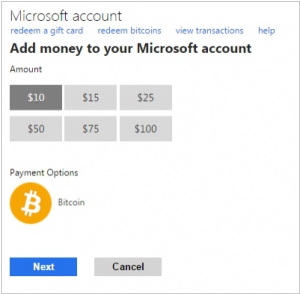

2014. Microsoft begins accepting Bitcoin in the Windows Store

Microsoft has introduced the option to use Bitcoin as a form of payment for purchasing games and other digital content on its Windows, Windows Phone, and Xbox platforms. To facilitate this, Microsoft has partnered with the payment provider Bitpay. However, there are a few important points to consider. While customers can utilize Bitcoin to add funds to their Microsoft wallet or create digital gift cards, direct payments with the cryptocurrency are not currently supported. Additionally, it appears that Bitcoin payments are limited to customers in the United States. Historically, Microsoft has been viewed as a slow-moving behemoth, somewhat resistant to change. Although accepting Bitcoin does not directly align with its recent surprising efforts to make core services like Office available on competing platforms or implement premium pricing models, it does demonstrate that Microsoft is willing to embrace emerging technologies ahead of many of its competitors. This suggests a potential modernization of Microsoft's overall approach and ethos.

2014. Apple launched own payment system Apple Pay

Apple has introduced a wallet feature called Apple Pay to its iPhones. This functionality allows users of iPhone 6 and iPhone 6 Plus to conveniently make payments at retail checkout terminals by simply tapping their devices. To utilize the wallet service, users must have an iPhone equipped with near field communication (NFC) technology and authenticate their transactions using Apple's Touch ID fingerprint authentication. The process of adding a card to Apple Pay involves either scanning the card or manually inputting the card information. Initially, Apple Pay supports purchases at over 220,000 stores across the United States. Prominent participants in this service include Macy's, Bloomingdales, Walgreens, Duane Reade, Subway, and McDonald's. However, it's important to note that many retailers, including the largest one, Wal-Mart Stores Inc., are not currently part of Apple's network. Only a minority of retailers have the necessary machines capable of reading the near-field communication radio signal required for Apple Pay to function.

2014. Visa Exec: we could support Bitcoin payments

According to Visa CEO Charlie Scharf, while the company is not currently actively engaging with developments in the bitcoin space, it remains open to the possibility of doing so in the future, should the need arise. Scharf emphasized that Visa's primary focus is as a network rather than a currency, stating that they have the capability to process both real and virtual currencies if it is deemed appropriate. However, he clarified that the company is not currently considering facilitating bitcoin payments. Scharf also expressed Visa's lack of interest in creating a Visa-branded digital currency, unlike some of its competitors who have pursued digital currency-related patent filings.

2014. BitPay makes bitcoin payment processing free

BitPay, the pioneering BitCoin payment processing company, has made an exciting announcement by eliminating the 1 percent transaction fee on all starter plans. This means that merchants who choose the starter plan can now enjoy free access to the BitPay API, app, and plugins, without any transaction costs. Additionally, there are no limitations on the number or amount of transactions within the plan. For those opting for the paid plans, various additional features are included, such as 24/7 phone support, personal account managers, and Quickbooks integration. BitPay's primary competitor, Coinbase, which handles payments for renowned companies like Expedia and Dell, follows a different pricing structure. Coinbase charges a one percent fee for cashing out bitcoin to a bank account, but this fee only applies after the first $1,000,000 in sales.

2014. Dell becomes the largest company that accepts Bitcoin

PC maker Dell has announced that it will now accept payments in Bitcoin for products purchased through its website. Additionally, customers using the cryptocurrency can enjoy a 10 percent discount on select items. Coinbase, a prominent bitcoin payment processor, has secured this business opportunity. When customers opt for bitcoin as their payment method on Dell's website, they will be redirected to Coinbase's platform to complete the transaction, following a standard procedure. This move by Dell represents a significant step towards mainstream acceptance of bitcoin. With sales amounting to nearly $57 billion in 2013, Dell would become the largest company to embrace bitcoin as a payment option.

2014. Google and Microsoft add Bitcoin to their currency convertors

A fascinating trick in Google search involves typing "5 Euro in USD" to obtain a reasonably accurate currency conversion within seconds. Now, an exciting update allows you to explore the world of Bitcoin by simply entering "price of bitcoin" or "X bitcoin to euro" in your search query. This feature was recently introduced as a response to Microsoft Bing's inclusion of BTC pricing in their search engine. Google has collaborated with Coinbase to facilitate BTC conversions. This capability to incorporate Bitcoin in search queries builds upon Google Finance's introduction of a dedicated bitcoin page on their website back in June of last year.

2014. Shopify allows to accept payments in Bitcoin

The popular online store platform, Shopify, had previously offered support for the bitcoin merchant service BitPay since November. However, in a recent announcement, Shopify unveiled that its users now have the option to accept bitcoin payments via Coinbase as well. This development creates a competitive dynamic between the two payment processors. By integrating both companies into its platform, Shopify recognizes that each has its own strengths and weaknesses. The key aspect is that businesses using Shopify now have the flexibility to choose between these two options. It is crucial for the growth of the bitcoin economy to prevent the emergence of a monopoly. By offering consumers a choice, the accessibility of bitcoin can be expanded to a wider audience. Ultimately, fostering healthy competition between these payment processors can prove beneficial for all stakeholders involved.